When the COVID-19 pandemic struck, many industries and even entire economies worldwide hit the brakes hard. Confronted by uncertainties and challenges that ranged from supply chain logistics interruptions to government-imposed restrictions, business entities had to rapidly take measures limiting exposure to risks while reinventing their business models. The prospects of sustainable growth under such circumstances seem rather problematic. However, one of the surprising side effects that came out of the pandemic is the acceleration of the digital transformation of global economies, which has driven a structural shift and propelled the already mature semiconductor industry to record highs.

Despite all the turbulence brought by COVID-19, geopolitical tensions, and supply-chain constraints, 2021 marked a second consecutive year of record growth for the semiconductor industry overall. Silicon shipments reached record-breaking results in 2021 as demand for silicon remained strong to support the large variety of semiconductor devices needed for the modern digital economy. Semiconductor materials market expanded surpassing the previous market high set in 2020. Secular demand for semiconductors fueled this remarkable growth as digitization of industries worldwide continued.

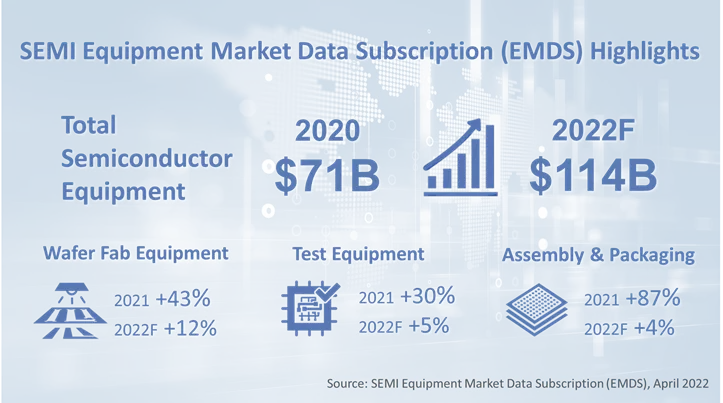

According to SEMI Equipment Market Data Subscription (EMDS), the industry’s foot in 2021 was firmly on the accelerator. Capacity investments to satisfy growth drivers contributed to the expansion of both the front-end and back-end semiconductor equipment segments. Worldwide semiconductor manufacturing equipment billings registered super-cycle growth of 44%, surpassing $102 billion and beating the previous industry high set in 2020. The equipment market growth was driven by advanced logic and foundry capacity builds, DRAM investment recovery and robust spending in NAND Flash. Spending on equipment was strong for all regions in 2021, which also marked the first time the top three regions – China, Korea, and Taiwan – each registered over $20 billion in annual spending for capital equipment.

Wafer Fab equipment, representing approximately 86% of the total equipment market, ended 2021 with 43% growth. The expansion of Wafer Fab equipment investments was boosted by the Foundry and Logic segments and a strong Memory spending recovery. Foundry and Logic, which accounts for more than half of Wafer Fab Equipment investments, finished 2021 with a 50% year-over-year surge. At the same time, robust demand for memory drove spending on NAND and DRAM manufacturing equipment, with DRAM leading the expansion in 2021 with 52% year-over-year growth and NAND flash equipment coming in at 24%.

For back-end equipment, both the Assembly & Packaging and the Test Equipment segments also rose to new highs. Assembly & Packaging equipment finished 2021 with an 87% increase to $7 billion after recording a 34% expansion in 2020. The demand for Assembly & Packaging tools was primarily driven by investments in flip-chip, wafer-level packaging (WLP), and other advanced packaging technologies as well as growth in wirebonding capacity. The Automated Test Equipment segment registered 30% expansion in 2021, reaching $7.8 billion following a 20% expansion in 2020. The long-term drivers for Test Equipment remain steady with demand driven by 5G, automotive, IoT and high-speed memories. Additionally, the Test Equipment market is rapidly expanding due to growing chip complexity and the growing adoption of chiplet architectures.

As a result, we are witnessing a structural shift in the industry marked by higher capital intensity and significant growth that is limited by the agility of the supply chain to fulfill demand and keep pace with capacity expansions. Current equipment investment levels relative to semiconductor revenues were at 18.5% in 2021, up from 16.2% in 2020.

And while digitization of economies is driving the semiconductor industry to new highs with respect to capital intensity and scale of investments in manufacturing, the road ahead is still a bit bumpy. Since the beginning of the pandemic, the semiconductor industry has faced many significant challenges that range from labor, materials and components shortages to logistics delays and insufficient manufacturing capacity. These challenges have resulted in increased lead times for the equipment needed to make chips due to supply-chain constraints. Further geopolitical tensions and potential export restrictions could add to the bottlenecks and contribute to supply chain and regulatory uncertainties. However, any significant restructuring of supply chain networks will take years, not months, regardless of whether it is brought about by politics or market forces.

It is fair to ask, with all the semiconductor industry’s recent acceleration and potholes to navigate around, is its growth running out of fuel? Not yet. The consensus outlook for semiconductor equipment for 2022 is solid 10-12% growth, with SEMI Semiconductor Equipment Forecast - An OEM Perspective projecting the market to expand to $114 billion, supported by investments in leading-edge technologies and strong memory equipment spending. Historically, multiple years of successive expansion have been difficult to maintain and back-to-back years of continuous growth are typically followed by spending contractions to allow the industry to digest new capacity and reach supply-demand balances. Yet, in today’s environment, the diverse range of emerging technologies tied to digital transformation leaves open the possibility for the market to drive further forward on its growth path with gauges pointing to the industry’s long-term road to expansion.

For more information about semiconductor equipment market trends by region and segment, please see the SEMI Equipment Market Data Subscription (EMDS) and related reports. For additional information regarding SEMI Market Data products or to subscribe, please contact mktstats@semi.org.

Inna Skvortsova is a market analyst on the SEMI Market Intelligence Team.