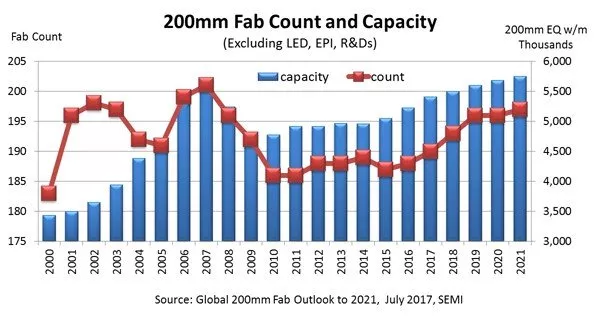

In the shadow of other more trendy news about China and Memory fab investments, 200mm fabs continue to “flex their muscles.” At least 500,000 wafers per month (wpm) capacity, or a 10 percent expansion, is forecast for 200mm fabs from this year through 2021. This includes capacity from a number of new 200mm fabs expected to start operation in 2017. The recently published report "Global 200mm Fab Outlook to 2021" by SEMI is tracking production, pilot, and R&D 200mm facilities worldwide with a special focus on capacity expansions and new facilities.

Driven by mobile and wireless applications, IOT, and automotive, the 200mm market is thriving. Many of the products used in these applications are produced on 200mm wafers, so companies are expanding capacity in their facilities to the limit, and there are nine new 200mm facilities in the pipeline. Looking only at IC volume fabs, the report shows 188 fabs in production in 2016 and expanding to 197 fabs by 2021.

China will add most of the 200mm capacity through 2021, with 34 percent growth rate from 2017 to 2021, followed by South East Asia with 29 percent and the Americas with 12 percent.

SEMI’s recent publication of the “Global 200mm Fab Outlook report to 2021” (July 2017) is the third update since the report was first launched in 2015. Since the last release in November 2016, the SEMI Industry Research and Statistics analyst team has made 232 changes and updates to 132 fabs. The report tracks over 300 facilities using 200mm wafers from R&D, EPI, LED fabs to volume IC fabs.

For more information, visit: https://discover.semi.org/global-200mm-fab-outlook-registration.html