In early April, the SEMI Industry Strategy Symposium (ISS) explored how Europe can capitalize on and help drive digital innovation. With three plenaries and a dedicated session on talent and diversity, ISS Europe brought together more than 150 industry, academia, education and government representatives for in-depth discussions on strategies and innovations for Europe to compete globally in the digital era.

Hosted by SEMI Europe, the three-day flagship forum examined how Europe can seize the full potential of digital innovation through collaborations in the electronics, components and systems communities. Here are the five key takeaways from this year’s ISS Europe:

1) Semiconductors: anywhere and anytime

The digital world relies on semiconductors. Data centers, online platforms, autonomous spacecrafts, blockchain algorithms, self-driving cars, 5G infrastructure and medical devices may serve different purposes but share one vital element: semiconductors. Indeed, many emerging applications rely on semiconductor memory and computational power to store and process data, making advances in chip design and manufacturing key to enabling new digital capabilities.

The digital world relies on semiconductors. Data centers, online platforms, autonomous spacecrafts, blockchain algorithms, self-driving cars, 5G infrastructure and medical devices may serve different purposes but share one vital element: semiconductors. Indeed, many emerging applications rely on semiconductor memory and computational power to store and process data, making advances in chip design and manufacturing key to enabling new digital capabilities.

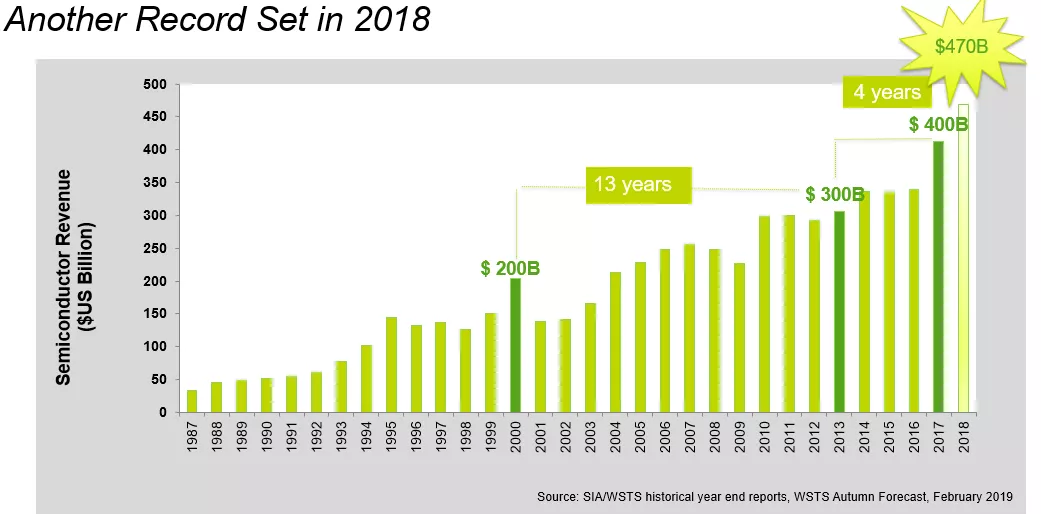

The central role of semiconductors in the digital economy powered industry revenues to a record $470 billion in 2018. Next generation chips need new materials, equipment, faster architectures, more advanced nodes, new design methodologies, and novel manufacturing processes to enable unprecedented computing at low power. In short, if Europe wants to lead the digital economy, it needs to lead the technology and business of semiconductors.

2) “Made in Europe” is on the rise

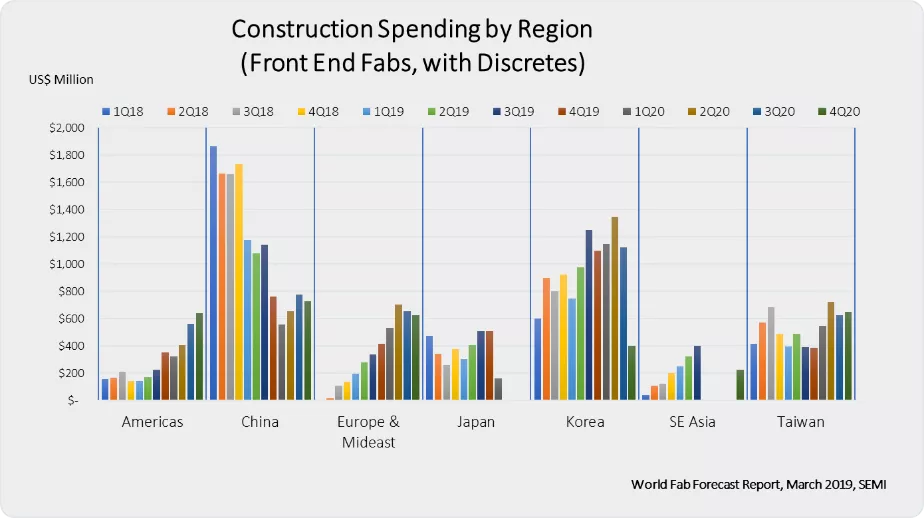

With its leading research and development hubs and businesses, Europe has always been in a strategic position in the global electronics value chain, and a new wave of investments is sweeping Europe to buttress its influential role. Over the past few years, leading businesses have announced new investment plans and started building new semiconductor fabs around Europe. In addition, last December the European Commission approved the IPCEI Microelectronics Project, which focuses on developing Internet of Things (IoT) and connected car technologies.

