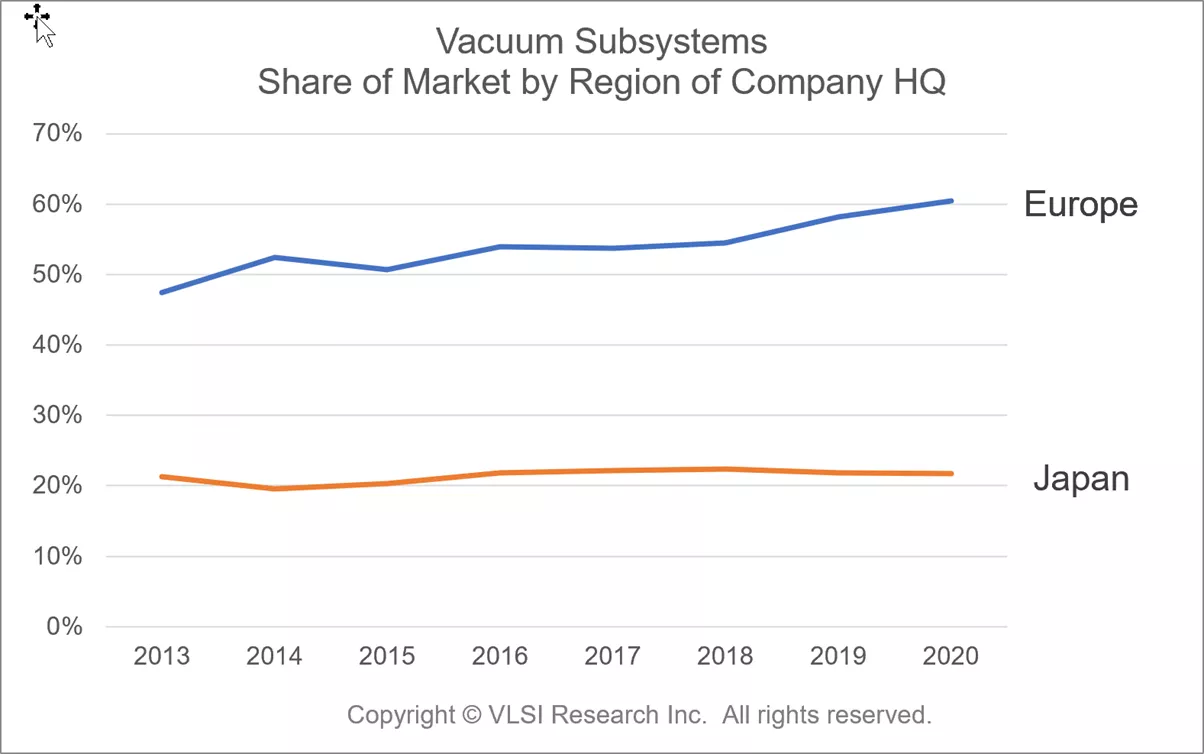

Vacuum pumps, pressure gauges, and vacuum valves combined make up the biggest expense on the bill of materials for semiconductor OEMs. The semiconductor industry consumed almost $2.7 billion worth of vacuum subsystems in 2020, with over 60% supplied by vendors based in Europe. In fact, just three European companies – Edwards, Pfeiffer, and VAT Valve – provided 55% of all vacuum subsystems sold for semiconductor applications worldwide in 2020. Substantial share gains by Edwards and VAT Valve, in particular, have contributed to Europe stretching its lead over Japanese suppliers, which have been stuck at 22% for several years.

The huge volumes of vacuum process chambers now being shipped each year combined with near double-digit growth rates favor the larger suppliers of vacuum subsystems. This means the momentum is with European suppliers as they have the resources to scale up quickly and the funds to finance the research and development effort required to stay ahead of their customers’ needs.

Attempts by end users to source vacuum subsystems from indigenous suppliers, especially in China, Korea, and Taiwan, have been largely unsuccessful. Instead, European suppliers have shifted significant parts of their manufacturing to Southeast Asia and Korea to be nearer their customers’ manufacturing locations. On the other hand, Japanese suppliers have continued to manufacture the majority of their products in Japan.

The expectation is that unless the Japanese vacuum subsystems suppliers can find a way to respond, then European suppliers as a group will continue to gain market share.

The source of this data is an analysis published in the June 2021 VLSI Critical Subsystems report. For more information, please visit VLSI Research.

John West is managing director at VLSI Research Europe.