Clouds continue to persist over the semiconductor supply chain with little sign of lifting. In March, the decline in week-over-year chip sales appeared to be slowing, providing a glimmer of hope for the beginning of a new cycle. However, the recent rapid escalation of the tariff war between the U.S. and China heaped more uncertainty on the industry and visibility continues to remain low.

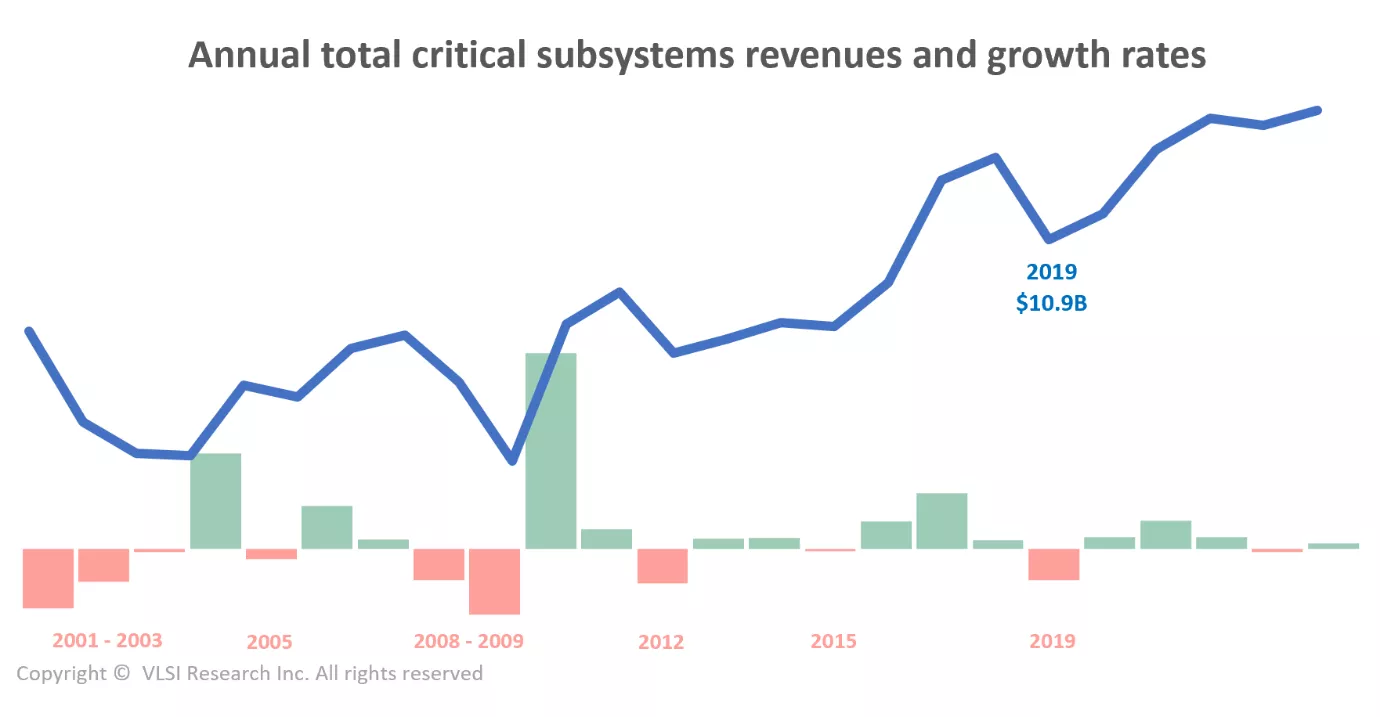

Revenues for critical subsystems are expected to decrease approximately 20% to $10.9 billion in 2019 from their record highs of $13.6 billion in 2018. This appears to be a considerable drop, and it is, but we should not forget that the industry is still operating at extremely high levels and $10.9 billion would be the third highest on record (Figure 1). Lots of money is being made in the supply chain, but many companies face tough operational decisions, as they have been left with excess capacity and high fixed costs after the previous upturn, and correctly timing the next upturn remains critical.

Figure 1. Total critical subsystems revenues and the corresponding year over year growth rates. Includes critical subsystems sales to semiconductor, flat panel display and photovoltaic industries. Note that semiconductor applications account for over 85% of total critical subsystems revenues.