With its leading research and development hubs and businesses, Europe has always been in a strategic position in the global electronics value chain, and a new wave of investments is sweeping Europe to buttress its influential role. Over the past few years, leading businesses have announced new investment plans and started building new semiconductor fabs around Europe. In addition, last December the European Commission approved the IPCEI Microelectronics Project, which focuses on developing Internet of Things (IoT) and connected car technologies.

The project, involving 29 participating companies and research organizations, will receive €1.75 billion in public support, and is courting €6 billion in private investment. The investment infusions both from the private and public sectors bolster Europe’s strategic position in key electronics components and systems that are engines of the global digital economy.

3) The secret ingredients of European success: Connect, Collaborate and Innovate

Europe’s deep electronics ecosystem provides a complete supply chain: world-class R&D hubs, education institutes, material and equipment companies, chip manufacturers and key industries such as automotive, healthcare, manufacturing and aerospace. Europe is also home to agile start-ups, export-driven SMEs and family-owned companies to large global players. But it is the collaboration among these important players that drives European innovation.

Europe’s deep electronics ecosystem provides a complete supply chain: world-class R&D hubs, education institutes, material and equipment companies, chip manufacturers and key industries such as automotive, healthcare, manufacturing and aerospace. Europe is also home to agile start-ups, export-driven SMEs and family-owned companies to large global players. But it is the collaboration among these important players that drives European innovation.

And it is the combined dynamism, agility and innovation of smaller companies and the ability of large organizations to mature and scale new product ideas that boosts Europe’s industry growth. Just as critically, Europe’s globally admired public-private partnerships and R&D instruments such as Horizon 2020, ECSEL Joint Undertaking, PENTA and Erasmus+ Sector Skills Alliances are instrumental to cross-border collaboration in Europe and, as an extension, sustaining its rich industrial ecosystem.

4) Investment in STEM education and a diverse talent pipeline will be decisive in future competitiveness

The electronics industry in Europe faces the increasing challenge of attracting and hiring workers with a hybrid skill set. The deepening penetration of electronic components and systems in the digital economy and new verticals is giving rise to industry requirements for a workforce pool with soft skills and expertise in production technologies, software and data science. The European Commission has found that 40 percent of companies in Europe have difficulties finding ICT specialists and it predicts that by 2020 electronics businesses in the region will be saddled with 500,000 unfilled vacancies for ICT professionals.

The electronics industry in Europe faces the increasing challenge of attracting and hiring workers with a hybrid skill set. The deepening penetration of electronic components and systems in the digital economy and new verticals is giving rise to industry requirements for a workforce pool with soft skills and expertise in production technologies, software and data science. The European Commission has found that 40 percent of companies in Europe have difficulties finding ICT specialists and it predicts that by 2020 electronics businesses in the region will be saddled with 500,000 unfilled vacancies for ICT professionals.

Another challenge, as Eurostat reports, is that females account for only one in six ICT students in Europe – a similar proportion seen in the labour market, with females represented only 17.2 percent of all ICT specialists employed in the EU. To sustain industry growth, Europe needs to invest more heavily in STEM education and make a diverse talent pipeline a top priority.

To help close the gender gap, governments and private actors in Europe have launched programs to attract young people with diverse background to STEM education and to the electronics industry by connecting the importance technology and innovation with social awareness, sustainability and responsibility. SEMI, with its workforce development and diversity program, supports education and career awareness in high tech by connecting students, young professionals and companies to help its members meet their skills requirements critical to business growth.

5) Protectionism and political uncertainty hampers competitiveness

The semiconductor manufacturing industry heavily relies on cross-border supply chains and international trade. According to a SIA report, a semiconductor company could have as many as 16,000 suppliers worldwide, and SEMI estimates that, on average, many of its members export more than 80 percent of their domestically produced goods. In the semiconductor manufacturing sector, trade and innovation are intrinsically linked. With the imposition of new tariffs, businesses in the semiconductor industry are facing higher costs and increased uncertainty.

Simply put, increased tariffs by one jurisdiction hamper global innovation, growth and competitiveness. SEMI, with its 10 Principles for the Global Semiconductor Supply Chain in Modern Trade Agreements, has long supported efforts to reduce and ultimately end trade tensions between global actors and has been engaged in extensive dialogue with policymakers, underscoring the importance of free trade to the industry.

Simply put, increased tariffs by one jurisdiction hamper global innovation, growth and competitiveness. SEMI, with its 10 Principles for the Global Semiconductor Supply Chain in Modern Trade Agreements, has long supported efforts to reduce and ultimately end trade tensions between global actors and has been engaged in extensive dialogue with policymakers, underscoring the importance of free trade to the industry.

ISS Europe gathers prominent stakeholders from around the world to define future market demands and to help decision-makers with strategic planning. ISS, a common platform for the electronics industry, academia, education and governments in Europe, has set the standard for the industry’s most influential organizations for nearly three decades. Seeking to educate, inform and create a discussion platform on digital innovation, business strategy and public policy, ISS Europe in 2020 will take place in Brussels, 1-3 April.

Laith Altimime is president of SEMI Europe.