Driven by the adoption of evermore electronic components in end products, the semiconductor industry is facing a new era in which device scaling and cost reduction will no longer continue on the path followed for the past few decades. Advanced nodes no longer bring the desired cost benefit, and R&D investments in new lithography solutions and devices below 10nm nodes are rising substantially. In order to satisfy market demands, the industry is looking for technology solutions to bridge the gap and improve cost/performance while at the same time adding more functionality through integration.

More than-Moore devices (including MEMS and sensors, CMOS Image Sensors, power electronic, along with RF devices) represent this new functional diversification of technologies, combining performance, integration and cost not limited to CMOS scaling, and their importance will become more and more preponderant.

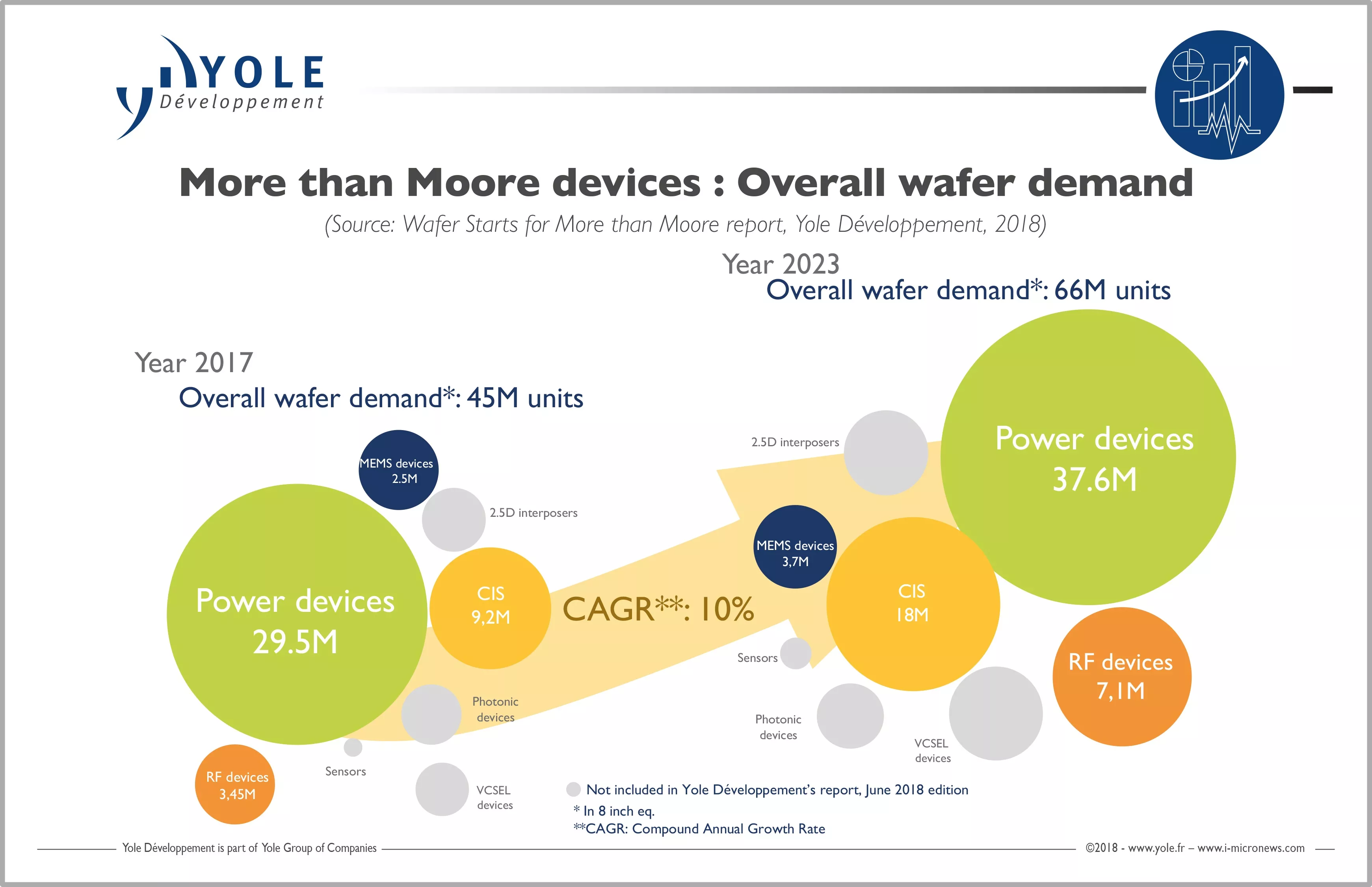

In 2017, wafer demand for More than Moore devices1 reached almost 45 million 8-inch eq. wafers. This figure is expected to reach more than 66 million 8-inch eq wafers by 2023, showing an almost 10 percent growth during this period.

This increase is supported by the famous megatrends detailed in the new analysis, Wafer Starts for More Than Moore Applications2, performed by Yole Développement (Yole). This analysis is relevant to the following markets: 5G with wireless infrastructure and mobile segments, mobile including additional functionalities, voice processing, smart automotive and electrification, AR/VR3, and AI4.

For the first time, the market research and strategy consulting company presents a dedicated technology and market analysis focused on the overall wafer demand for More than Moore devices. The aim of this report is to give an overview of wafer shipments for More than Moore devices, from wafer size to semiconductor material substrate type including silicon, glass, SOI5, SiC6, SiGe7, GaN8, InP9, GaAs10, sapphire and ceramic, and thus identify business opportunities in the More than Moore industry.

