Publication Date:

Principal Analysts:

Christian Gregor Dieseldorff, SEMIChih-Wen Liu, SEMI

Format:

Microsoft® Excel® file (.xls)

Highlights for SEMI Website published April 15, 2024.

- Fab equipment spending is expected to decline by about-15% in 2024, recovering in 2025 with 43%, and 21% in 2026. 2027 is expected to slow with -2% YoY which may be due to lack of visibility.

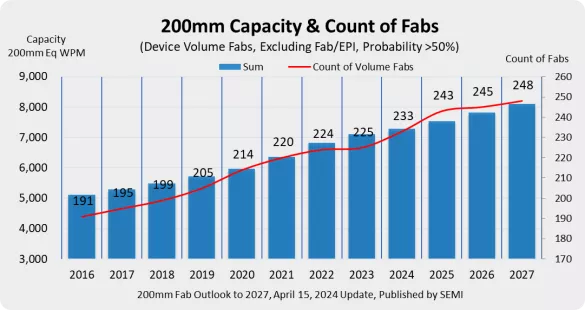

- Installed 200mm capacity for device fabs/lines (excluding EPI) is expected to decline slightly from 4% (YoY) in 2023 to 3% in 2024 and expected with steady growth in low single-digits through 2027.

- The industry is adding more 200mm fabs/lines. It is expected that 15 new device volume fabs (excluding EPI) will start operation from 2024 to 2027. The number is higher if EPI and low-probability fabs are included.

The ‘200mm Fab Outlook to 2027’ tracks worldwide more than 330 fabs and lines by over 160 companies and organizations. This report provides insight to current business activity in 200mm manufacturing and informs business planning and investment.

Since the last update in September 13, 2023, the Market Intelligence Team at SEMI has done 122 changes on 101 fabs and lines including adding 11 new records.

**Multi-user and Enterprise licenses must be purchased when more than 1 user accesses SEMI reports/databases**

Product Information

|

|

The information for the fab reports and forecasts is compiled from various sources in the industry including publicly available information such as capital spending plans, fab plans, ramp schedules, and technology roadmaps.

Source data are verified across an extensive network of industry contacts. These data are used in modeling for each company and facility, incorporating various economic indicators and best educated estimates.

The report uses a bottom-up approach, tracking projects per cleanroom facility but uses also a top down analysis by company, region, and industry segment.

Content details include capital expenditure for construction and equipment, capacities, technologies used, product types, and wafer sizes.

Purchase

| Product | Member | Non-Member | |

|---|---|---|---|

| 200mm Fab Outlook to 2027 - 1 User, One Time Purchase | $3,500 | $5,750 | Buy Now |