After a record January, Taiwan-listed electronics companies, many of which manufacture in China, reported significant drops in February sales.

A number of events likely contributed:

- Far fewer working days in February due to Lunar New Year factory shutdowns

- Inflated January production and shipments in anticipation of the February holiday shutdowns

- Downward adjustment in Apple iPhone X forecasted demand

- Normal seasonality and traditionally lower post-Christmas consumer products demand – including PCs and mobile phones

Results (based upon composite revenues of large groups of Taiwan-listed companies):

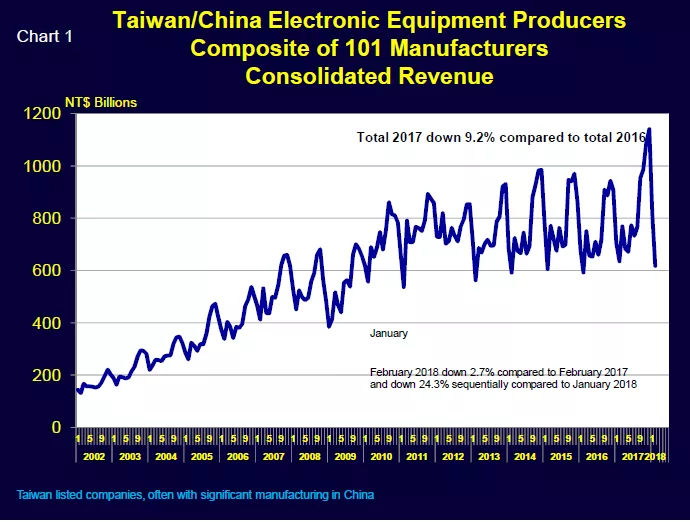

- OEM sales dropped 28 percent from December to January (normal seasonality) and then an additional 24 percent from January to February. This 101-company OEM group saw record high sales in December 2017 followed by a two-year low in February 2018 (Chart 1).

- ODM sales dropped in sync with OEM sales, with Foxconn/Hon Hai sales declining from 675 billion NT$ (US$22.9 billion) in December to 401 billion NT$ in January and to 278 billion NT$ in February.

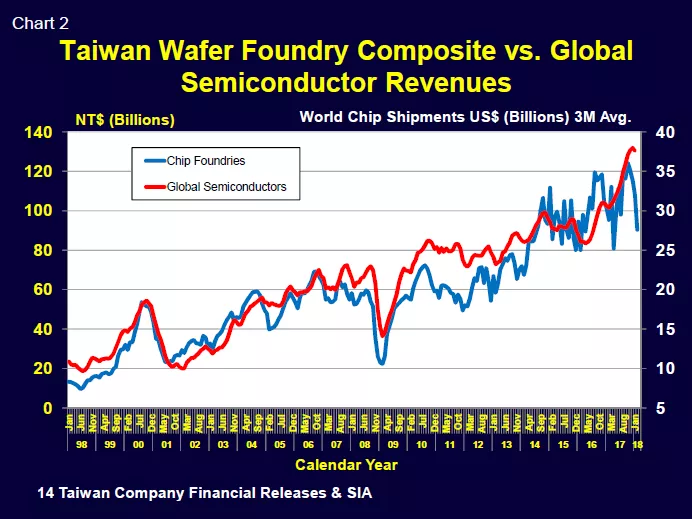

- Chip foundry sales (historically a leading indicator for global semiconductor shipments) also registered a large January to February decline (Chart 2).

- Other electronics firms (package and test, passive components, printed circuit boards) saw the same type of February declines.

We await March results as the sharp February decline is very likely due to multiple causes. Historically, the annual recovery begins in spring.

Walt Custer, Custer Consulting Group