Can it be that no more new semiconductor fabs are being built in the U.S.?

The last new volume fab known is Micron’s Building 60 in Utah, according to the SEMI World Fab Forecast report published in February 2018. The catch is Building 60 is not a new or greenfield facility but rather an existing structure being retooled for 3D NAND. Fab equipment spending for this fab is expected to be high in 2018.

Then there is Fab 42 from Intel. Construction started in 2011 before it was shelved. It is expected to begin equipping by end of this year, with equipment spending expected to be high next year.

Other fabs built many years ago are still ramping such as Globalfoundries Fab 8 phase 3 (TDC) and D1X (module 1 and module 2). D1X is a research and development pilot, not a high-volume fab. And Globalfoundries’ plans for a second fab in Malta have been pushed out.

Samsung in Austin has space for more modules, but there is no indication they will ever be added.

The SEMI World Fab Forecast shows five smaller facilities either planned or under construction, but these have little impact in this U.S. fab construction trend.

And that’s basically it! No more volume fabs!

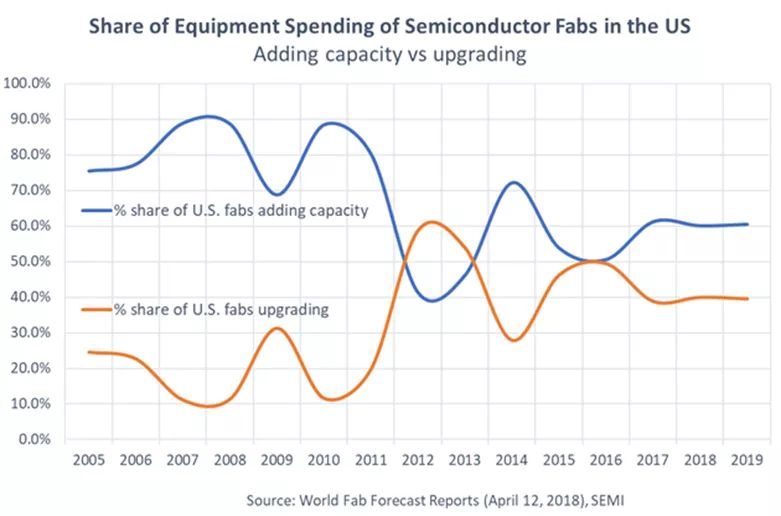

If we divide fab equipment spending into two categories – investment in new capacity versus upgrades – we see a declining trend for fabs adding capacity. See chart below. (Compare 2005-2011 with 2017-2019). If we look at 2017, 2018 and 2019, Globalfoundries, Intel, and Micron are the big investors in new capacity.

This year 60 percent of all fabs are expected to invest in equipment to add capacity, but just one or two volume fabs (Micron and Globalfoundries) account for the bulk of this growth. Same story for 2019, with two volume fabs (Intel and Globalfoundries) representing the lion’s share of the growth. Strike the Intel and Globalfoundries fabs from the equation, and investments in additional capacity would fall below upgrade spending levels.

Once these fabs have reached full capacity, additional equipment investments will significantly lag spending increases for upgrades, signaling the end of new fabs in the U.S.