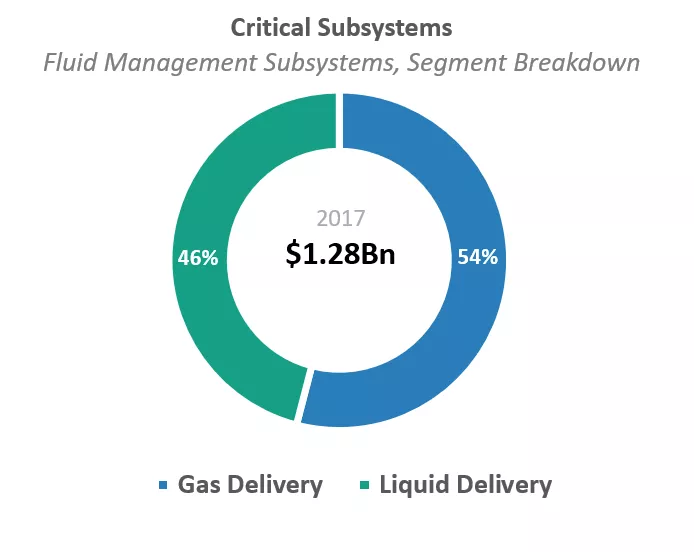

Sales revenues for fluid management subsystems grew 28 percent in 2017 to $1.28 billion, breaking the $1 billion mark for the first time. Fluid management subsystems have now seen five years of consecutive growth, and 2018 is expected to extend the growth streak to six years for the segment.

Fluid management subsystems control the delivery of process gases and chemicals onto the wafer during processing and may be located either on-tool or near the tool. This segment can be further divided into two main categories – gas delivery and liquid delivery subsystems. Gas delivery subsystems, such as mass flow controllers (MFCs), deliver gases or speciality chemicals to a vacuum process chamber, and liquid delivery subsystems typically deliver liquid chemicals to a wet processing module. Demand for gas and liquid delivery subsystems is roughly 54 percent and 46 percent respectively – a ratio that has not changed significantly over the past few years.

Although fluid management subsystems account for approximately 10 percent of expenditures on all critical subsystems used on semiconductor manufacturing equipment, growth of other critical subsystems such as vacuum processing subsystems has been sluggish.

Mass flow controllers (MFCs), however, are showing strong growth potential and are set to buck their historical slow growth trend as the industry transitions into sub 10 nm processing. At the leading edge, processes are becoming more vacuum intensive and the importance (and difficulty) of accurately controlling chemical delivery for deposition onto the wafer is increasing. Process operating windows are getting tighter and the specification ranges demanded by chipmakers are shrinking, posing challenges for existing MFC technology. The upshot is that new MFC solutions and technologies are needed to enable transitions to smaller nodes, providing an opportunity for growth in this segment.

The fluid management subsystems market is currently dominated by Japanese- and U.S.-based vendors. Horiba is the largest player, accounting for 30 percent of total fluid management sales, and the rest of the market is extremely fragmented, with a raft of companies competing in this space.

Given the large size and fragmentation of this segment, interest in these products in the coming year is sure to intensify as the race to find lucrative solutions to enable sub 10 nm processing heats up.

For more information about VLSI Research and Critical Subsystems, visit www.vlsiresearch.com.