Global fab equipment spending is slowly crawling out of its slump in the second half of 2019 with a pickup in investments in memory – particularly 3D NAND – leading-edge logic and foundries. Compared to the first half of 2019, the second half smacks of a recovery, with fab equipment spending revised upward to show a stronger 2019 overall in the latest update of the World Fab Forecast report, published by SEMI.

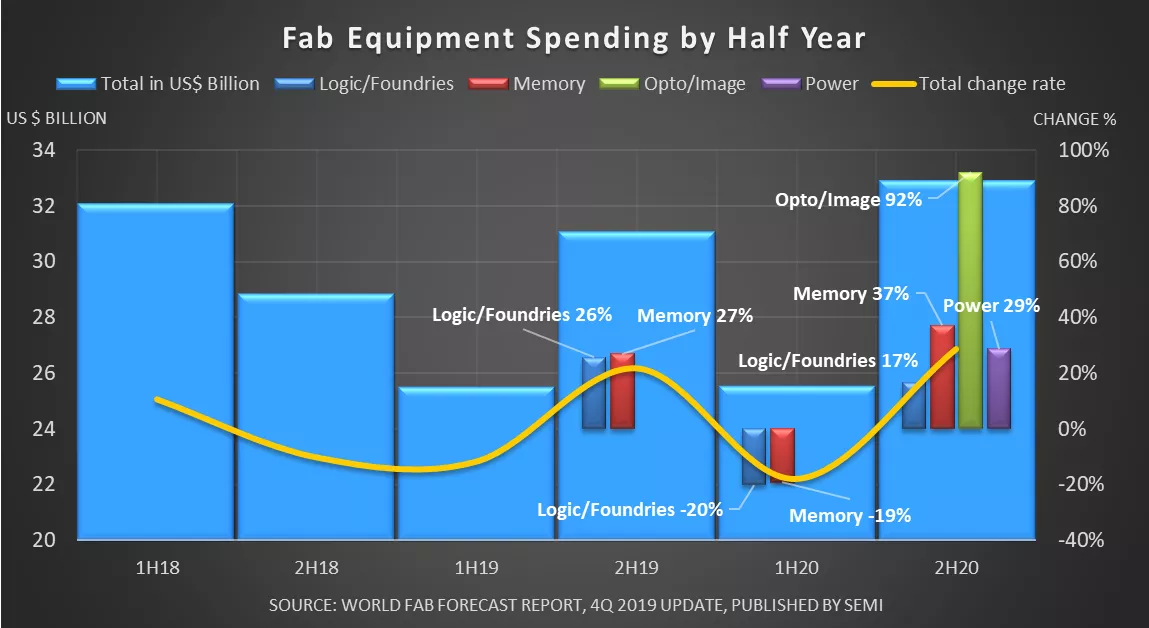

SEMI data now point to just a 7 percent decline in fab equipment investments from 2018 to 2019, a marked improvement on the previously forecast drop of 18 percent. Projected 2019 spending now totals about US$56.6 billion, and investment expectations for 2020 have also been revised upward to US$58 billion. See figure 1.

Blame the roller coaster on memory. Lower memory sector investment began dragging down total spending in the second half of 2018 (10 percent fall) and the slide continued into the first half of 2019 (12 percent drop), as indicated by the yellow trend line in Figure 1. Fab equipment spending for memory sagged 38 percent, to below US$10 billion, in the first half of 2019 as 3D NAND sector investments took an especially hard hit, plunging 57 percent from the second half of 2018. DRAM investments fell 12 percent in the second half of 2018 and another 12 percent in the first half of this year.

Figure 1: Fab equipment spending by half year and change rates of main investment contributors

But then the trend shifted abruptly toward the end of 2019. Investments in leading-edge logic and foundry now are expected to climb 26 percent in the second half of the year, lead by TSMC and Intel, and 3D NAND spending will skyrocket more than 70 percent over the same period. While the decline in DRAM investments continued in the first half of this year, the descent since July has been more muted. The upshot is aggregate memory growth of 27 percent in the second half of 2019. The company driving the spending surge toward the end of the year? Samsung.

Logic/foundry and memory spending is expected to drop again in the first half of 2020, a period when other segments will slowly increase investments, though on a smaller scale. Lead by Sony, image sensors spending will jump 20 percent in the first half of next year and soar by over 90 percent in the second half, peaking at US$1.6 billion. Investments for power-related devices, driven by Infineon, ST Microelectronics and Bosch, are projected to grow by over 40 percent in the first half of 2020 and another 29 percent in the second half, reaching nearly US$1.7 billion.

In a breakdown of fab spending by region, Taiwan and the Americas stand out with year-over-year (YoY) investment increases of 60 percent and 40 percent, respectively. In China, equipment spending, fueled by new indigenous fab projects, is resilient with only a 1 percent decrease in 2019. A YoY decline over 30 percent is projected for all other regions. China is expected to increase investments by almost 16 percent YoY in 2020, a rise mainly driven by 3D NAND, while logic/foundry and power will be big contributors to a healthy 52 percent YoY increase in Europe/Mideast.

In a breakdown of fab spending by region, Taiwan and the Americas stand out with year-over-year (YoY) investment increases of 60 percent and 40 percent, respectively. In China, equipment spending, fueled by new indigenous fab projects, is resilient with only a 1 percent decrease in 2019. A YoY decline over 30 percent is projected for all other regions. China is expected to increase investments by almost 16 percent YoY in 2020, a rise mainly driven by 3D NAND, while logic/foundry and power will be big contributors to a healthy 52 percent YoY increase in Europe/Mideast.

The latest World Fab Forecast report, published in late November 2019, covers quarterly spending for construction and equipment from 2018 to 2020. The report lists more than 1,340 fabs and lines and 135 facilities expected to start volume production in 2019 or later. The World Fab Forecast also provides quarterly totals for capacities, technology nodes, 3D layers, product types and wafer sizes.

Learn more about SEMI fab databases.

Christian G. Dieseldorff is senior principal, Semiconductors, in Industry Research and Statistics at SEMI.