For over 20 years, Yole has been analyzing the industry evolution, discussing with leading companies to understand market challenges, and identifying technical breakthroughs. The Wafer Starts for More Than Moore Applications report is the result of this 20-year research. Yole’s analysts combine technical and market expertise to describe the More than Moore world. Market size (volume and value), substrate sizes and formats, value chain, technology processes and market drivers, business opportunities and competitive landscape are all part of Yole’s analysis.

The various research teams at Yole, encompassing power electronics, imaging and sensing, RF and semiconductor manufacturing, collaborate to present an in-depth understanding of the current market evolution, taking into account innovations and emerging businesses. This methodology allows Yole to cover the overall megatrends and illustrate the links between wafer substrate, device, module, sub-system, system and high-end product.

Under this dynamic ecosystem, the deployment of renewable energy sources and industrial motor drives as well as the electrification of the automotive industry are good examples of the impact of megatrends on the semiconductor industry development. They are directly impacting the power devices’ wafer market, resulting in an expected 13 percent CAGR between 2017 and 2023. Already in 2017, this market represented more than 60 percent of the overall wafer market for More than Moore devices, and is currently still dominating the More than Moore industry.

5G is one megatrend driving wafer demand. 5G is leading the More than Moore evolution, bringing any service to any user, anywhere. Antennas and filtering functionalities are two of the key innovations of this evolution.

Without doubt, the stringent requirements of 5G are driving increasing demand for RF components like RF filters, power amplifiers (PAs), and low-noise amplifiers (LNAs) to ensure access to tomorrow’s radio network.

This year, Corning and Menlo Micro announced a major agreement to develop a DMS[11] product platform. Both partners propose an innovative approach based on TGV12 packaging technology. According to both partners, this technical choice allows them to cover operation of frequencies beyond 50GHz.

Amongst the numerous megatrends, mobility is not far behind 5G. Demand for advanced mobile applications integrating more and more functionality is growing. In order to compete companies are developing smart combinations of devices such as fingerprint sensors, ambient light sensors, 3D sensing, microphones, and inertial MEMS devices. As an example, impressive developments focused on SOI-based NIR sensors have been released by SOITEC for front-side imager applications including advanced 3D image sensors. This technical evolution will clearly contribute, in the near future, to strong growth of the wafer market for MEMS and sensors.

Additionally, the automotive industry, with the development of smart cars, has reached a new level of complexity requiring the development and integration of new sensors. In this context, many companies are aiming to extend their capabilities in ADAS13 and autonomous driving. Recently the leading company On Semiconductor acquired SensL Technologies, the leader in SPAD and LiDAR sensing products for automotive. This acquisition is one sign among many highlighting the evolution of this historic industry, searching for new expertise and welcoming new players, more aware of consumer habits and needs.

Yole’s analysts expect smart automobiles to drive consistent growth of CIS14 and sensor wafer production over the next five years. It is fueled by the increasing integration of high-value sensing modules like RADAR, imaging, LiDAR and more. Although automotive will be mainly supported by these growth areas, historic MEMS and sensors such as MEMS pressure sensors and inertial MEMS will continue growing at a reasonable rate, supporting the standard automotive world.

Yole Group of Companies including Yole, System Plus Consulting, KnowMade, PISEO and Blumorpho follows and analyzes the industry continuously. The Group has developed in-depth expertise and knowledge focused on the semiconductor manufacturing process and markets. Companies of the Group work together to understand the technical issues, identify business opportunities and propose valuable analyses.

Yole invites you to an overview of the Wafer Starts for More Than Moore Applications report during the exclusive online event, titled “Wafer Starts for More than Moore Applications – Webcast”. This hourlong webcast takes place on June 28 at 5:00 PM CEST. The market research company will present key results of this report including megatrends, wafer market evolution and technical trends. Moderated by David Jourdan, Sales Coordination & Customer Service at Yole, it welcomes the two leading companies, SPTS (an Orbotech Company) and Corning Precision Glass Solutions:

- "Trends in Wafer Processing Technologies for RF MEMS" – Speaker David Butler, Executive Vice President and General Manager at SPTS Technologies

- "Benefits of Through Glass Vias for RF applications" – Speaker: Ravij Parmar, New Product Development Manager for Corning Precision Glass Solutions

These results will be also presented by the Semiconductor & Software team at SEMICON West (Booth #1320), SEMICON Taiwan and SEMICON Europa (Booth #A-4667). Make sure to meet Yole’s analysts and get a valuable overview of the More than Moore industry. Agenda and more information are available on i-micronew.com. Stay tuned!

About the authors:

Amandine Pizzagalli is a Technology & Market Analyst, Equipment & Materials - Semiconductor Manufacturing - at Yole Développement (Yole). Amandine is part of the development of the Semiconductor & Software division of Yole with the production of reports and custom consulting projects. She is in charge of comprehensive analyses focused on semiconductor equipment, materials and manufacturing processes.

Emilie Jolivet is Director of the Semiconductor & Software Division at Yole Développement, part of Yole Group of Companies, where her specific interests cover package & assembly, semiconductor manufacturing, memory and software & computing fields.

1 Including: MEMS & sensors, CIS, and power, photonics and RF devices

2 Yole Développement, March 2018

3 AR/VR : Augmented Reality/Virtual Reality

4 AI : Artificial Intelligence.

5 SOI : Silicon On Insulator

6 SiC : Silicon Carbid

7 SiGe: Silicon Germanium

8 GaN: Gallium Nitride

9 InP: Indium Phosphide

12 TGV : Through Glass Via

13 ADAS : Autonomous Driving Assistance Service

14 CIS : CMOS Image Sensor