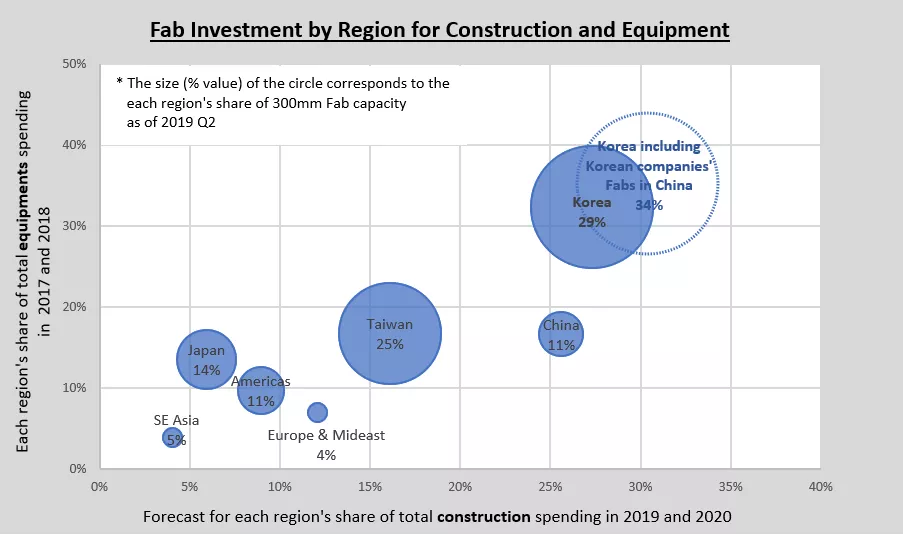

Despite recent global economic uncertainties and a downbeat memory market outlook for the second half of 2019, new 300mm fab construction in Korea is still going strong. The graph below, based on the SEMI World Fab Forecast and WWSEMS reports, shows regional shares of total equipment spending in 2017 and 2018, forecast facility construction spending in 2019 and 2020, and 300mm fab capacity as of Q1 2019. Korea is expected to continue its equipment spending dominance.

The vertical axis of the graph shows each region’s share of total equipment spending in 2017 and 2018. Korea accounted for 32 percent of global market investments primarily on the strength of Samsung’s aggressive investment and capacity buildup in the new Fab Pyeongtaek P1 and Line 17 over the past two years. Also during this period, SK Hynix ramped up its M14 fab and completed the new M15 in October 2018 as Korea remained on top with 29 percent of the world's installed 300mm fab capacity as of Q1 2019.

* Source: SEMI World Fab Forecast & WWSEMS

1) Forecasts for regional shares of construction spending and 300mm fab capacity were calculated based on SEMI World Fab Forecast report as of 2019 Q2.

2) Actual equipment spending was calculated based on SEMI Worldwide Semiconductor Equipment Market Statistics (WWSEMS).

Moreover, when the two companies’ China fabs are included, Korea’s share – shown as a dotted circle in the figure – jumps to 34 percent. In response to the sluggish memory market, both companies are expected to meet demand through technology migration rather than new capacity additions. However, spending on equipment technology upgrades and product conversions is expected to continue for efficient fab operations.

Potential equipment spending can be extrapolated from each region's share of total construction spending during 2019 and 2020, shown in the horizontal axis. Korea’s fab construction spending in 2019 and 2020 is expected to account for 27 percent of the total market, the highest proportion of all regions. Samsung’s new fabs such as Pyeongtaek P2 Fab and the Hwaseong EUV Line and Xian Line 2 under construction in Korea and China are driving this investment.

SK Hynix celebrated the completion of Wuxi C2F in China on April 18 and is now building a new Icheon M16 Fab in Korea. The company also has secured a new manufacturing site in Korea where several fabs are planned. For its part, Samsung has extra land adjacent to the Pyeongtaek P2 Fab that is available for future fabs. With these fab growth projects and prospects, Korea’s equipment market should continue to grow over the long term.

While a sharper decline in the memory market could delay Korea’s current plans to build new 300mm fabs, Korea is likely to maintain its lead in semiconductor equipment spending over other regional markets through the next upturn in the memory cycle.

The SEMI World Fab Forecast report covers new, planned and existing fabs as well as fab spending for construction and equipping, capacity expansion, and technology nodes by quarter and by product type with more than 1,300 front-end fab listings. Since its previous publication in February 2019, 192 updates have been made to the report including the addition of 14 new facilities and lines.

Learn more about SEMI fab databases.

Sungho Yoon is senior research manager in the Industry Research & Statistics Group at SEMI.