Despite a tough year for critical subsystem suppliers, their overall expenditure on research and development has remained at near record levels – evidence that critical subsystems are indeed critical to the semiconductor manufacturing equipment industry and that high research and development (R&D) spending on these products is essential.

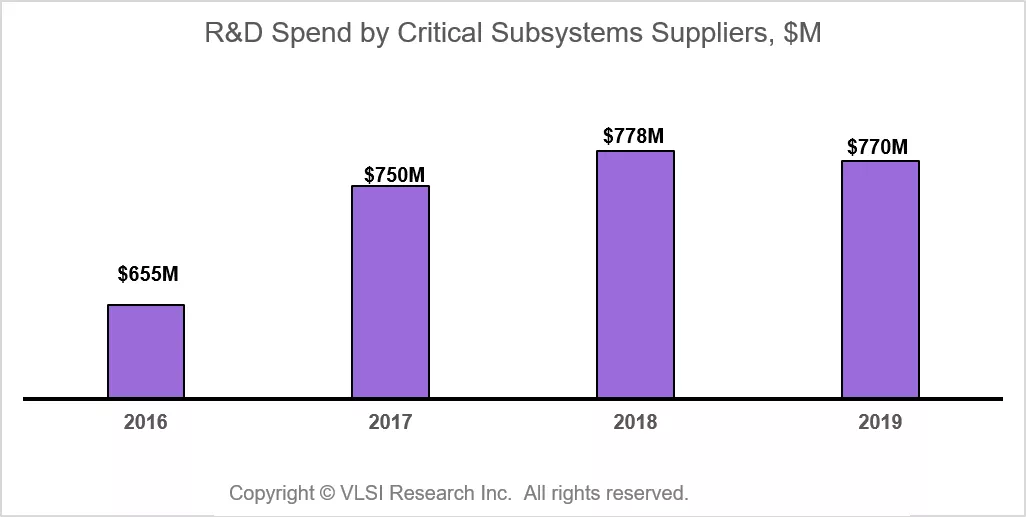

In 2019, R&D investment is expected to reach $770 million, down slightly from the $778 million spent in 2018. Long-term historical growth for R&D spend trended in the region of 2% year over year. By contrast, it has shown signs of growing at a rate closer to 4% in recent years.

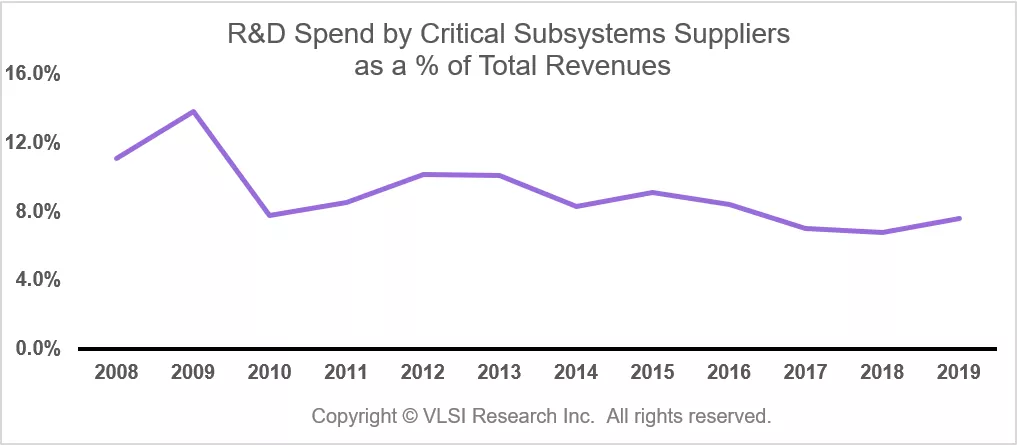

This higher rate of R&D expenditure growth, at least for now, is not a problem as industry revenues are growing at a faster rate. In fact, R&D investment in critical subsystems as a percentage of total revenues has declined over time and is currently settling in the 7.5% to 8% range.

From 2000 to 2010, R&D expenditure averaged around 10% of total revenues. The steady fall since then has been due to industry consolidation. Scale really matters when it comes to R&D spending, and it is clear from the analysis of individual companies that larger companies spend less as a percentage of total revenues than smaller companies in the same markets. Interestingly, companies with smaller R&D budgets can still hold their own in this environment. With larger companies focusing on big projects, plenty of opportunities remain for small suppliers.

For more information about critical subsystems and VLSI Research, please visit click here.

John West is managing director at VLSI Research Europe.