Publication Date:

Publication Schedule:

Published QuarterlyPrincipal Analysts:

Christian Gregor Dieseldorff, SEMIChih-Wen Liu, SEMI

Format:

Microsoft® Excel® file (.xls)

The World Fab Forecast subscription is your ultimate resource for continuous tracking of worldwide fab spending, construction, production capacity, and technology trends by device type. It tracks more than 1,500 facilities worldwide including more than 191 facilities/lines starting production in 2024 or later. Companies include TSMC, UMC, GLOBALFOUNDRIES, SMIC, Samsung, Intel, Kioxia, Micron, SK Hynix, PSMC, Texas Instruments, Renesas, STMicro, Fujitsu, Infineon, Panasonic, NXP, Winbond, Sharp, Hua Hong Group, Nexchip, Onsemi, Magna Chip, X-Fab Silicon Foundries, and many more.

Leverage this comprehensive database to strengthen your business intelligence efforts, accessing line-by-line details about your customers, suppliers, competitors, and partners.

Understand what types of semiconductor products are manufactured in various facilities and lines, including future plans.

- Quantitatively analyze the impact of semiconductor fab plans for demand/supply imbalances.

**Multi-user and Enterprise licenses must be purchased when more than 1 user accesses SEMI reports/databases**

World Fab Forecast Report (2023 to 2025). Published Mar 12, 2024

Highlight:

1. The report lists a total of 1515 facilities/lines, including 191 future facilities/lines with various probabilities of starting volume production in 2024 or later.

2. The report tracks active investments (combination of construction and equipment) with 716 facilities and lines in the report time frame from 2023 to 2025.

3. Since the last publication in December 2023, we have made 358 changes to 325 fabs/lines. We added 26 new fabs/lines.

Fab Equipment Investments:

1. Fab equipment spending is expected to remain flat at US$ 103 B in 2024, which is lower than our last projections in 4Q23.

2. The largest investment in 2024 is for Foundry, with about US$ 58 B (-5% YoY). Memory is increasing 27% to US$ 21 B.

3. We expect equipment spending to increase by 21 % to US$ 125 B in 2025. The largest investments in 2025 will be the same as in 2024: Foundry with about US$ 70 B and Memory with about US$ 34 B.

Capacity:

1. Memory capacity is expected to add 2% in 2024, and 4% in 2025.

2. Total Foundry capacity (including Foundry/IDM) shows a steady growth in 2024 (9% YoY) and a 10% increase in 2025.

New Fabs/Construction:

1. Investments in construction projects is expected to decline 16% to US$ 33 B in 2024.

2. The report shows 58 new construction projects for volume fabs (greenfield and shell) with high probability starting construction from 2024 to 2030 (excluding expansions, not including R&Ds and pilots).

