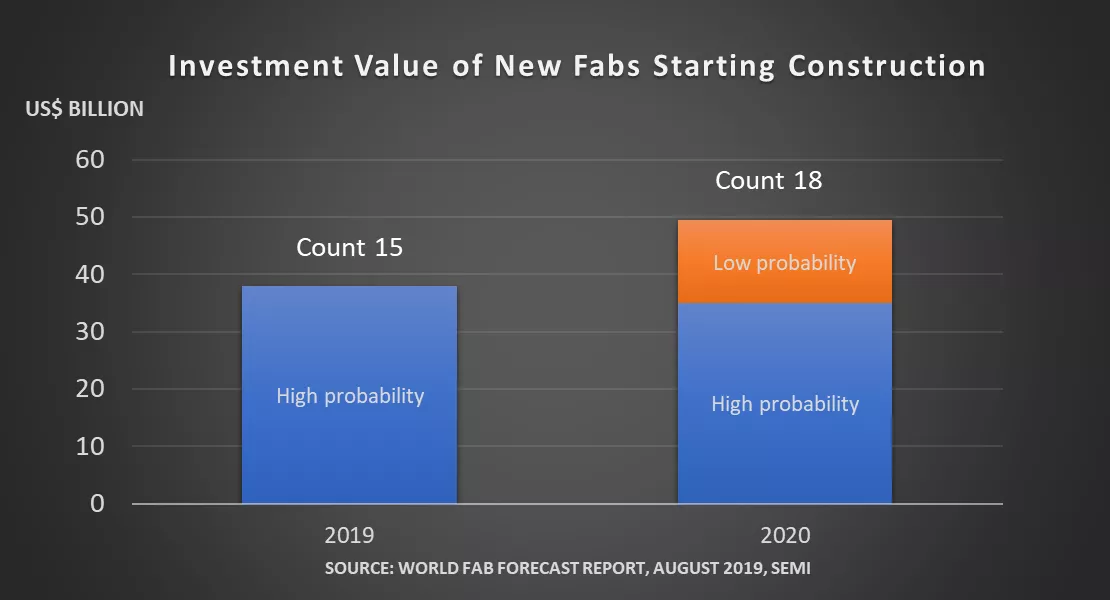

After a downturn in 2019, investments in new fab projects starting construction is expect to jump US$12 billion to nearly US$50 billion in 2020, with China accounting for the bulk of the investments, according to the latest update of the World Fab Forecast from SEMI. See figure 1.

By the end of the year, 15 new fab projects with a total investment of US$38 billion will have started construction and 18 more fab projects will kick off construction in 2020. Of the 18, 10 fab projects with a total investment value of more than US$35 billion carry a high probability. The other eight, with a total investment value of more than US$14 billion, are weighted with a low probability of materializing.

Figure 1: Total investments (construction and equipment) for new fabs and lines (greenfield, shell, new line) starting construction through 2020

