The ESG Market

Electronic Gases represents the largest percentage of the spend on chemicals and materials by semiconductor producers. Taken altogether, the spend on Electronic Gases was almost $6 billion worldwide in 2018. Recent critical shortages of key gases have impacted the industry tremendously and, in some cases, has also limited output. The Electronic Specialty Gas (ESG) market, while a small segment of the global gas market, is one of the most complex and least understood market segments of the electronic chemicals and materials landscape.

Linx Consulting estimates that the ESG market totaled nearly $3.4 billion in 2018, up from roughly $3.1 billion in 2017 with a growth rate of 10 percent last year. Growth was driven by rising demand and the increasing use of higher-value products in applications such as etch and specialized deposition.

ESGs are used in the manufacture of electronic devices that are subsequently assembled in systems and in a variety of processes such as film deposition, film etching, substrate doping and chamber cleaning. The devices – semiconductors, LEDs, and displays – are processed on larger substrates, and then separated before assembly.

Key differentiators for ESGs are not only the technical complexity of the gases and mixtures supplied, but the purity and consistency demands placed on the gas supply. Product purity and consistency, often at the limits of analytical capability, must go hand in hand with rigorous application of statistical process control in manufacturing and absolute delivery reliability. ESGs include fluorocarbons, hydrocarbons, deposition precursors, dopants, corrosives (halides/hydrates) and rare gas mixtures.

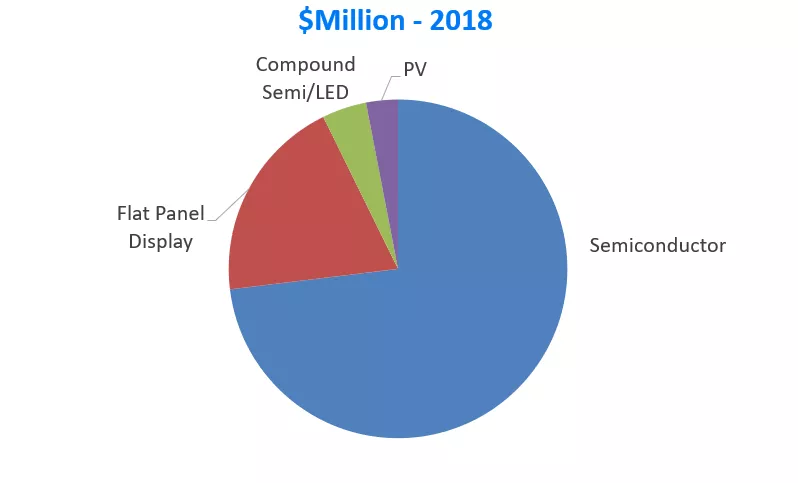

The key end-use markets for ESGs include semiconductor wafer fabrication, flat panel display (FPD) manufacture, compound semiconductors / LEDs production and Photovoltaics cell manufacture, as illustrated below in Figure 1.

Figure 1 - ESG Market by End-Use Applications

Source: Linx Consulting

The semiconductor industry is the largest user of ESGs and has the most diverse ESG requirements in terms of products, package sizes and purity requirements. The semiconductor industry uses all the different specialty gases produced. Purities are typically 4N and above and the packages can range from small cylinders to tonner/Y packages to tube trailers. The ESG market is global, with key demand centers in China, Europe, Japan, Korea, Southeast Asia, Taiwan and the United States.

The Flat Panel Display (FPD) community is the second largest user group for ESGs. However, the breadth of ESG products used in FPD fabs is much more limited than in the semiconductor industry. Key product applications include silicon sources, dopants, oxidation and nitridation sources, chamber cleans, and etchants. ESG use has grown with the development of the FPD industry across both TFT-LCD segment and AMOLED segment, with many large end users in Korea, China, Taiwan, and Japan. Korea and China boast large ESG supply infrastructures geared towards serving the FPD industry. Early on, these countries targeted the development of the FPD industry and the associated value chain, so there has been large-scale development of required ESG products such as NF3 and silicon precursors.