Product Information

|

|

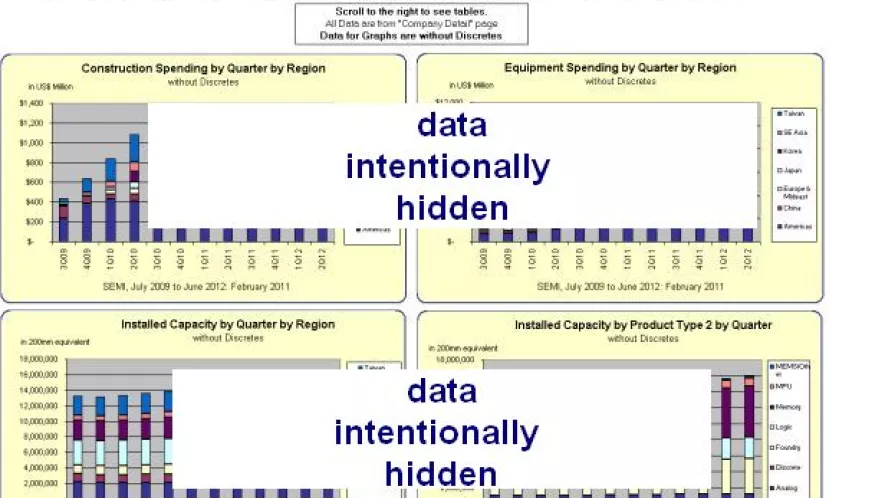

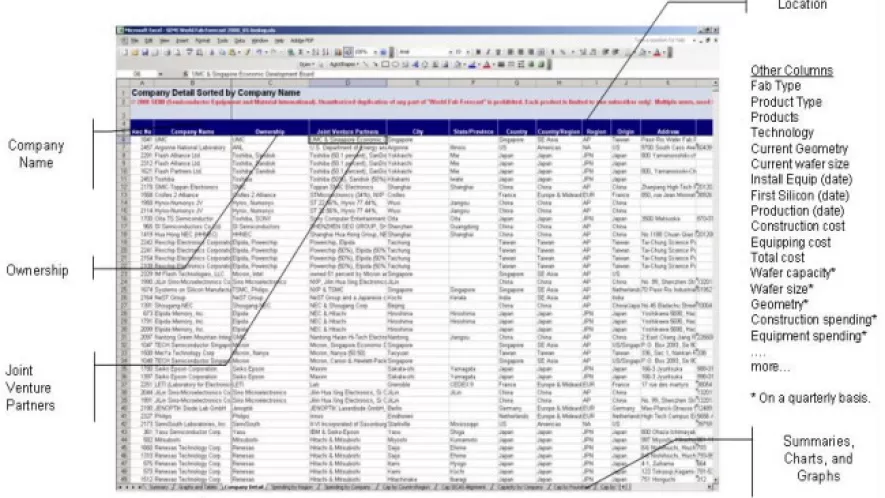

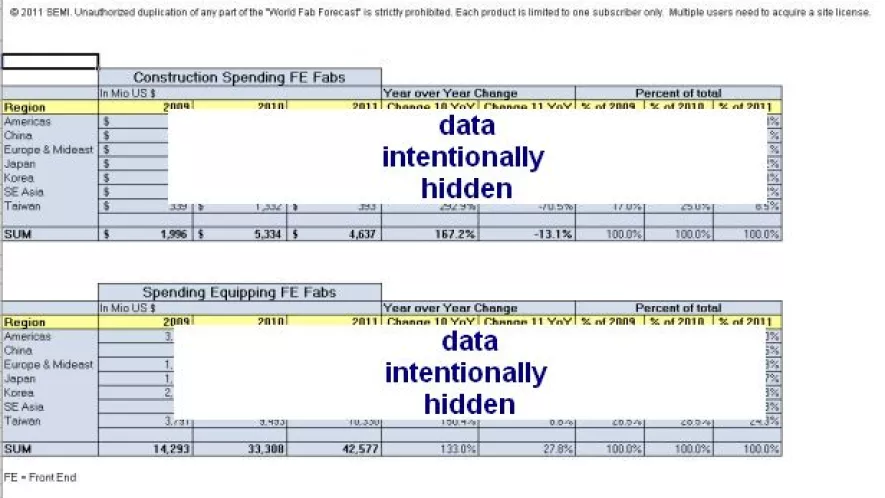

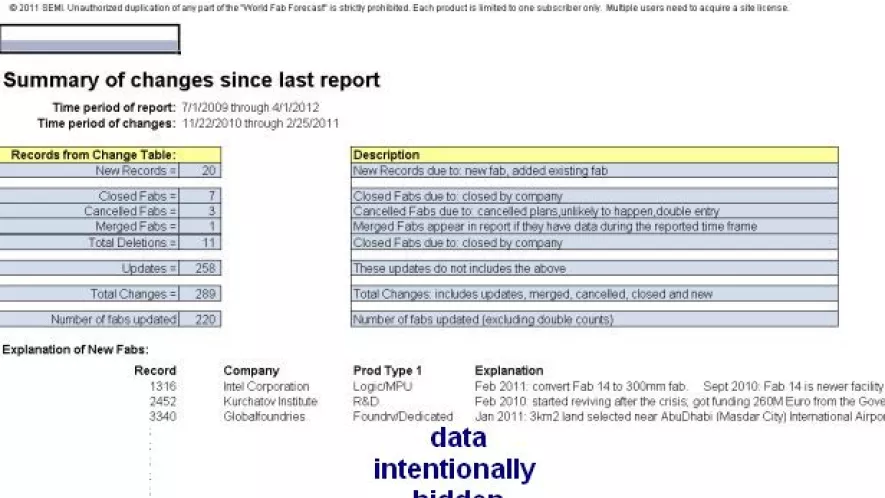

Screenshots

Summary Page, Graphs/Tables, Company Details, Capacity by Foundries

Tutorial - Introduction

Tutorial - Tables and Graphs

Tutorial - Pivot Tables

The information for the fab reports and forecasts is compiled from various sources in the industry including publicly available information such as capital spending plans, fab plans, ramp schedules, and technology roadmaps.

Source data are verified across an extensive network of industry contacts. These data are used in modeling for each company and facility, incorporating various economic indicators and best educated estimates.

The report uses a bottom-up approach, tracking projects per cleanroom facility but uses also a top down analysis by company, region, and industry segment.

Content details include capital expenditure for construction and equipment, capacities, technologies used, product types, and wafer sizes.

Purchase

| Product | Member | Non-Member | |

|---|---|---|---|

| World Fab Forecast - 1 user , One-time Purchase | $3,500 | $5,150 | Buy Now |

| World Fab Forecast - 1 user , Subscription | $7,000 | $10,250 | Buy Now |

| World Fab Forecast Premium with FabView - 1 User, Subscription | $9,500 | $13,750 | Buy Now |

*Pricing does not apply to Individual Members.

For product related inquiries or questions regarding Enterprise pricing, please email mktstats@semi.org.

To purchase multiple user licenses at a discount, please contact mktstats@semi.org.