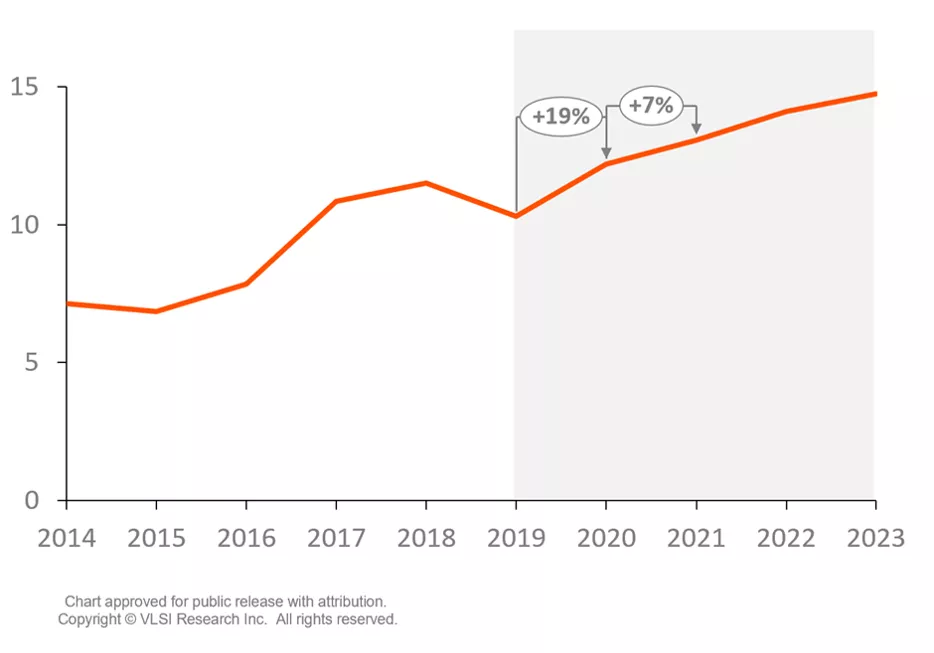

Sales of critical subsystems for use in semiconductor manufacturing equipment will exceed $12.2 billion in 2020, a 6% increase over the previous record of $11.5 billion reached in 2018. What makes this such a remarkable feat is they achieved this despite unprecedented disruptions to the supply chain.

The key to critical subsystems suppliers’ success was a swift and efficient response to the initial local shutdowns due to COVID-19 in February and March. Within four to six weeks, most vendors had secured their supply of raw materials and put the required measures in place to ensure the safety of their workforce and reduce the risk of being shut down themselves. Most were reporting a return to high volume manufacturing by May. There were no significant holdups reported, which means everyone stepped up their response to enable the semiconductor equipment industry to deliver double-digit growth. It also helped that before the pandemic, most suppliers expected 2020 to 2023 to be healthy growth years and already had plans to add capacity this year. Those plans are being accelerated, and delivery is no longer an issue for most vendors in the near term. This is just as well as OEMs are advising their suppliers to cope with a 20% surge in orders in any given quarter in 2021.

While the overall growth rate for critical subsystems in 2020 is on track to beat 19%, some suppliers had to deal with extraordinary growth. Suppliers of vacuum valves, chillers, and optical fiber thermometry are likely to grow above 35%, while suppliers of process power subsystems are looking at increasing around 30%. The extra demand can be explained partly by the very low inventories of these products held by customers at the beginning of the year, which needed replenishing. However, the main reason for the above-average growth is that these segments have been outgrowing the overall critical subsystems industry for several years due to semiconductor manufacturing becoming more vacuum intense.

Critical Subsystems for Semiconductor Applications in Billions of Dollars

Next year is shaping up to be another record for critical subsystems with growth rates in the high single digits predicted. The next cyclical downturn is forecast to be 2024, but these are unprecedented times, and the risk of a downturn in 2022 cannot be excluded. Whatever the future holds, the critical subsystems supply chain has proved they can raise their game when the chips are down… or up.

For more information about critical subsystems and VLSI Research, please visit our website.

John West is managing director at VLSI Research Europe.