Data management tools need to become whip-smart, multi-sensor packages are the real deal, and a renewed emphasis on safety has thrust ADAS sensor systems into the spotlight. These were among the latest industry insights served up to the more than 400 MEMS, imaging and other sensor industry professionals from 21 countries who massed September 19-21 in Grenoble, France, to learn, network and share updates during SEMI-MSIG’s European MEMS & Sensors Summit and Imaging & Sensors Summit. Read on for more detail on each of these topics.

1. The industry must drive advancements in data management tools – including AI – to manage data streams from advanced sensors and sensor systems.

Managing artificial intelligence (AI) data and mining it for actionable insight gleaned from the sensors – including a deluge from improving machine vision systems – is necessary to drive adoption and integration of sensor hardware. Whether in cars, for security applications, or simply adjusting the thermostat based on how many people are in the room, intelligence is necessary – and a wrong answer is unacceptable.

Evgeni Gousev from Qualcomm noted that, driven largely by privacy concerns, data processing (intelligence) will get closer to the edge than previously thought. In wearables, according to Peter Weigand of Bosch, that means software better suited to manage power more efficiently, faster adaptation to individual behaviors, as well as greater accuracy and more functionality. Mark-Eric Jones from Leman Microdevices noted that for AI to fulfil its promise in healthcare, it must be fed huge quantities of accurate data.

2. Multi-sensor packages have arrived!

A few years ago, sensor fusion was recognized by MSIG as a promising development that would expand capabilities and enhance sensor sensitivity and accuracy. Given the presentations and discussions at the Summit, that promise has been met and multi-sensor packages are living up to the hype. Several products combining sensors into one package with connected control and data systems – rather than as discrete elements – were showcased.

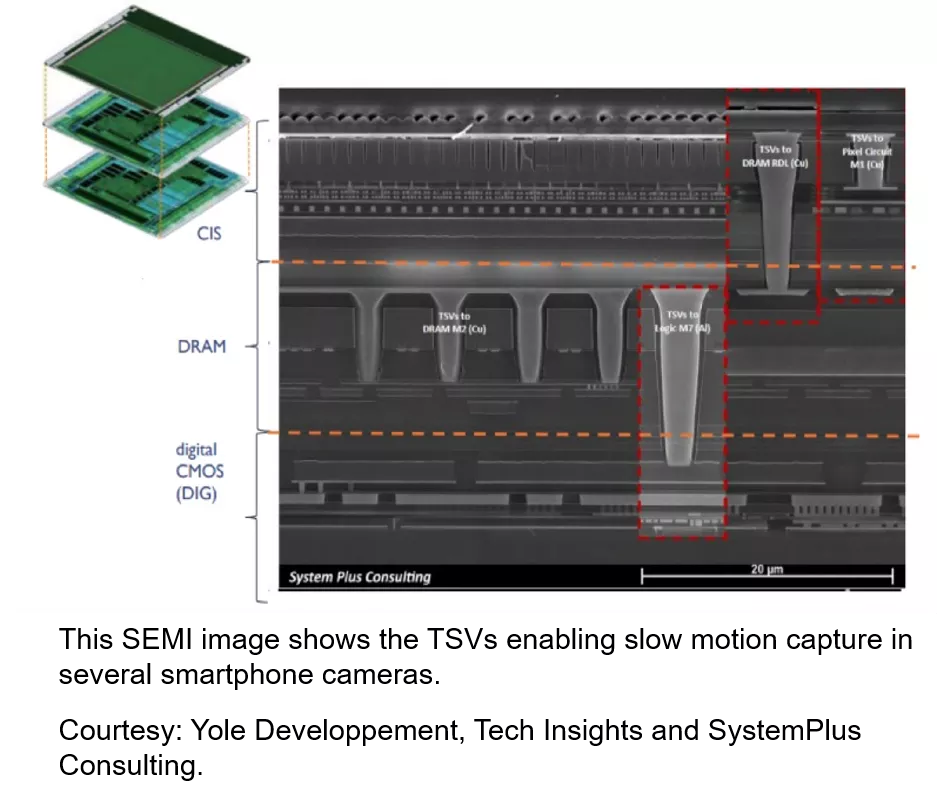

Adding another dimension (pun intended), 3D stacking and process and materials development are moving into volume applications to enable greater speeds and enhance capabilities for sensor modules. Companies taking advantage of 3D stacking and sensor fusion designs are gaining market share based on both volume and revenue forecasts. IHS Markit, Bosch Sensortech, On Semiconductor, Infineon and several other companies illustrated their work, while highlighting strong customer adoption.