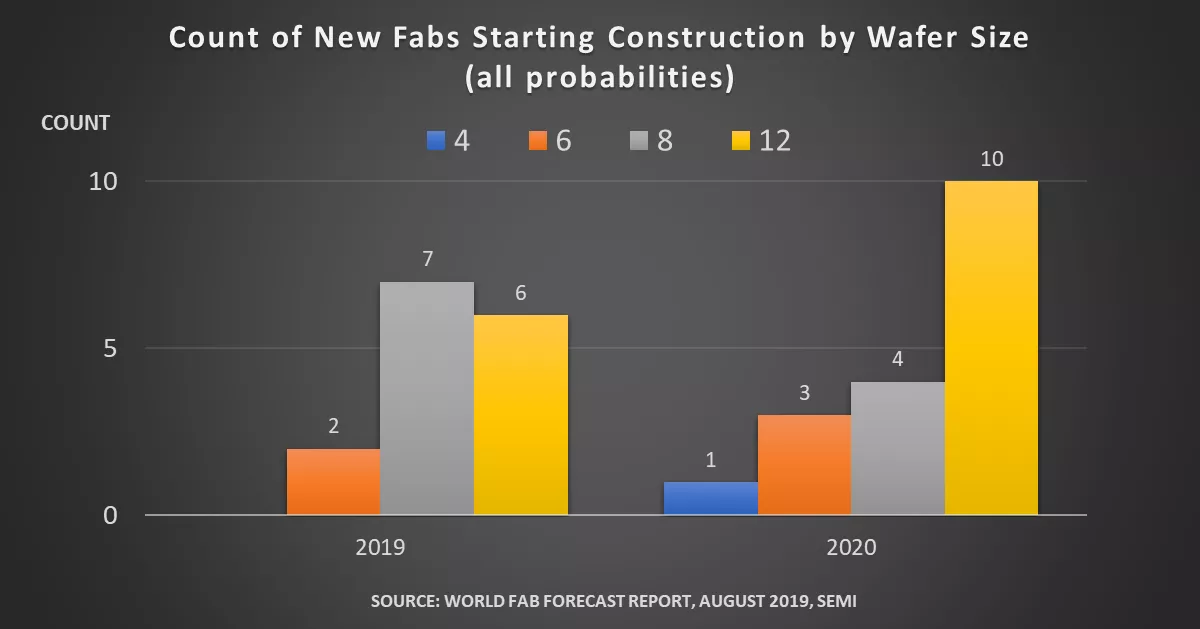

Facilities that commence construction in 2019 will begin equipping as early as the first half of 2020, with some starting to ramp production as early as mid-2020. These new fab projects will add more than 740,000 wafers per month (in 200mm equivalents). Most of the additional capacity will be dedicated to foundries (37%) followed by memory (24%) and MPU (17%). Of the 15 new fab projects in 2019, about half are for 200mm wafer sizes. See figure 2.

Figure 2: Fab Count by wafer size for new fabs and lines (greenfield, shell, new line) starting construction in 2019 and 2020

The fab projects to begin construction in 2020 are expected to produce more than 1.1 million wafers per month (in 200mm equivalents). Most of these fabs and lines will begin equipping in 2021. The high-probability fabs will increase capacity by 650,000 wafers per month (in 200mm equivalents) while the low-probability facilities may add another 500,000 wafers per month (in 200mm equivalents). The bulk of the capacity will be for foundry (35%) and memory (34%) across various wafer sizes.

After a slow 2019 with only three new fab projects, China will see fab construction starts surge to 11 projects valued at US$24 billion in 2020 across all probabilities, accounting for almost half of all worldwide new fab projects. The increase would vault China back to the top globally for new fab projects, a crown China last claimed in 2017. When low-probability projects are excluded, the China count falls to four valued at US$9.6 billion. By contrast, Taiwan’s new fab projects starting in 2020 are valued at almost US$13 billion with Europe and the Mideast planning fab projects valued at over US$11 billion the same year.

What remains to be seen is how many of the fab projects announced in China will materialize. Of the US$24 billion fab projects across all probabilities, Chinese-owned companies will contribute the lion’s share of the investment with almost US$20 billion, with more than US$ 4 billion stemming from non-Chinese companies. However, when low-probability fabs are excluded from the equation, Chinese-owned companies will account for US$6.6 billion and non-Chinese owned companies US$3 billion in new fab projects.

What remains to be seen is how many of the fab projects announced in China will materialize. Of the US$24 billion fab projects across all probabilities, Chinese-owned companies will contribute the lion’s share of the investment with almost US$20 billion, with more than US$ 4 billion stemming from non-Chinese companies. However, when low-probability fabs are excluded from the equation, Chinese-owned companies will account for US$6.6 billion and non-Chinese owned companies US$3 billion in new fab projects.

Published by the Industry Research and Statistics Group at SEMI, the World Fab Forecast covers new, planned and existing fabs as well as fab spending for construction and equipping, capacity expansion, and technology nodes by quarter and by product type with more than 1,300 front-end fab listings. All told, 192 updates have been made to the report, including the addition of 64 new facilities and lines since its previous publication in June 2019. The World Fab Forecast also includes projections for fabs and lines starting construction beyond 2020.

Learn more about SEMI fab databases.

Christian G. Dieseldorff is senior principal, Semiconductors, in Industry Research and Statistics at SEMI.