Orders for critical subsystems evaporated in the second half of 2018 after a very strong start to the year. Subsystems suppliers have been left with depleted order books after OEMs accumulated large inventories as the market for wafer fab equipment cooled off. Although overall critical subsystems revenue growth for 2018 is forecast to come in at +5% YoY, this year has been a tale of two halves with a bumpy ride for the critical subsystems supply chain along the way.

The year started very strongly with overstretched OEMs switching from a “just in time” ordering strategy to panic buying and over ordering critical subsystems “just in case” as they battled to keep up with equipment demand from chipmakers. However, falling memory prices and technology push outs from major chipmakers in Q2 saw a sharp reduction in capex and demand for equipment. The whiplash effect through the supply chain has been severe and critical subsystems suppliers running at full capacity were unable to stop fast enough.

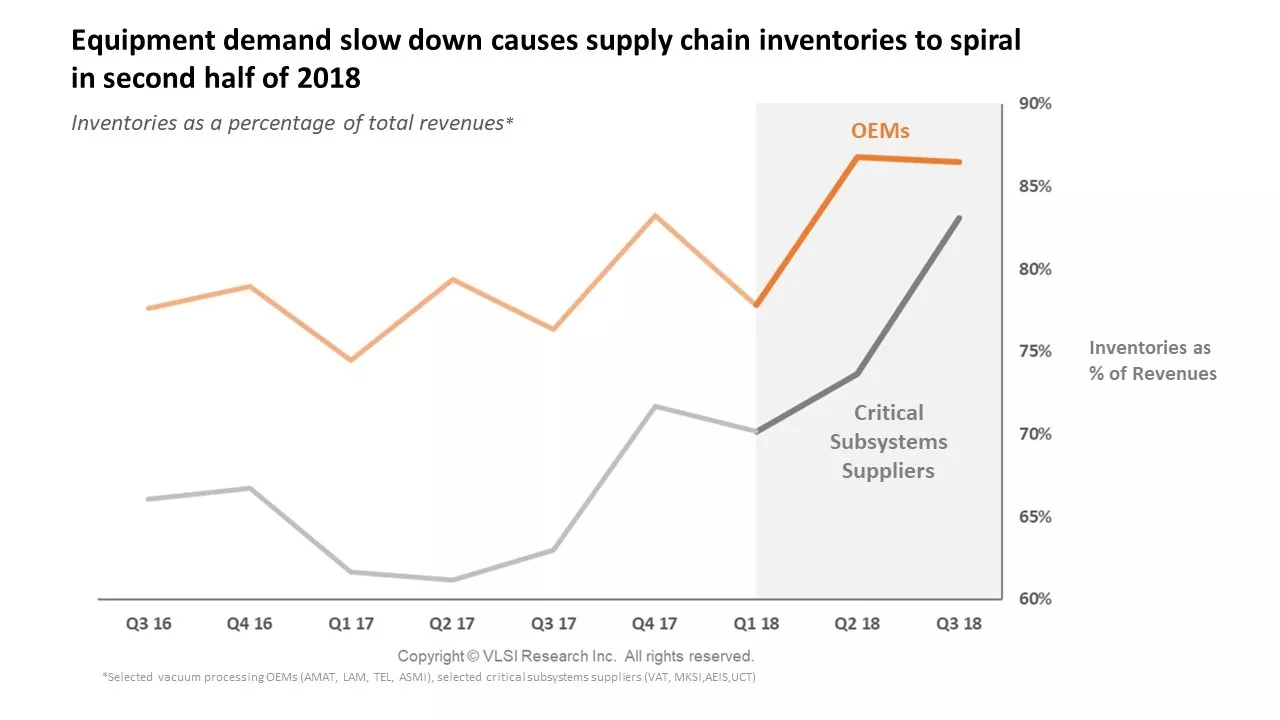

Comparing inventories of vacuum processing OEMs (major consumers of advanced critical subsystems) and critical subsystems suppliers, warning signs for subsystems suppliers were apparent after the Q2 quarterly earnings reports. After OEM inventories surged in Q2, critical subsystems supplier inventories spiked in Q3. The overproduction of subsystems leading to this spike suggests that the OEMs had been promising orders to subsystems suppliers but turned off the buying as they too struggled to shift their own products earlier in the year.

Suppliers of highly customised subsystems such as vacuum valves and power supplies were particularly badly hit. Whereas other subsystems such as vacuum pumps, which can generally be repurposed on other tools or applications, have fared better as the oversupply can be consumed by a wider variety of applications.

The bad news does not appear to be finished for subsystems suppliers as Q3 OEM inventories as a percentage of revenue remained at historically high levels, which is a concern in the short term. Nevertheless, the underlying drivers for the industry remain strong and there is light at the end of the tunnel as major fab building projects in Asia appear to be continuing without delay – a promising sign that chipmakers are still intending to increase capacity. There will be a lot of empty fab shells and upgraded clean rooms ready for equipment installations at short notice if required, ensuring that orders for equipment and subsystems will pick up again soon.

Although 2018 will appear in the historical data as a flat, if not slightly positive year, it does not quite reflect the bumpy ride that has been experienced by the supply chain along the way.

For more information about VLSI Research and Critical Subsystems, visit www.vlsiresearch.com/public/csubs/.

Julian West is a technical and market analyst at VLSI Research Europe.