3. Safety demands on ADAS systems has ratcheted skyward.

Presentations from Yole Developpement, Roland Berger, NXP Semiconductors, Renault, and STMicroelectronics (and more) demonstrated that the safety bar for autonomous driving systems is far higher than at last year’s event. Real-world conditions have exposed ADAS flaws, some grave after well-publicized fatal accidents, in monitoring and reaction time. The shortcomings have renewed efforts to improve LIDAR, RADAR and other imaging devices to integrate multi-faceted sensor systems into self-driving vehicles. The industry is clamoring for stronger algorithms to improve intelligence and wants more datapoints for smarter decisions, redundancies in sensors and systems ala commercial aircraft, and simulations of real-world scenarios.

Autonomous driving technology is young and going through a very natural maturation, moving from sky-high hopes for rapid adoption to the reality of putting multi-ton automobiles on the road with people and their physical vulnerabilities. We all welcome the breathing room as the industry renews its focus on safety. Learn more about the autonomous driving market and need for sensors at this SEMI webinar.

Highlights from the European Imaging & Sensors Sessions

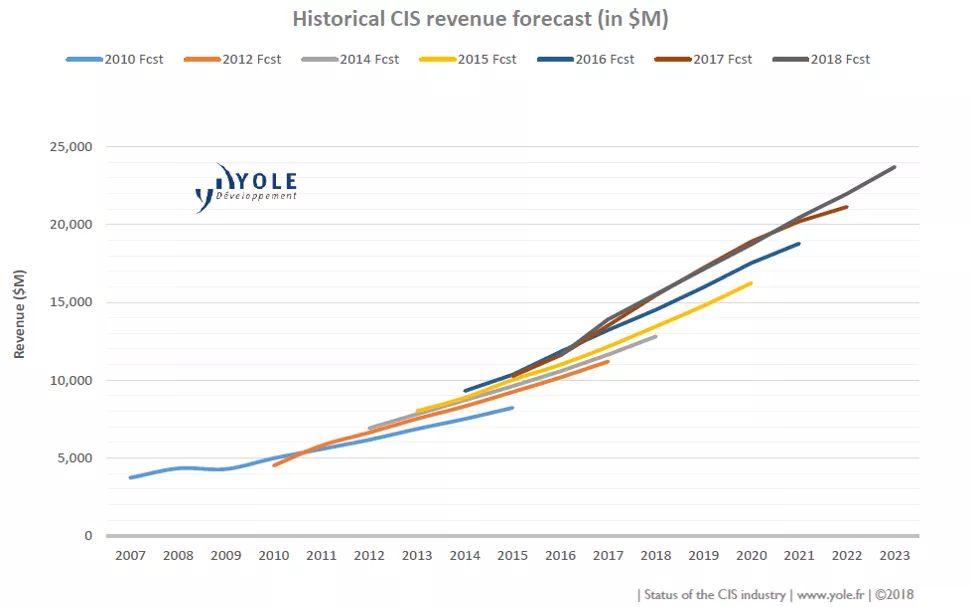

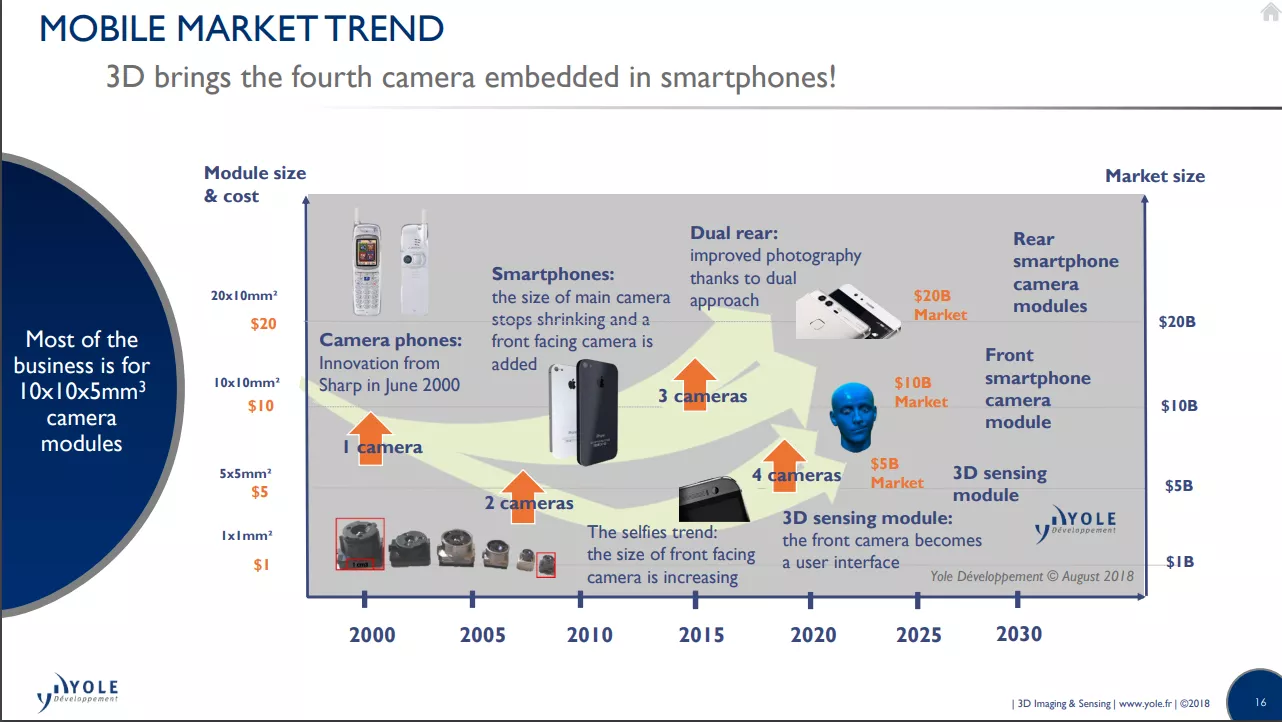

The Summit also boasted tracks on Imaging & Sensors that were well-attended and well-reviewed. Clearly the Imaging Sensors technology is building an ecosystem of suppliers and customers with exciting use cases. Yole Développement announced