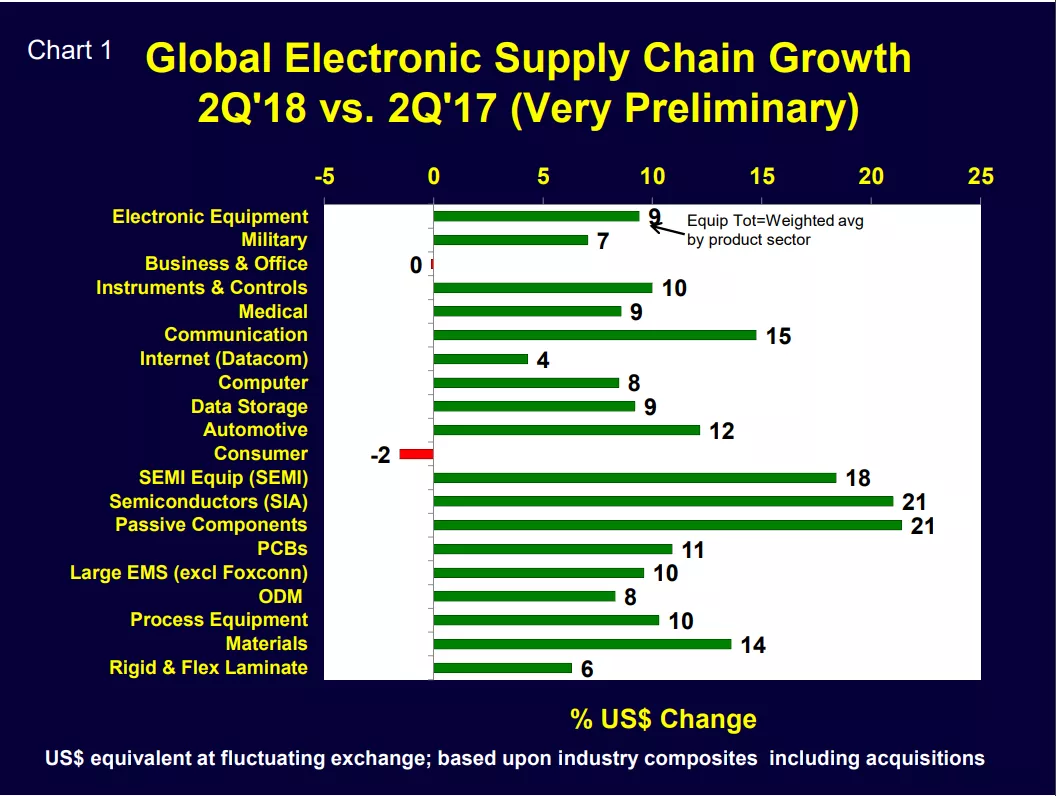

2Q’18 Electronic Supply Chain Growth Update - Chart 1 is a preliminary estimate of global growth of the electronic supply chain by sector for 2Q’18 vs 2Q’17. Note the strong performance of semiconductors, SEMI capital equipment and passive components.

