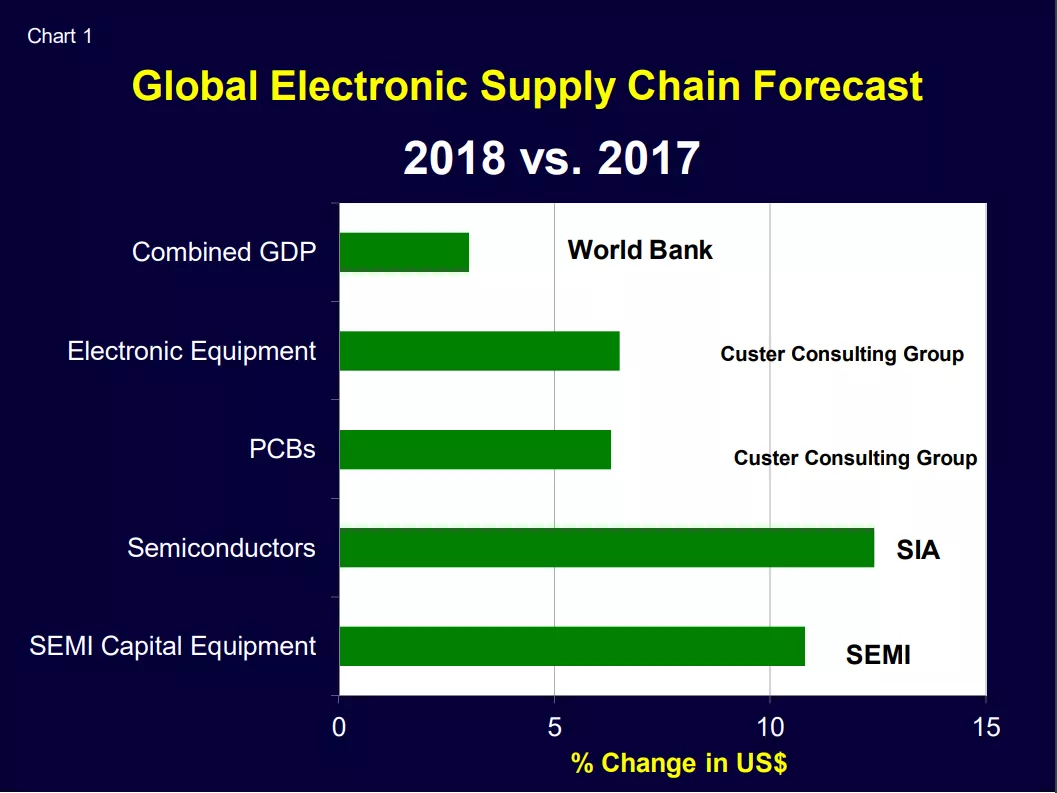

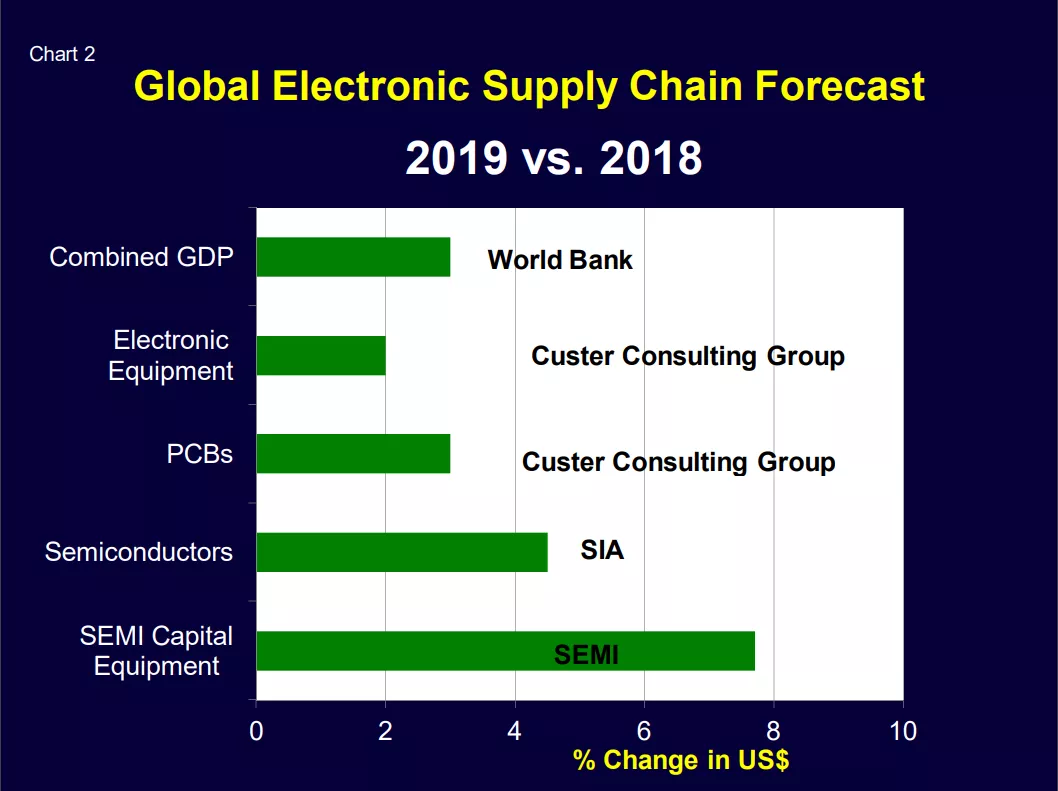

Forecast Summaries

Charts 1 and 2 are the recent world growth forecasts for this year and next for GDP (World Bank), Electronic Equipment and Printed Wiring Boards (Custer Consulting Group), Semiconductors (SIA/WSTSI and new Semiconductor Capital Equipment (SEMI). The semiconductor-related sectors are clearly outgrowing the rest of the supply chain.

These forecasts require regular review considering the current global political uncertainty and potential industry output and trade disruptions.

Updates to these forecasts are regularly available.

