The global economy has started down a gradual path to recovery from COVID-19 in recent months as the world continues to combat the virus. Yet one sector – semiconductors – has shown impressive growth powered by a transformation hastened by the pandemic across industries ranging from education and work-from-home to healthcare.

Semiconductor sales increased 12% in September to mark a second consecutive month of double-digit growth, and year-to-date semiconductor receipts as of September jumped 5.5% compared to the same period in 2019, according to SIA/WSTS.

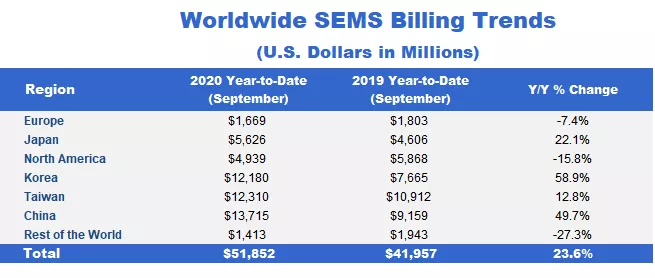

While this upward trajectory is encouraging, it pales compared to 2020 semiconductor equipment billings growth, with results from SEMI showing worldwide global chip equipment billings in September soaring to a new high of $7.6 billion this year. During the first nine months of 2020, aggregate equipment billings logged a 23.6% rise compared to the same stretch in 2019, surpassing $51 billion. Better still, the total semiconductor equipment market in 2020 is on track to beat the previous high of $64.5 billion set in 2018.

Investments in China, Taiwan and Korea are fueling the chipmaking equipment spending surge. With big domestic and international fab projects in the works, China this year is projected to become the world’s largest capital equipment market for the first time, surpassing Taiwan, which will follow at a close second. Korea will rank third in equipment investments. Taiwan and Korea growth will come on the strength of equipment spending for manufacturing leading-edge semiconductors.

Equipment billings in North America and Europe declined year-over-year as the automotive and industrial sectors suffered the heaviest blows from COVID-19. Investment momentum in both regions is expected to pick up in 2021 after automotive production recovers to pre-pandemic levels while factory automation will boost industrial demand.

For more information about monthly equipment billing trends by region and equipment segment, please see the SEMI Equipment Market Data Subscription.

Clark Tseng is director of Industry Research and Statistics at SEMI.