Electronic Industry Business Cycles Look Promising (with Reservations)

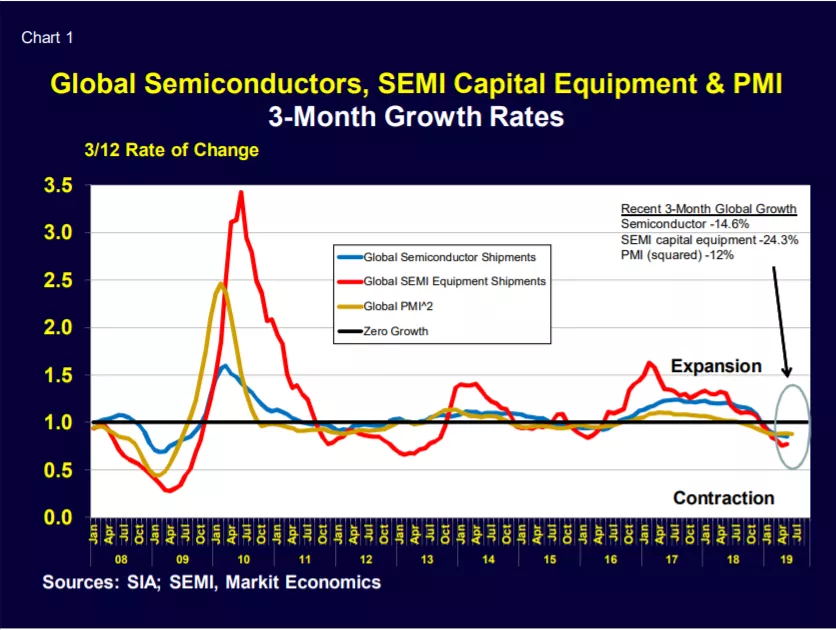

Although total electronic industry manufacturing activity is still far from expanding (3/12 is below 1.0), key global electronic industry monthly time series appear to have reached their 3/12 bottoms and now have begun to improve (Chart 1). Currently shipments are still shrinking, but at slowing rates. However real growth will only occur when these 3/12s exceed 1.0.

Growth Rates Vary by Region and Product

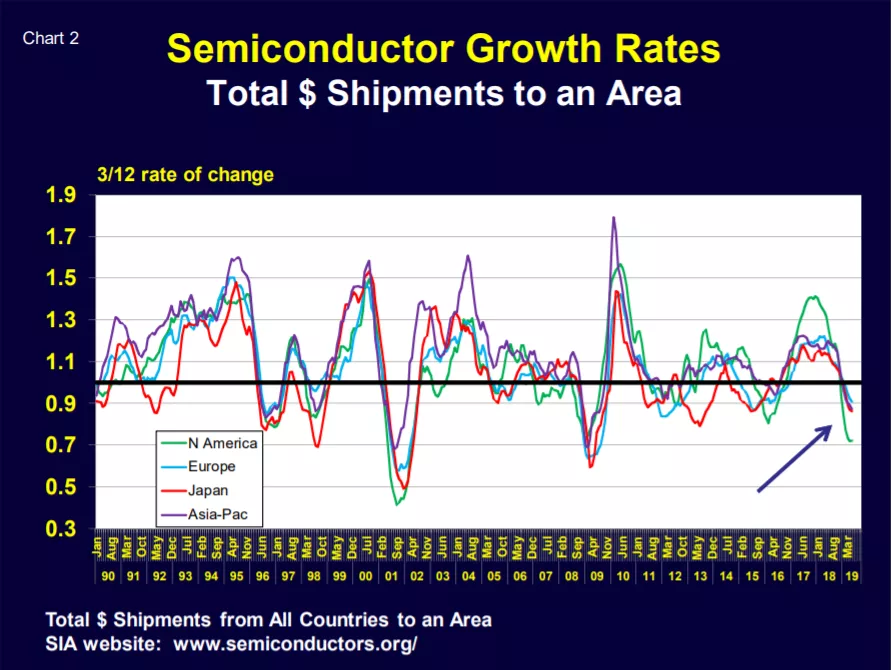

Chart 2 shows monthly 3/12 growth of semiconductors by geography. Growth rates are still in contraction territory but the regional trajectories have either reached bottom (North America) or appear to be nearing a turning point.