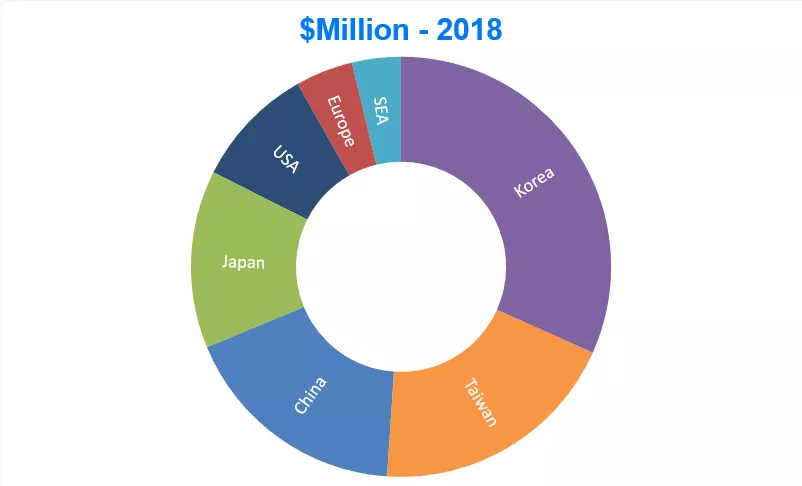

When we review the markets in aggregate, coupled with the geographic intensity of the electronics industry in Asia, it is unsurprising that a vast majority of the ESG market would be in Asia, as illustrated in Figure 2, below.

Figure 2 - ESG Market by Key Region

Source: Linx Consulting

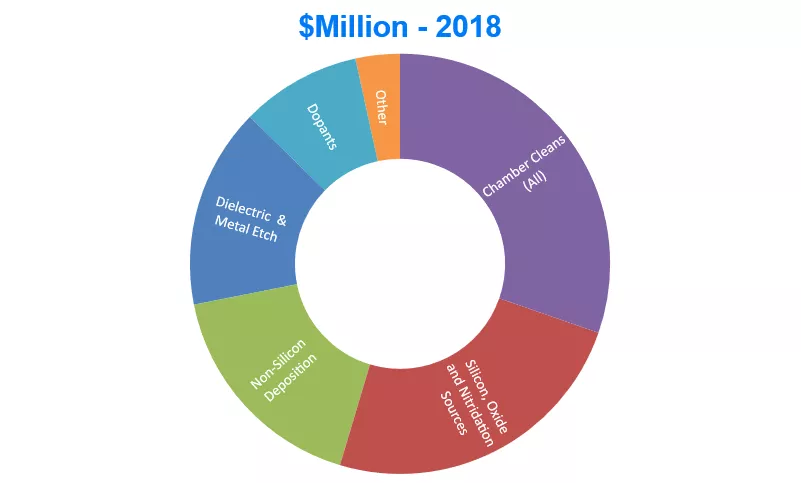

Key Applications

The applications for ESGs can be readily tied to major thin film fab processes that are commonly used in the microelectronics industry. The processes include dielectric and metal etch, dielectric deposition, metal deposition such as titanium or tungsten, deposition of non-silicon materials such as hard masks etc., dopants for thermal diffusion methods and ion implantation, reactor chamber cleaning; as well as some other specialty applications. This is illustrated in Figure 3 below.

Figure 3 - Applications for ESGs

Source: Linx Consulting

Clearly there is a close tie-in for ESGs into thin film deposition (CVD and chamber cleaning) and etch processing. In the future, the industry will increase its use of ESGs with novel deposition and etch processes. New applications may include lower temperature deposition, high deposition rate processes, flowable CVD films for high aspect ratio structures, and high selectivity deep etching with greater uniformity. All these processes improve device performance and will rely on ESGs and rare gases as enablers.

Outlook for ESGs

Overall, we believe that the ESG market will grow at a compound rate of about 6 percent over the next five years. Currently the largest six suppliers – Versum Materials, SK Materials, MTG/TNS, Air Liquide, Linde/Praxair, and KDK – control about half of the overall market, with about 50 suppliers accounting for the other half of the market. We anticipate that as the industry continues to grow, we will continue to see changes in the supplier base with both continuing consolidation and new regional suppliers emerging as unique technologies and value-added capabilities enter the market.

For More Information

This article is based on insights and analysis from Linx Consulting’s Electronic Specialty Gas report. The annual report is considered the leading industry source for comprehensive information about demand for specialty gases used in the electronics industry. We track more than 60 different ESG products used across the global semiconductor, flat panel display, solar and compound semiconductor industries.

For more information, please contact info@linx-consulting.com, or Mike Corbett at +1 973 698 2331, Mark Thirsk at +617 273 8837, or Andy Tuan + 886 952 111222, or visit Linx Consulting.

Interested in engaging with the electronic materials supply chain? The Electronic Materials Group (EMG) is a SEMI technology community representing SEMI member companies that provide substrates, polymers, metals, organic and inorganic materials, chemicals, and gases developed for electronics manufacturing. Linx Consulting has been a longtime member and supporter of the SEMI Electronic Materials Group.

Mike Corbett is managing partner and Andy Tuan is managing director, Asia, at Linx Consulting.