Global Manufacturing Activity

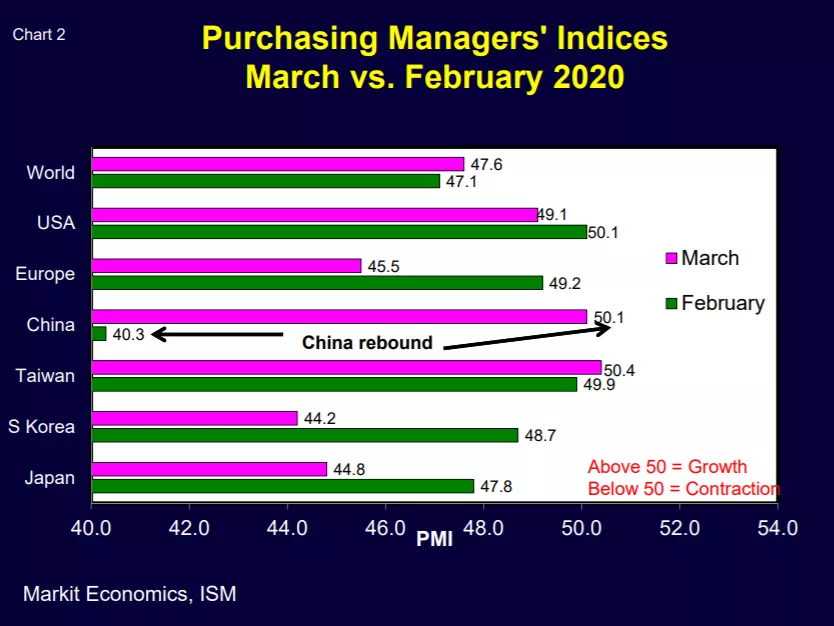

World manufacturing levels improved very slightly in March (Chart 1). The Global PMI rose from 47.1 in February to 47.6 in March, still remaining well in contraction territory. Results varied significantly by country (Chart 2).

China’s performance stood out. Its manufacturing PMI jumped from a February plunge to 40.3 to its March sharp rise to 50.2 – back into (barely) expansion territory.

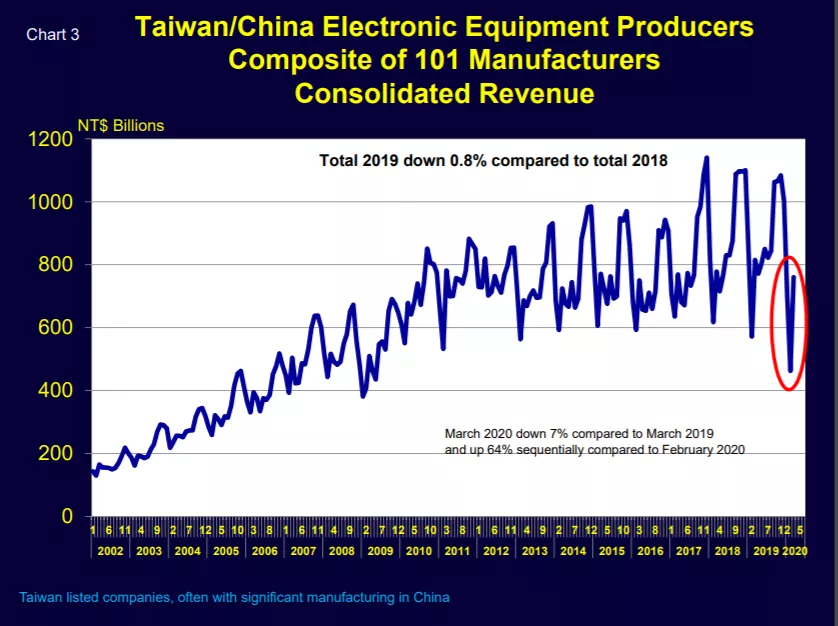

China’s March purchasing managers index rebound was mirrored by its sharp electronic equipment sales recovery (Chart 3). Taiwan-listed OEMs, many of which manufacture in China, reported March 2020 sales were down 7% compared to March 2019 but up 64% sequentially compared to February 2020.

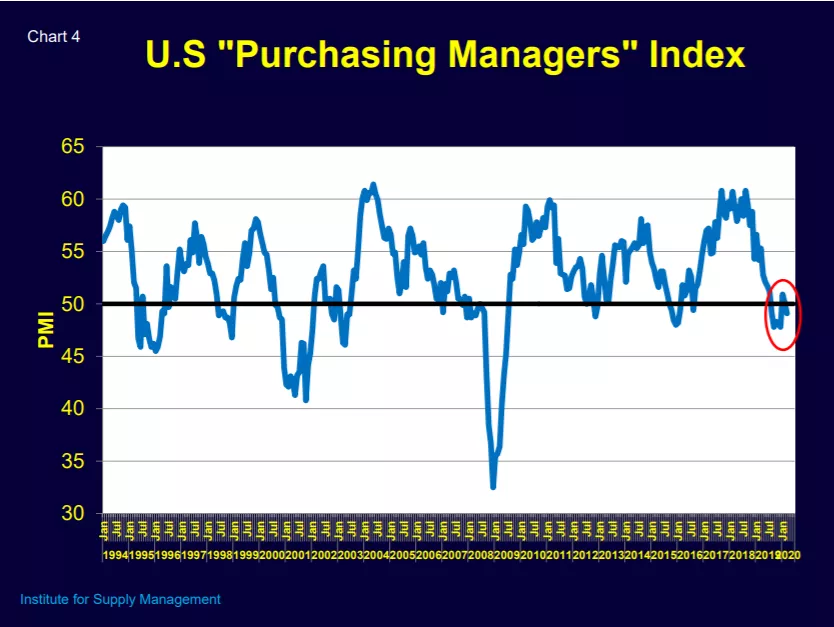

Unlike China, other world regions were still in decline in March with the U.S. (Chart 4), Europe (Chart 5) and Japan reporting further manufacturing activity deterioration. The COVID-19 virus has hit all regions hard with broad uncertainty looming regarding how and when recovery will occur.