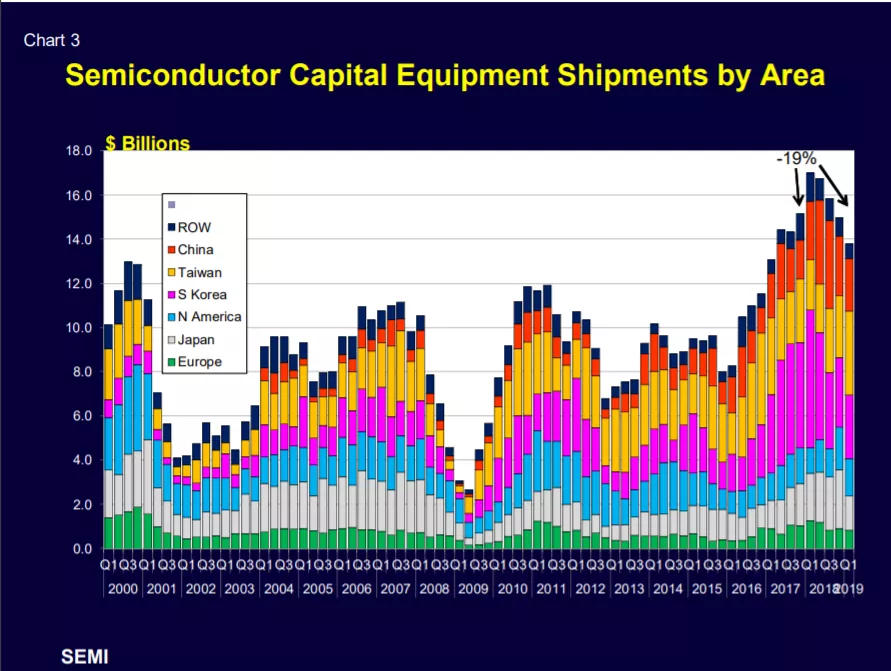

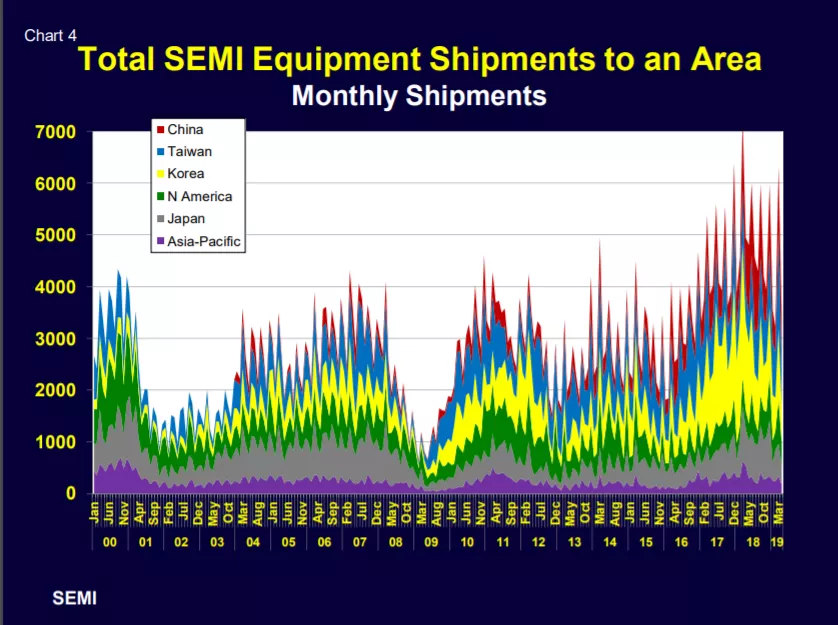

SEMI equipment shipments are more volatile than semiconductors (Charts 3 and 4). SEMI data are noisy but per Chart 1 their 3/12 growth rates appear to have reached bottom for this current business cycle.

June PMI Leading Indicators

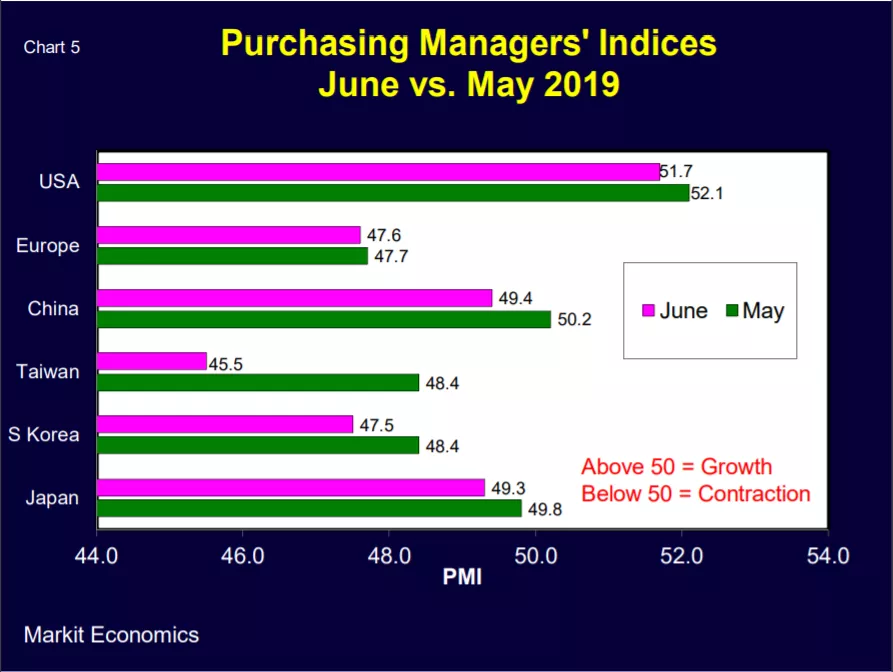

IHS Markit has released its June purchasing managers indices. PMIs are useful regional leading indicators.

- Per Chart 5 manufacturing activity in most key regions weakened last month.

- The Global PMI sank into contraction (PMI<50), reaching its lowest level since late 2012 (Chart 6).

In Summary

Global business conditions remain uncertain but the electronic sectors appear poised for growth in late 2019 or early 2020.

Real quarterly growth vs. this time last year remains unlikely until winter or spring. Normal seasonality will fuel short-term sales increases through late autumn but real growth is still a ways off.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.