Companies around the world are increasingly turning to mergers and acquisitions, research and development, and corporate venture capital (CVC) investment to sustain growth. For many years, global semiconductor companies including Intel, Qualcomm and Samsung have been active CVC investors. However, the economic fallout from the COVID-19 pandemic has forced many venture capital (VC) and CVC investors to rethink their investment strategies as they look to an uncertain future.

To help provide SEMI members with the latest market trend information, SEMI Taiwan held the webinar Challenges and Opportunities in Corporate Venturing during the Global Pandemic Crisis on April 28th. Featured speaker James Mawson, founder and editor in chief of Global Corporate Venturing, provided an analysis of the pandemic’s impact on deal flow, capital movement, sentiment and strategies among CVCs.

CVC takes larger role in past decade

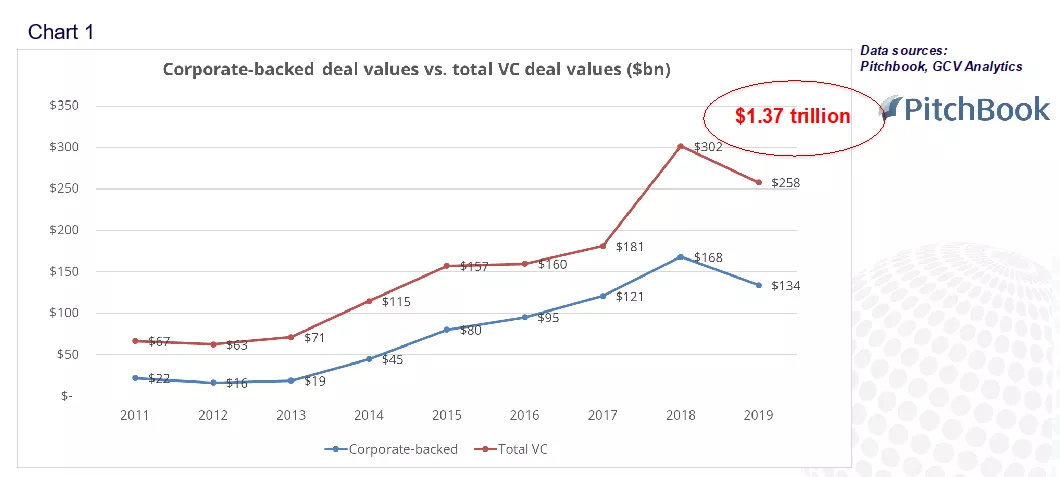

Corporations have been increasingly active direct and indirect venture investors over the past decade. From 2011-2019, more than US$1.3 trillion of venture capital was invested globally, with corporations accounting for more than half that total, according to data from Pitchbook/GCV Analytics.

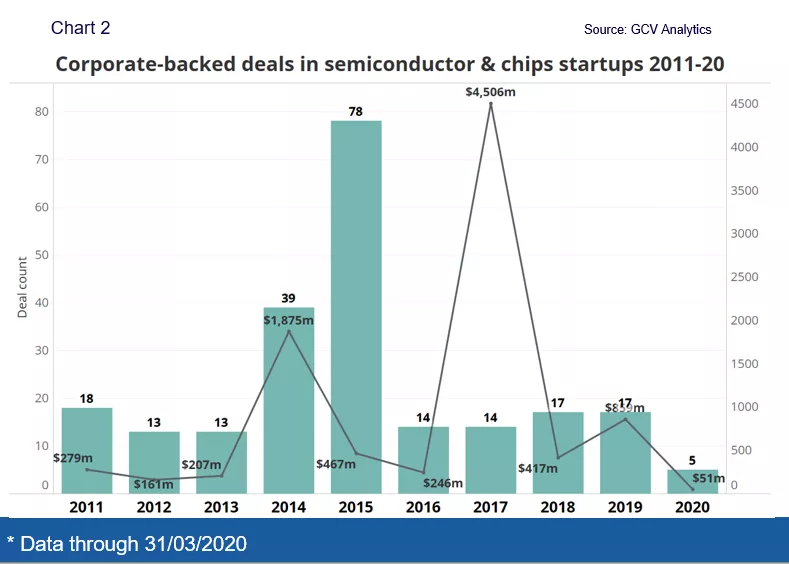

Semiconductor companies that have been active in corporate venturing include Intel, Samsung, Nvidia, ARM, AMD, SK Hynix, Broadcom and Qualcomm. Pure-play semiconductor and chip companies tend to make few investments in their start-up counterparts because sector saturation of powerful incumbents leaves little opportunity for growth, James said.

“While it is hard to find entrepreneurs wanting to be engaged in pure play S&C, once they do, they can be very valuable and often be able to bring disruptive forces to the whole ecosystem,” James said.