Semiconductor Chips and Equipment

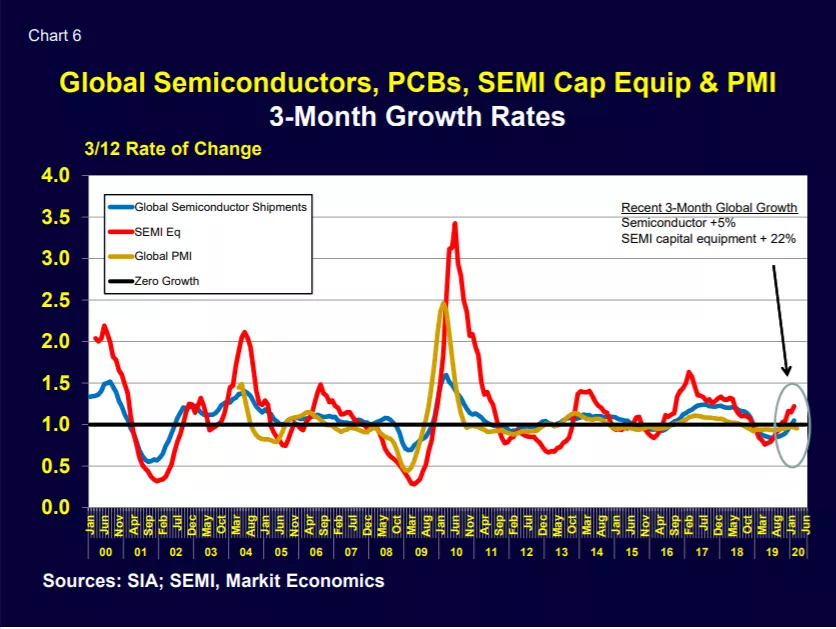

In spite of a possible looming economic crash, the semiconductor industry was still showing growth in early 2020 (Chart 6).

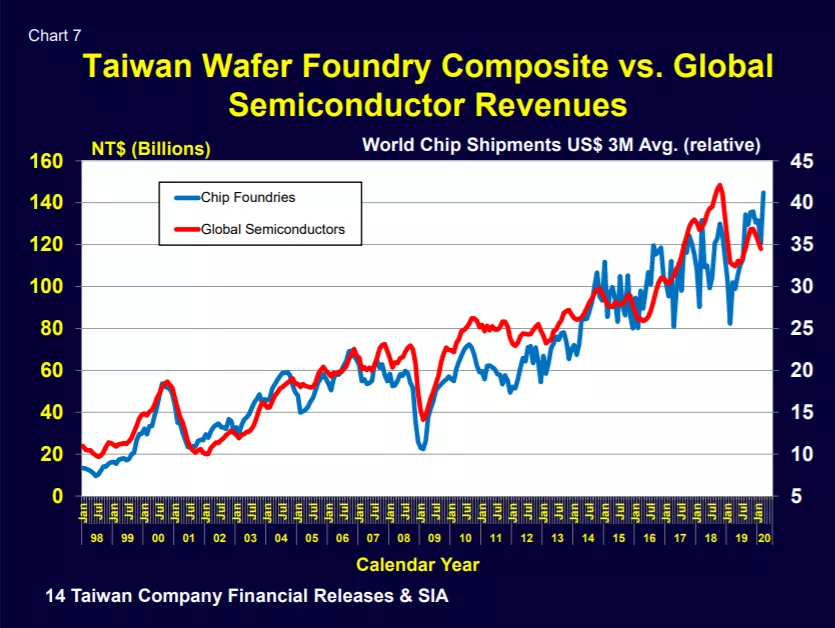

In February, world SEMI equipment and semiconductor shipments were still in a growth mode (3/12 >1), but the world PMI was weakening, suggesting that the coronavirus-driven economic slowdown could soon negatively impact the SIA and SEMI numbers. On the positive side, sales of Taiwan-listed chip foundries rebounded nicely in March (Chart 7). They are traditionally a leading indicator of global semiconductor shipments.

Reopening U.S Economy

The current world news is awash with stories about this current economic downturn including speculations about its probable depth and duration. Questions loom regarding what it will take to restart the world economies and how to accomplish this restart effectively.

Many countries are currently in lockdown to prevent the spread of the virus. This social distancing appears to have been effective in containing the virus but has meant painful side effects for social and business activity.

Some groups are pushing very hard to quickly reduce or end restrictions in hopes of rapidly increasing economic activity. Others are more cautious, wanting to ensure that what progress has been made thus far to slow the virus spread is not undone by premature and reckless short-term activities to reopen the economy.

Hopefully decisions will be made based on careful analyses using solid scientific data and not simply political agenda driven by instinct and wishes.

Will the recovery occur soon or are we in for a prolonged global recession?

The next 30 days should be very telling.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.