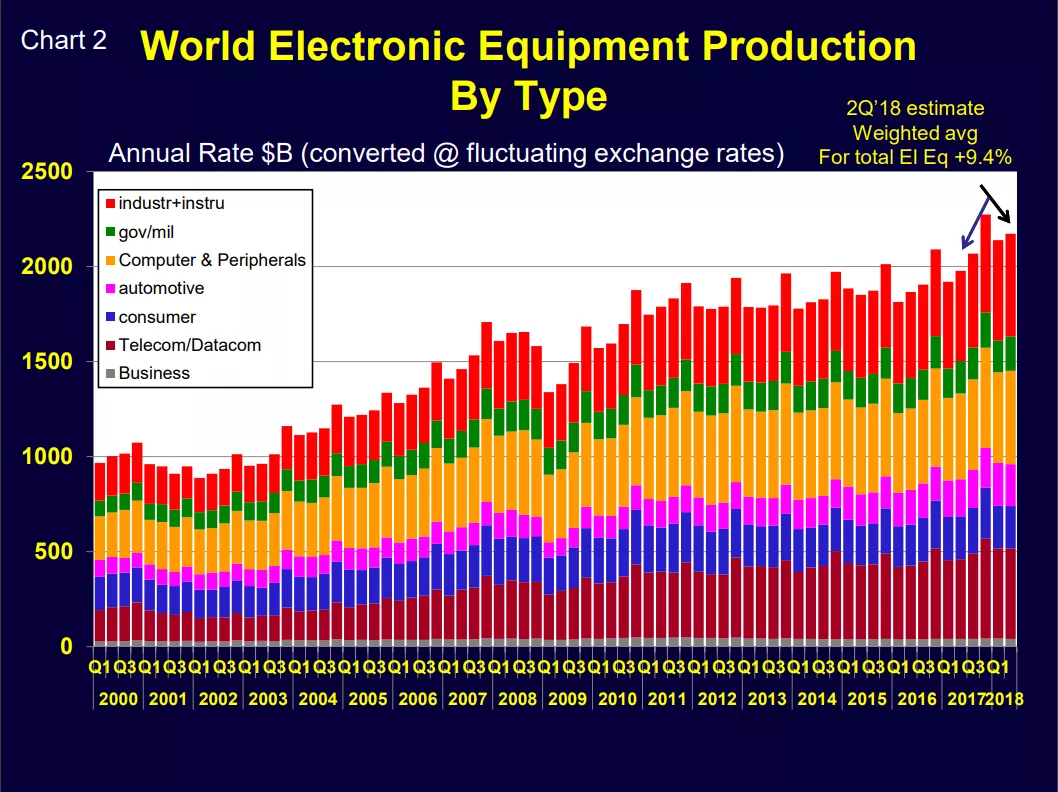

- Chart 2 gives preliminary 2Q’18 world electronic equipment growth by type. Global electronic equipment sales rose an estimated 9%+ when consolidated into US dollars in the second quarter of this year compared to the same quarter in 2017.

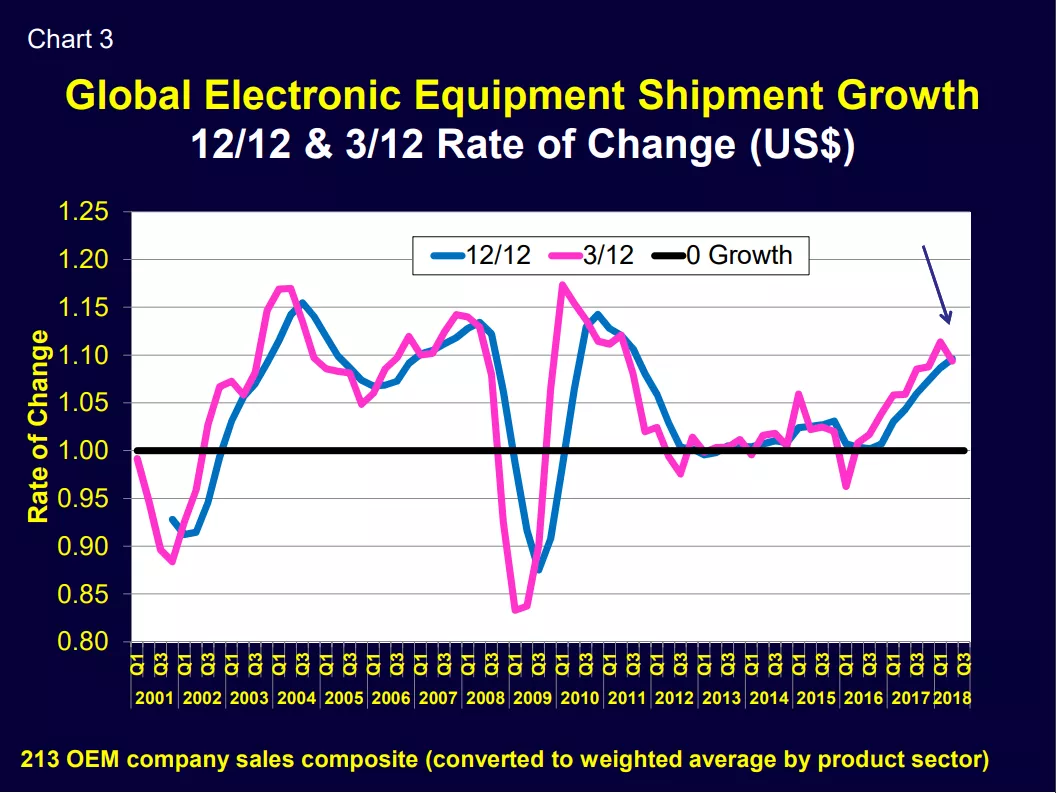

- Based on this, data global electronic equipment sales growth appears to have now peaked on a 3/12 growth basis for this present business cycle (Chart 3).

As a caution these charts are based on a combination of actual company financial reports and estimates for companies that have not yet reported their calendar second quarter financial results. A number of large companies have yet to report but these early estimates have historically been close to final growth values. We will update Chart 1 next month.

