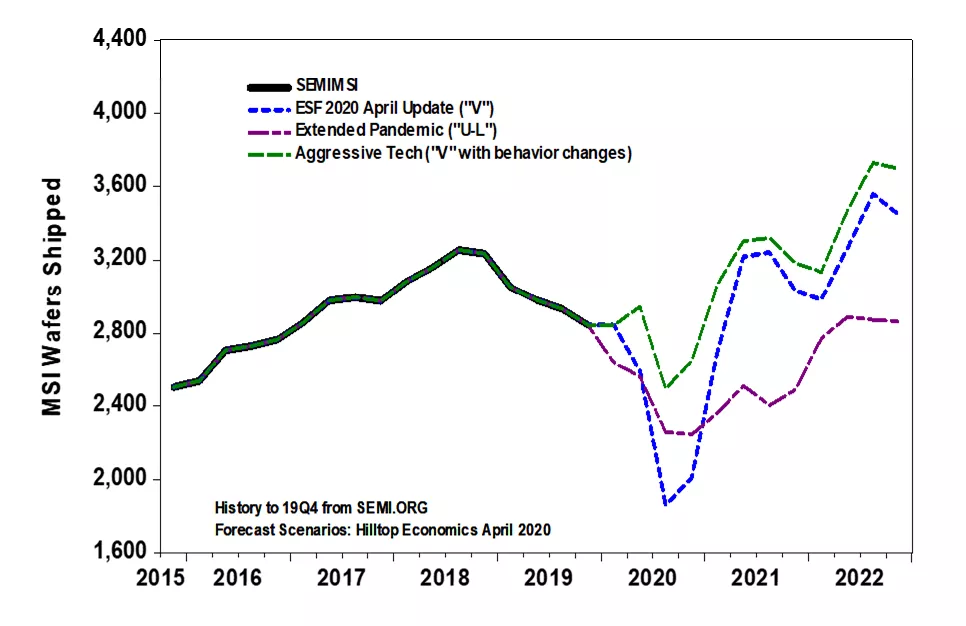

Linx Consulting and Hilltop Economics continue to monitor how the global economy impacts the electronic materials supply chain. Amidst the recent economic and revenue results releases, we have generated a series of potential scenarios for the next few years. These scenarios are based around sales of silicon wafers expressed in millions of square inches (MSI). Our work develops a multiyear forecast from the historic record of the SEMI-reported MSI demand by developing an econometric relationship with underlying demand drivers. Using this methodology, Linx Consulting and Hilltop Economics have introduced the following three silicon demand forecast scenarios:

- V-shaped global recession consistent with severe COVID-19 impact followed by a sharp economic rebound. Probability of approximately 40%.

- V-shaped global recession but with business and consumer behavior differing from the past recession in that there is much more aggressive spending on technology goods that softens the impact for semiconductors in 2020. Probability of approximately 25%.

- An extended COVID-19 impact developing into a U- or L-shaped global recession with an economic rebound delayed for several years. Probability of approximately 35%.

In the few months since coronavirus hit the world, the economic prognosis for all major economies has worsened dramatically, although forecasts remain speculative given the rapid rate of change in the political and economic environment. The forecast changes in GDP since February 2020 of the G7 nations vary from -5.9% for Japan to -10.2% for Italy. These changes are closely linked to unprecedented declines in employment, consumer demand and industrial investment – all key drivers for wafer area demand. This leads us to believe there will be a significant reduction in wafer demand as these economic factors feed through the supply chain.

Other leading indicators show dramatic drops in the global and regional economies taking effect at an unprecedented pace. These indicators have a loose predictive relationship for silicon wafer consumption and portend a rapid drop in demand.

![]() The demand picture for the semiconductor supply chain (be it wafers, materials, consumables or devices) is thus gloomy, and our models are currently showing Q2 to Q3 2020 reductions in MSI demand of between -11% and -28% depending on the scenario.

The demand picture for the semiconductor supply chain (be it wafers, materials, consumables or devices) is thus gloomy, and our models are currently showing Q2 to Q3 2020 reductions in MSI demand of between -11% and -28% depending on the scenario.

In marked contrast to this depressing economic picture, the indications from the end-to-end semiconductor supply chain continue to be much more positive. Demand for silicon reported by SEMI increased in Q1 2020 by close to 3% from Q4 2019, while results from materials supply companies vary from slightly negative to record-breaking growth rates through the first three to four months of 2020. Added to this, reported revenues from WSTS for Q1 2020 ticked up 6.2% versus the prior year and the three large foundries in Taiwan and China showed continued growth of Q1 wafer area shipments and a 32.3% growth versus Q1 2019.

Revenue and demand reports from leading device manufacturers remain on trend from 2019 with no indication of a precipitous change. Anecdotal reports of strong technology equipment demand to support people working from home and demand for medical devices in response to the pandemic can be substantiated somewhat by demand data although not convincingly.

Reports from materials supply companies indicate that factories continue to be fully utilized, having been designated essential businesses, and that safety measures implemented against infection are largely effective.

There are some indications of caution, however. The major public silicon wafer suppliers saw a 4% drop in revenues in Q1 over Q4, despite the reported strength in silicon area shipments from SEMI, indicating either ASP declines or some inventory effects.

There are some indications of caution, however. The major public silicon wafer suppliers saw a 4% drop in revenues in Q1 over Q4, despite the reported strength in silicon area shipments from SEMI, indicating either ASP declines or some inventory effects.

We are advising clients supplying materials into the wafer fabs and packaging supply chains to develop contingency plans for a sharp decline in product demand of as much as 28%, which may bounce back rapidly to 2019 levels or higher in early 2021. However, companies should also be vigilant of a slower than hoped for return to previous activity levels if the effects of the pandemic continue for an extended period.

For further information please contact Mark Thirsk at +1 774-245-0959 or on mthirsk@linx-consulting.com.

Interested in engaging with the electronic materials supply chain? The Electronic Materials Group (EMG) is a SEMI technology community representing SEMI member companies that provide substrates, polymers, metals, organic and inorganic materials, chemicals, and gases developed for electronics manufacturing. Linx Consulting is a longtime member and supporter of the SEMI Electronic Materials Group.

Mark Thirsk is managing partner at Linx Consulting. Duncan Meldrum is president of Hilltop Economics.