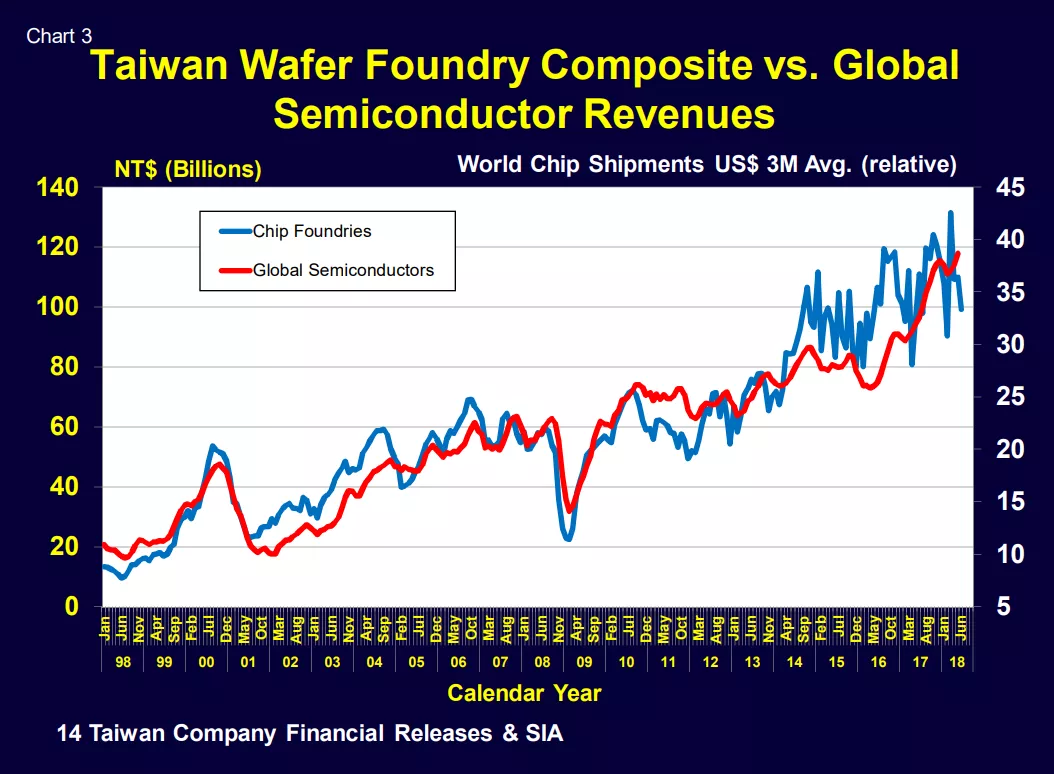

Taiwan Wafer Fab Sales

Composite sales of 14 Taiwan-listed wafer fabs including TSMC and UMC dipped sharply in June. This sales composite has been historically a useful leading indicator for global semiconductor shipments (Chart 3). If wafer fab sales remain weak, they may signal an imminent chip slowdown.

These data are updated monthly.

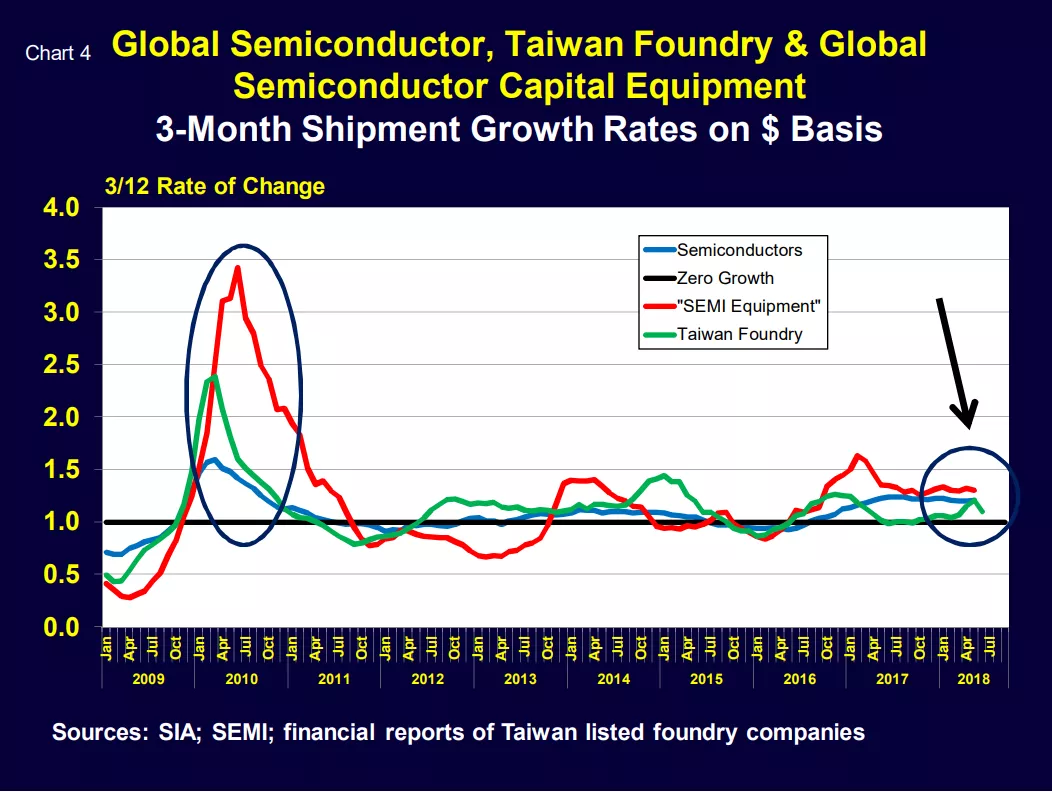

Wafer Fab, Semiconductor and SEMI Capital Equipment Business Cycles

Chart 4 compares the 3/12 growth of global semiconductor and semiconductor capital equipment to Taiwan-listed wafer fabs. Watch this information over the next few months to see if the wafer fab dip is temporary or leads semiconductor and SEMI equipment down to slower growth.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.