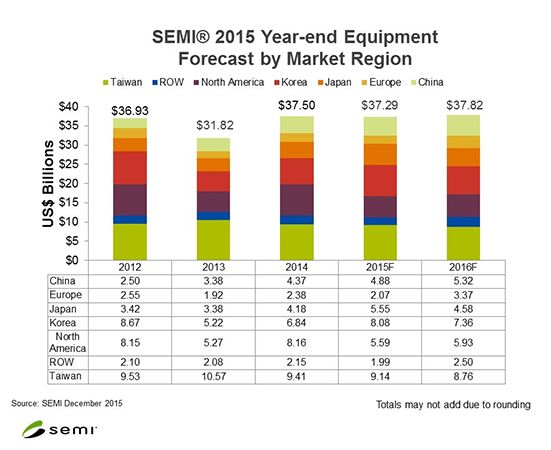

TOKYO, Japan — December 15, 2015 — SEMI projects that worldwide sales of new semiconductor manufacturing equipment will decrease 0.6 percent to $37.3 billion in 2015, according to the SEMI Year-end Forecast, released today at the annual SEMICON Japan exposition. In 2016, nominal positive growth is expected, resulting in a global market increase of 1.4 percent.

The SEMI Year-end Forecast predicts that wafer processing equipment, the largest product segment by dollar value, is anticipated to increase 0.7 percent in 2015 to total $29.5 billion. The “Other Front End” category (fab facilities, mask/reticle, and wafer manufacturing equipment) is expected to increase 20.6 percent in 2015. The forecast predicts that the market for assembly and packaging equipment will decrease by 16.4 percent to $2.6 billion in 2015 and that the market for semiconductor test equipment is forecast to decrease by 7.4 percent, totaling $3.3 billion this year.

For 2015, Taiwan, South Korea, North America, remain the largest spending regions, with investments in Japan approaching North American levels. SEMI forecasts that in 2016, equipment sales in Europe will climb to $3.4 billion (63.1 percent increase over 2015). After a 13 percent contraction for Europe in 2015, GLOBALFOUNDRIES, Infineon, Intel, and STMicroelectronics are all expected to significantly accelerate fab equipment spending in 2016, resulting in strong growth in the region in 2016. In Rest of World, essentially Southeast Asia, sales will reach $2.5 billion (25.7 percent increase), the China market will total $5.3 billion (9.1 percent increase), and North America equipment spending will reach $5.9 billion (6.1 percent increase). The equipment markets in Japan, Korea, and Taiwan are expected to contract in 2016.

The following results are given in terms of market size in billions of U.S. dollars:

SEMI is the global industry association serving the electronics manufacturing supply chains. Our more than 2,000 member companies are the engine of the future, enabling smarter, faster and more economical products that improve our lives. Since 1970, SEMI has been committed to helping members grow more profitably, create new markets and meet common industry challenges. SEMI maintains offices in Bangalore, Beijing, Berlin, Brussels, Grenoble, Hsinchu, Moscow, San Jose, Seoul, Shanghai, Singapore, Tokyo, and Washington, D.C. For more information, visit www.semi.org.

Association Contacts

Deborah Geiger/SEMI

Phone: 408.943.7988![]() 408.943.7988 FREE

408.943.7988 FREE

Email: dgeiger@semi.org

Dan Tracy/SEMI

Phone: 408.943.7987![]() 408.943.7987 FREE

408.943.7987 FREE

Email: dtracy@semi.org

# # #