The global electronics industry normally experiences a seasonal upturn from mid-summer through the December holidays. However, this autumn’s upturn is less robust.

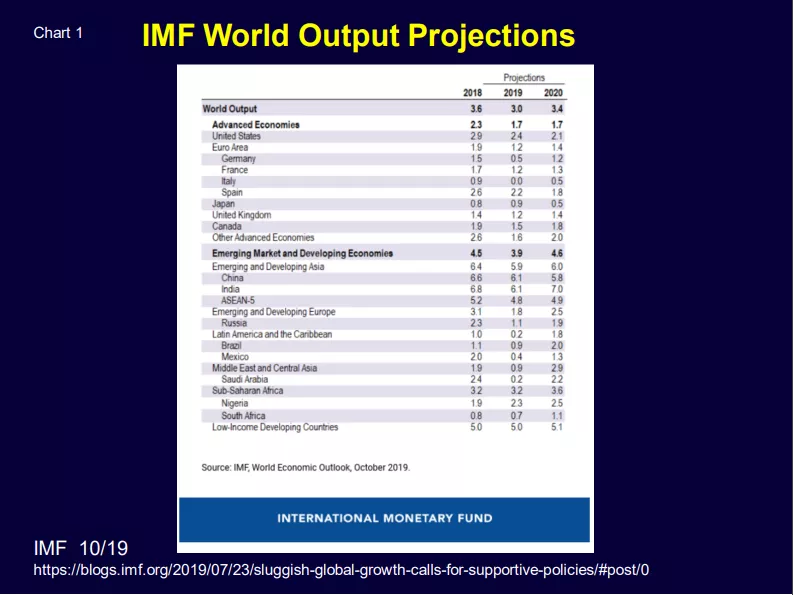

IMF: World Economy – Synchronized Slowdown, Precarious Outlook (Chart 1)

In mid-October, the International Monetary Fund updated its global forecasts:

“The global economy is in a synchronized slowdown and we are, once again, downgrading growth for 2019 to 3 percent, its slowest pace since the global financial crisis. Growth continues to be weakened by rising trade barriers and increasing geopolitical tensions. We estimate that the US-China trade tensions will cumulatively reduce the level of global GDP by 0.8 percent by 2020.”

Here’s the complete IMF narrative.

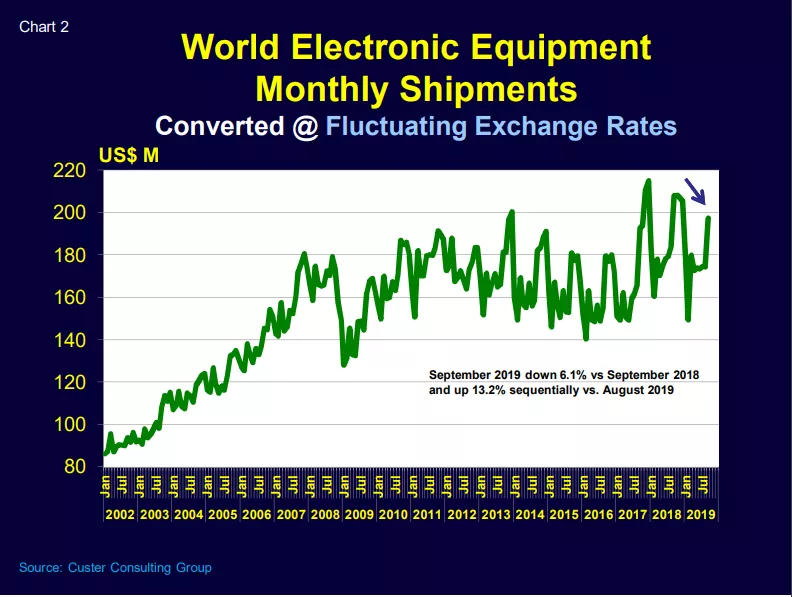

Weaker Electronic Equipment Growth

Chart 2 shows monthly world electronic equipment growth. It uses a base year scaled by monthly U.S. (Dept. of Commerce), Europe (Eurostat) and Japan (JEITA) information plus company composite sales for Taiwan/China and South Korea. September is estimated based on partial data.

