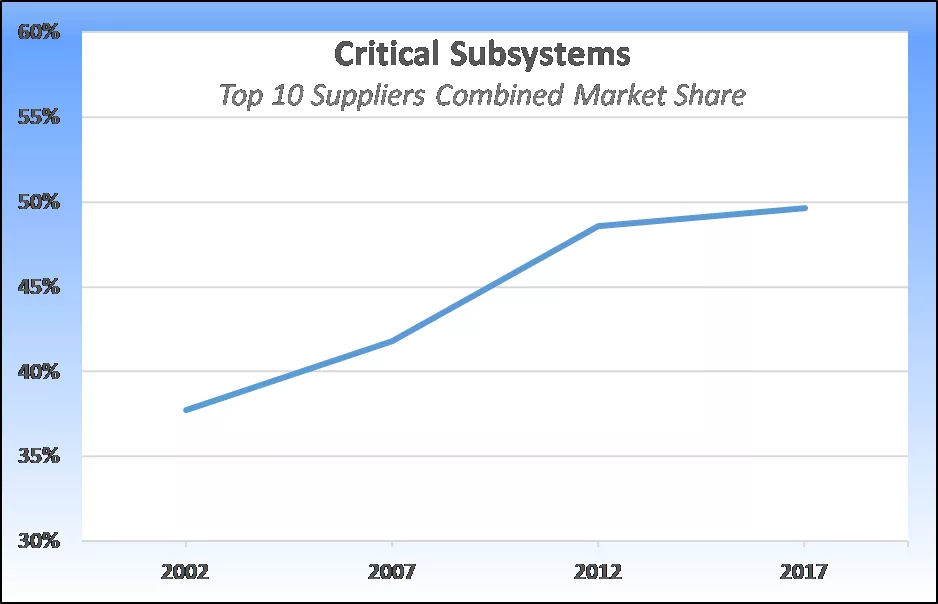

Years of industry consolidation in the critical subsystems market appears to be coming to an end.

The top 10 suppliers’ share of the critical subsystems market has stabilised at around 50 percent after many years of industry consolidation. Through a combination of acquisitions and organic growth, this percentage has been increasing steadily from 38 percent at the turn of the millennium. However, in recent years the trend has slowed considerably as medium and smaller sized suppliers are starting to provide stiffer competition for incumbents.

Driven by a number of factors, consolidation produces a number of benefits that accrue to the resulting larger suppliers, including the following:

- Economies of scale

- Combined research and development budgets

- Improved access to global markets through strategic regional acquisitions

- Stronger financial backing that can facilitate any required rapid scale up in production

For their part, buyers must rely on a smaller pool of larger suppliers and face these downsides:

- Less innovation

- Less flexibility

- In some cases, dependency on a single supplier for a particular subsystem that can lead to supply chain bottlenecks

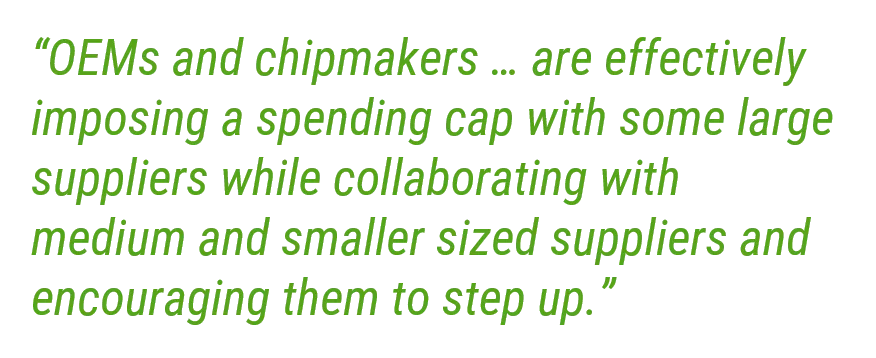

Until 2014, the balance was clearly in favour of consolidation, but since then the trend has stalled and there is strong evidence that over the next few years the trend may even revert, favouring medium and smaller sized suppliers. The current industry upswing has already allowed these companies, versatile and nimble enough to quickly develop and deliver innovative solutions, to gain market share from overstretched incumbents. What’s more, OEMs and chipmakers, increasingly concerned about having to rely on a single or dominant source for their most critical subsystems, are effectively imposing a spending cap with some large suppliers while collaborating with medium and smaller sized suppliers and encouraging them to step up.

The data supporting these observations suggests that the main beneficiaries are companies ranked between 11th and 30th in size, with many of these organizations’ market share growth slightly outpacing that of the top 10 in recent years.

For more information about VLSI Research and Critical Subsystems, visit www.vlsiresearch.com.

Julian West is a technical and marketing analyst at VLSI Research Europe.