Publication Date:

Publication Schedule:

Published QuarterlyPrincipal Analysts:

Christian Gregor Dieseldorff, SEMIChih-Wen Liu, SEMI

Format:

Microsoft® Excel® file (.xls)

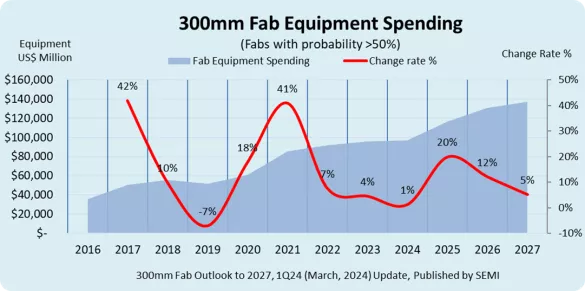

- Fab equipment spending for 2024 is expected to slightly increase to US$ 97 B (+1% YoY)

- We expect fab equipment for 2025 with $ 117 B (+20% YoY), 2026 with $ 131 B (+12% YoY), and 2027 with $137 B (+5% YoY).

- Total installed capacity is expected to grow 9% in 2024, 10% in 2025, 9% in 2026, and 8% in 2027.

- The report shows 75 new 300mm volume fabs (greenfield, shell, volume fabs, high probability, counted as fab) to begin operation from 2024 to 2027, raising the count to 234 fabs by 2027 (including EPI). The number is higher if including low probability fabs.

**Multi-user and Enterprise licenses must be purchased when more than 1 user accesses SEMI reports/databases**

Product Information

|

|

The information for the fab reports and forecasts is compiled from various sources in the industry including publicly available information such as capital spending plans, fab plans, ramp schedules, and technology roadmaps.

Source data are verified across an extensive network of industry contacts. These data are used in modeling for each company and facility, incorporating various economic indicators and best educated estimates.

The report uses a bottom-up approach, tracking projects per cleanroom facility but uses also a top down analysis by company, region, and industry segment.

Content details include capital expenditure for construction and equipment, capacities, technologies used, product types, and wafer sizes.

Purchase

| Product | Member | Non-Member | |

|---|---|---|---|

| 300mm Fab Outlook to 2027 - 1 user, One Time Purchase | $4,500 | $6,600 | Buy Now |

| 300mm Fab Outlook to 2027 - 1 user, Annual Subscription | $8,900 | $13,250 | Buy Now |

To purchase multiple user licenses at a discount, please contact mktstats@semi.org.