The muted seasonal recovery is obvious. In 2019, August was down 6.4% and September was down 6.1% comparing 2019 vs. 2018. All regions are seeing weaker growth.

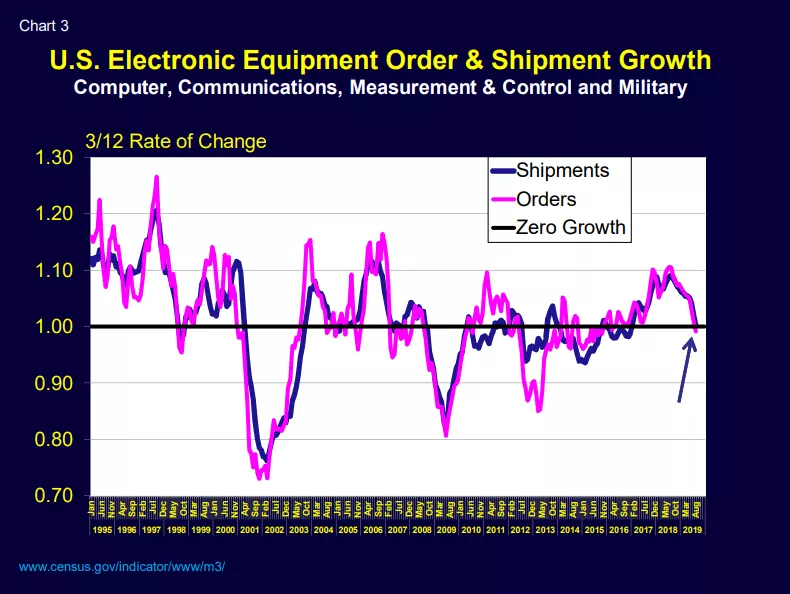

In the U.S., electronic equipment order and shipment growth dropped to nil in August (Chart 3).

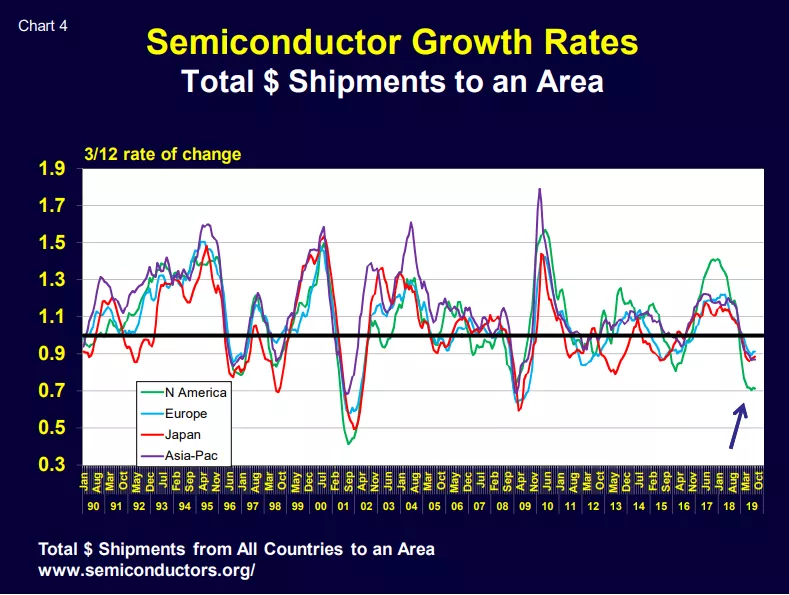

Semiconductors – Turning the Corner but Still in Contraction

Chart 4 shows regional 3/12 growth rates for semiconductor shipments. Values below 1.0 indicate contraction. Based on August data, the rate of contraction has reached bottom but we are still likely 6 months away before returning to actual growth (3/12>1.0).