Semiconductor Capital Equipment Business Cycle

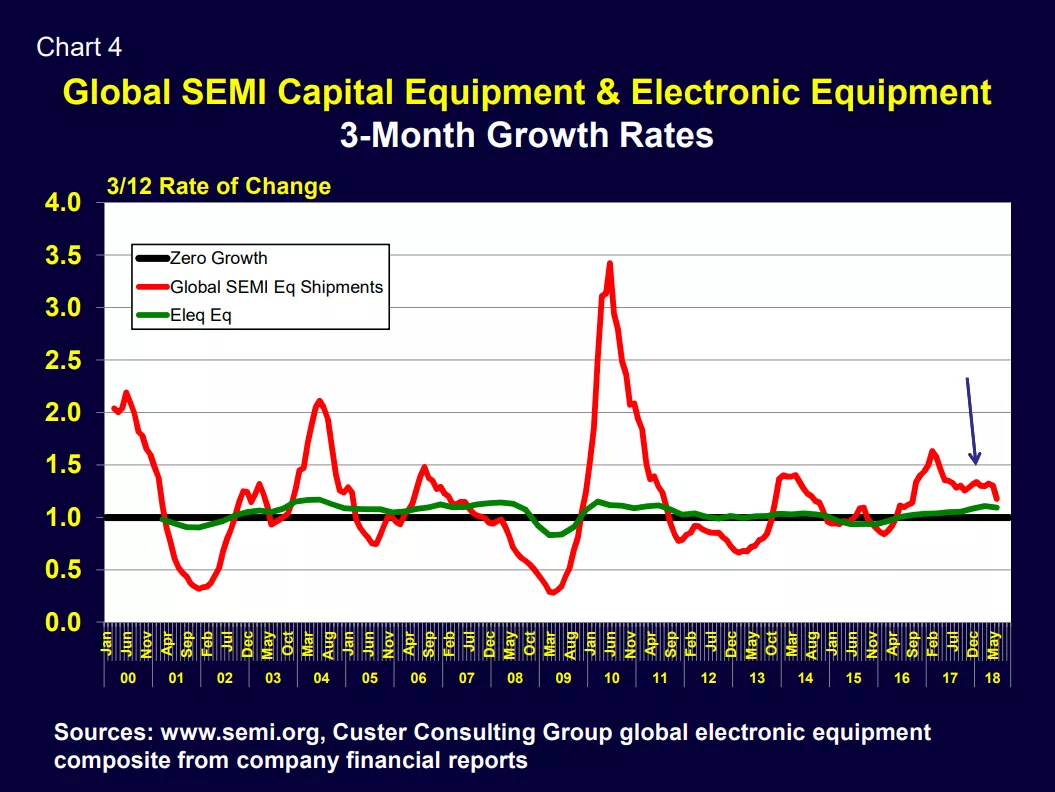

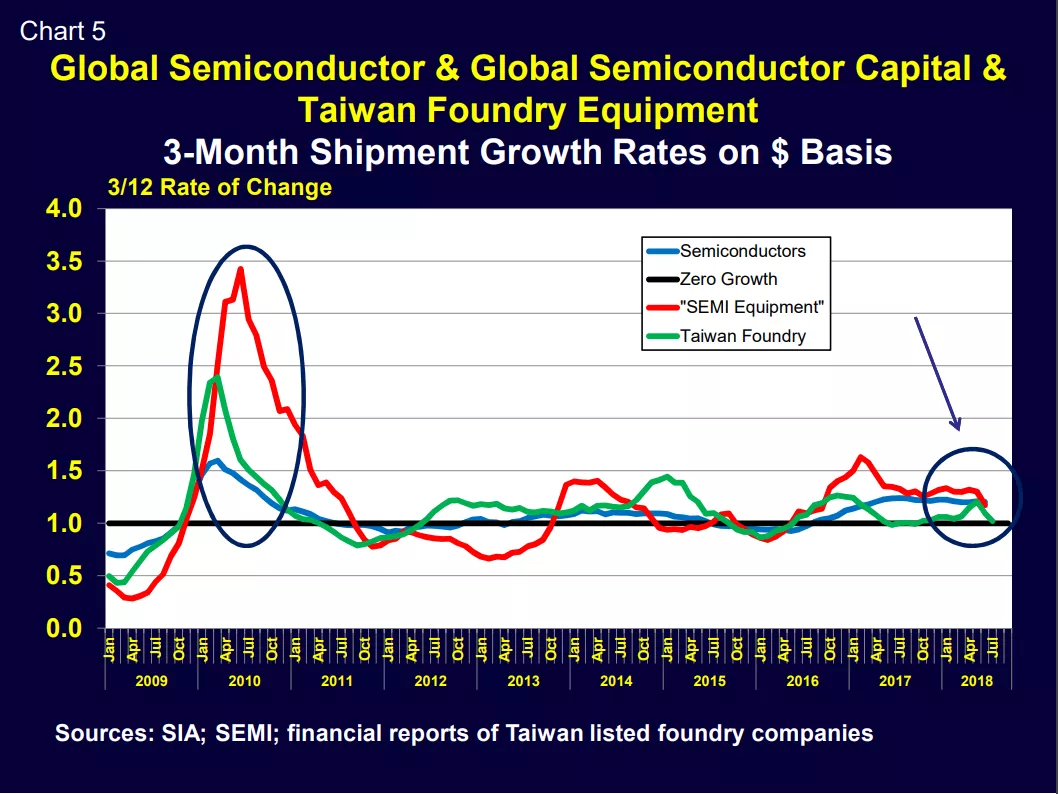

- Semiconductor capital equipment sales are historically very volatile, with their growth fluctuating MUCH MORE than electronic equipment (Chart 4). However, both series appear to have peaked on a 3/12 basis for this current cycle.

- Semiconductors, SEMI capital equipment and Taiwan chip foundry sales all are seeing slower growth. 3/12 values >1 still indicate an expansion but slower growth is indicated.

Supply chain performance in the second half of this year bears careful watching!

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.