S&C corporate investors focus on chip applications

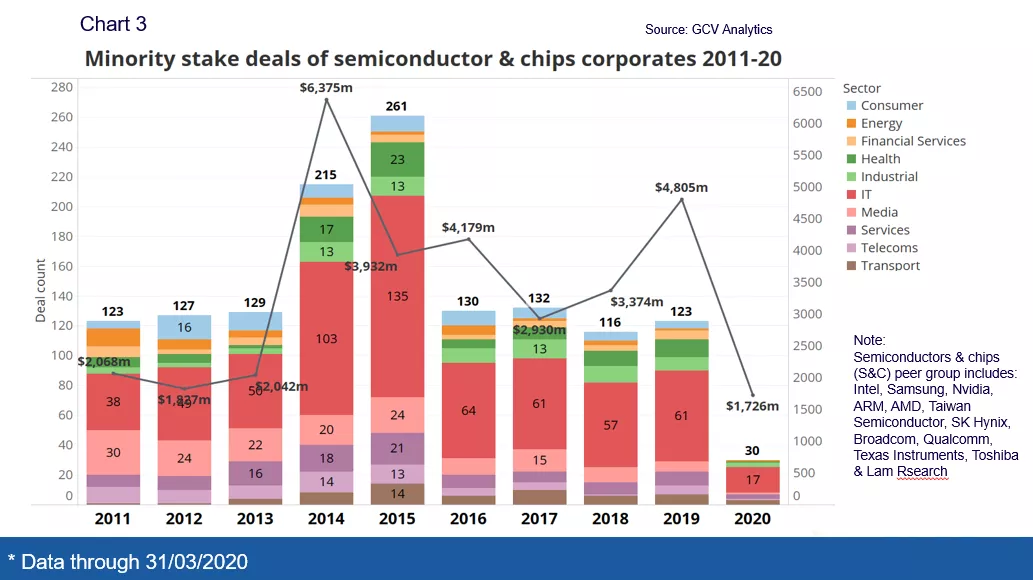

Semiconductor companies looking beyond pure-play S&C start-ups for investment opportunities often target applications or developers that require the additional data, processing power, and memory their chips provide.

“There is lots of interest by the big chip companies such as Intel, Qualcomm, and Samsung in developing some of those chip applications, getting them used more and creating a whole ecosystem,” James said.

For example, Intel Capital, based on its data-centric theme, has focused on areas like autonomous vehicles, data centers and artificial intelligence (AI) because of the sheer amount of data and processing power they require. In another notable trend, non-traditional S&C players such as Apple and Alibaba are leveraging investments in start-ups to develop their own chips for competitive advantage, James said.

March deal flow down 20%

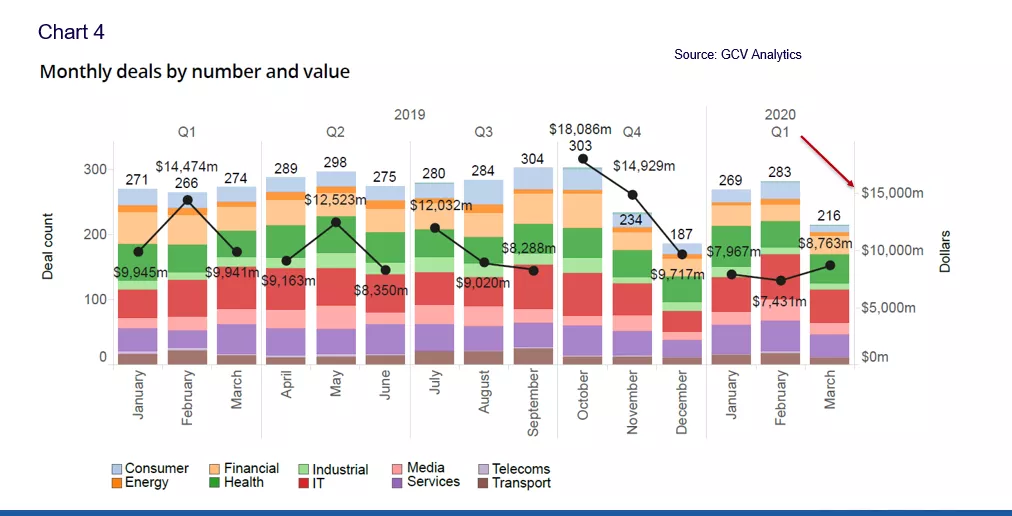

With COVID-19 slowing the global economy, James expects semiconductor and chip companies to scale back direct investments this year due to rising pressure on their balance sheets. Deal flow in March was down roughly 20% from February.

James is hopeful corporates will focus on investing in innovation over the long term rather than target share buybacks to boost near-term earnings. James pointed out that investors can uncover opportunities by identifying future problems to be solved in areas such as quantum computing, biotech, energy, healthcare, communications and ICT.

Still, in the near term, where there is a crisis, there is opportunity. While the pandemic hit some sectors hard, it benefits start-ups in industries including gaming, education and telemedicine.

This time is different?

James said corporates need to rethink the investment model they want to follow. One option is the approach taken by General Electric, which divested its investment team and sold all its portfolio companies last year. Another is to focus on the long term. For example, Intel Capital has been dedicated to investments in innovation for nearly 30 years and continues to invest during downturns.

Compared with the internet bubble and global financial crisis, today there are more experienced and mature CVCs that better know how to negotiate a crisis. James also pointed out investors are interested in backing CVCs with sector investing experience. There are now more than 600 CVCs with a 10-year-plus track record.

James expects a variety of funding models to emerge over the next decade as pressure on corporate balance sheets encourages corporate investors to consider models that allow third-party capital to effectively leverage their CVC units. Corporate investors are also open to other ways to efficiently deliver financial returns.

For more information about the SEMI Taiwan Corporate Growth and Innovation Community, please contact Irene Lin at irenelin@semi.org.

For GCV’s latest news and event, visit its website.

Jo-Ann Su is senior director of the Corporate Growth and Innovation Community at SEMI Taiwan.