another upward revision of its forecast for CMOS based image sensors revenue – from US$21 billion to US$22 billion in 2022. This increase is mostly driven by dual-camera approaches and the introduction of new cameras in smartphones – an average of 3 per phone by 2022 – a huge volume that is still driving many sensor markets as well as technology development.

Yole Developpement forecast showing a consistent increase in the forecast each year.

Yole Developpement shares forecasts for smartphone imagers and demand for 4 cameras.

Presenters covered miniaturizing LIDAR; infrared, photon and multispectral detectors; image compression and other advanced software approaches. Speakers reviewed use cases for autonomous driving, smart cities, other consumer IOT, Industrial IOT, high-precision scientific instruments, and biomedical applications.

What’s the right solution? With so many options changing so rapidly, how is an integrator to know which sensor to place their purchase order. We need to help end users understand the long-term sustainability of their technology. Events like this one that connect lots of industry players can give product engineers the confidence to sign the PO and get on with moving their best product to market.

For more coverage of the European MEMS & Sensors Summit, visit our MSIG News page at http://www.semi.org/en/msig-news.

More details about these and other new trends will highlight the upcoming MEMS & Sensors Executive Congress in Napa, Calif., Oct. 28-30.

Heidi Hoffman is senior director of Technology Communities Marketing at SEMI.