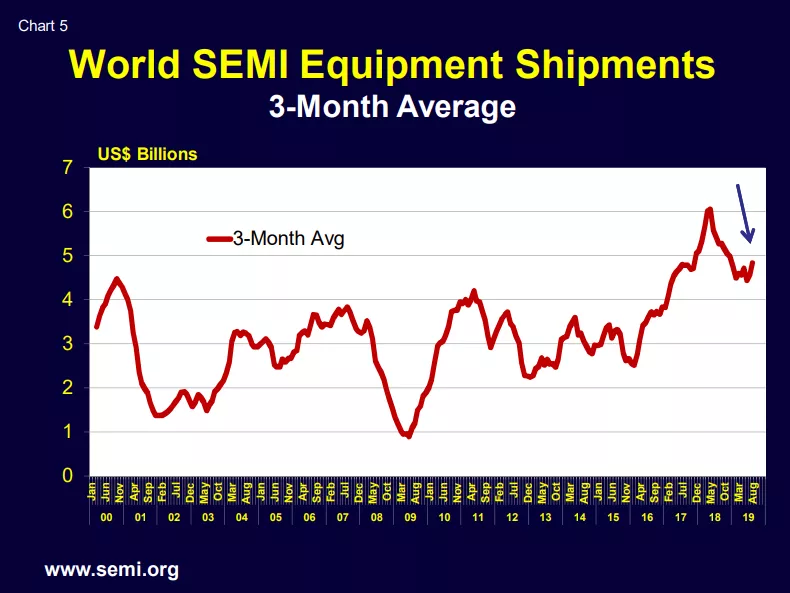

SEMI Equipment – Also at a Turning Point

Chart 5 shows world monthly SEMI equipment shipments on a 3-month average basis. Sales are improving but we are still quite far from the May 1998 peak.

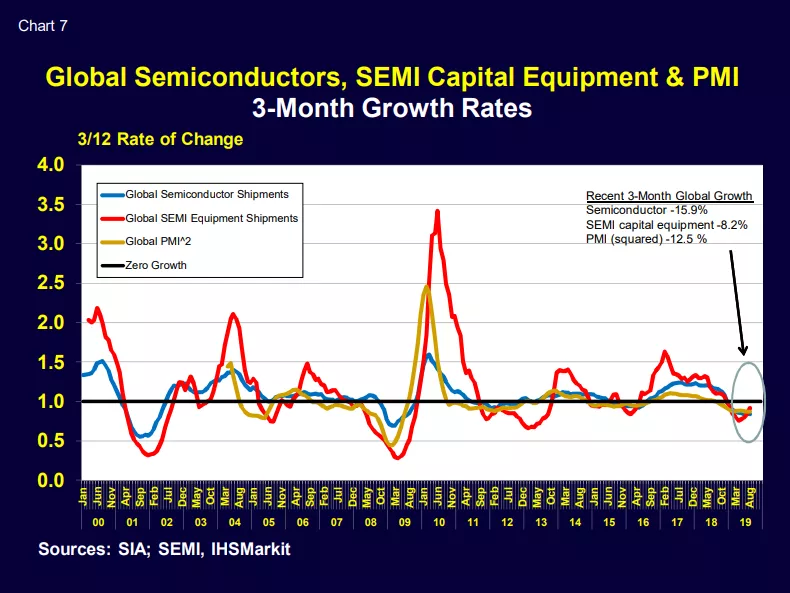

PMI Leading Indicator – Pointing North

The global manufacturing PMI recovered to break even in September (Chart 6), indicating no contraction in world manufacturing activity. However as noted above by the IMF, the world business climate is very fragile.

Chart 7 compares global semiconductor and SEMI equipment shipments to the PMI. We are recovering but the path ahead still has its challenges.

Hang in there. If we can stop shooting ourselves in the foot with trade wars and global infighting, 2020 should be a better year.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.