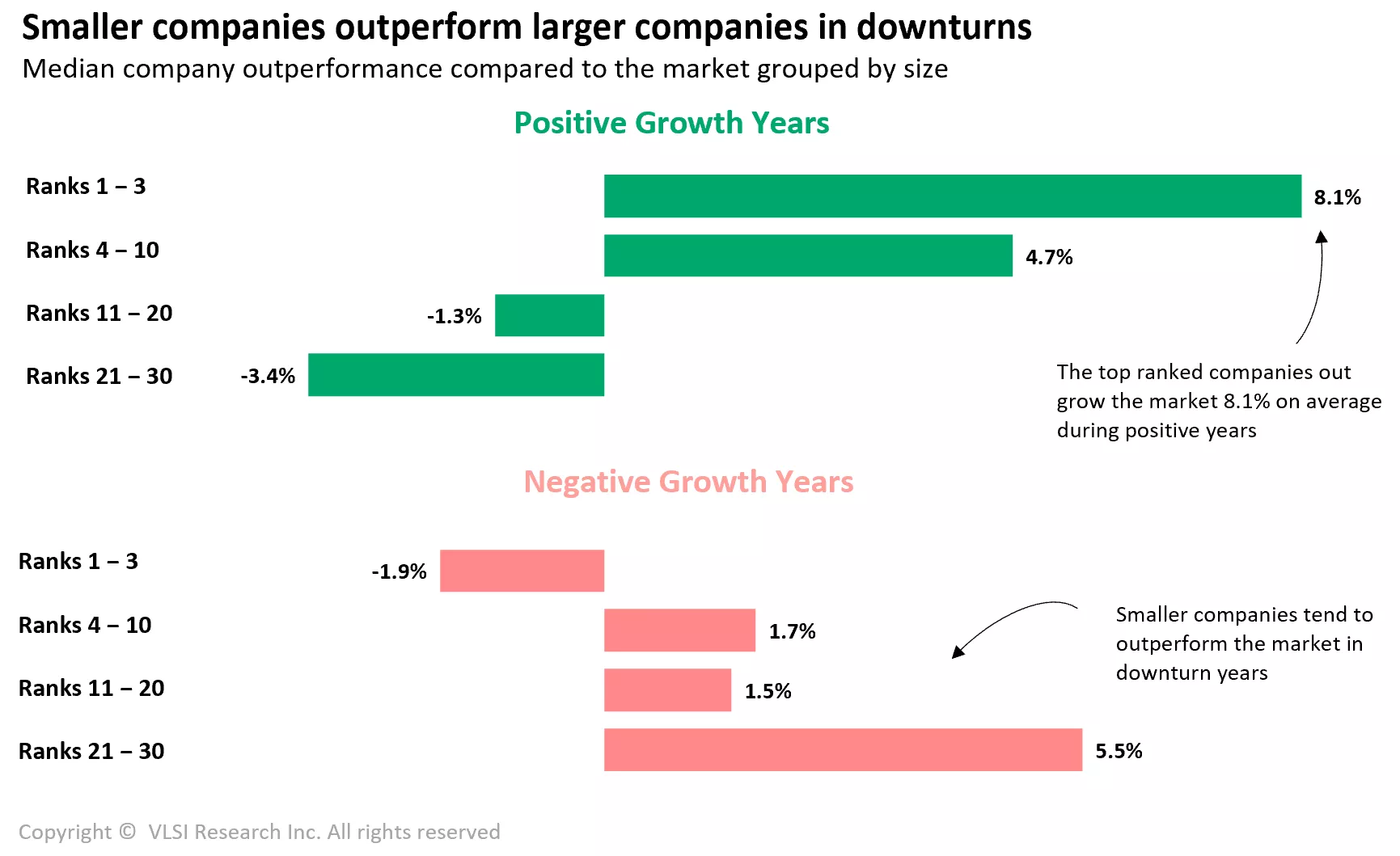

Recently we analysed the revenue performance of different sized companies supplying critical subsystems to see how they fared in downturn years versus upturns. Since 2000, there have been six downturn periods ranging from just a 2% year-over-year drop in 2015 to a massive 42% year-over-year drop in the aftermath of the financial crisis in 2009. Using the market share information of over 150 companies supplying critical subsystems in the VLSI Research database going back to 2000, we found that smaller companies tend to outperform the market in downturn years, whereas larger companies tend to underperform. This trend is reversed during upturns (Figure 2).

Figure 2. Median company outperformance grouped by company size. For every year between 2000 and 2018, each company was ranked by size and its growth compared to the market for that year was calculated. Results were aggregated and the median value in positive and negative growth years was calculated.

Figure 2 compares the median outperformance of companies in positive and negative growth years grouped by their size. In positive growth years, the companies ranked in the top three largest suppliers outperform the market by 8.1%, whereas smaller companies ranked between 11 and 30 underperform during those years. Conversely, the top three companies tend to underperform by -1.9% in downturns and those ranked 21 to 30 outperform by an amazing 5.5%.

This is slightly counterintuitive as one might expect larger companies to ride out downturns more easily as they tend to be more diversified. However, this finding may provide an interesting insight into the buying patterns and behaviours of equipment manufacturers that are the main buyers of critical subsystems.

In upturns, order volume can be very high and the primary concern for critical subsystems buyers is delivery. Larger suppliers tend to benefit the most as they are able to deliver high-volume orders with short lead times. Smaller suppliers also benefit from upturns. However, many not be able to capitalise on high-margin opportunities in the same way as the well-resourced large companies.

In downturns the large company advantage becomes a hinderance. Large companies can build up big inventories at customer warehouses, which customers draw from during a downturn instead of placing new orders. On top of this, equipment manufacturers face downward pressures on their margins and look for alternative lower cost suppliers, providing an opportunity for smaller companies to compete as volumes and lead times are no longer such as issue.

We are yet to apply this analysis to other parts of the supply chain, but, at least for suppliers of critical subsystems, the majority of the 20% decline will be carried by larger companies while smaller companies are likely to see sales fall by a lower amount.

If you are still wondering what critical subsystems even are – check out the video and information at https://www.vlsiresearch.com/public/csubs/.

Julian West is a technical and marketing analyst at VLSI Research Europe.