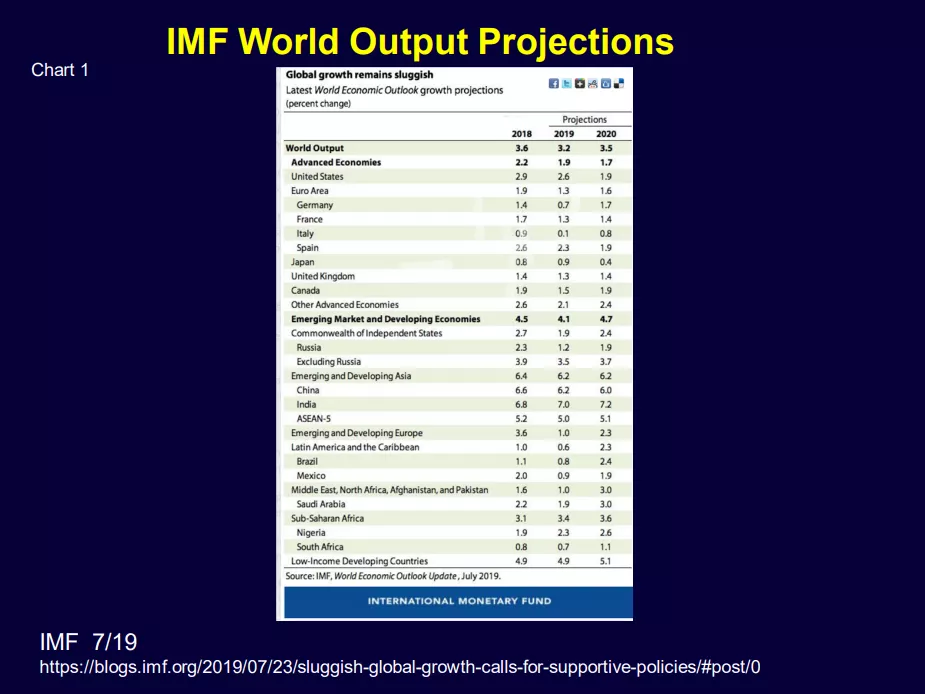

IMF Revises Global Growth Estimates

The IMF (International Monetary Fund) stated in its July update of the World Economic Outlook: Chart 1

“We are revising downward our projection for global growth to 3.2% in 2019 and 3.5% in 2020. While this is a modest revision of 0.1 percentage points for both years relative to our projections in April, it comes on top of previous significant downward revisions. The revision for 2019 reflects negative surprises for growth in emerging markets and developing economies that offset positive surprises in some advanced economies.”

IMF further stated that “growth is projected to improve between 2019 and 2020.”

Read the entire IMF press release.

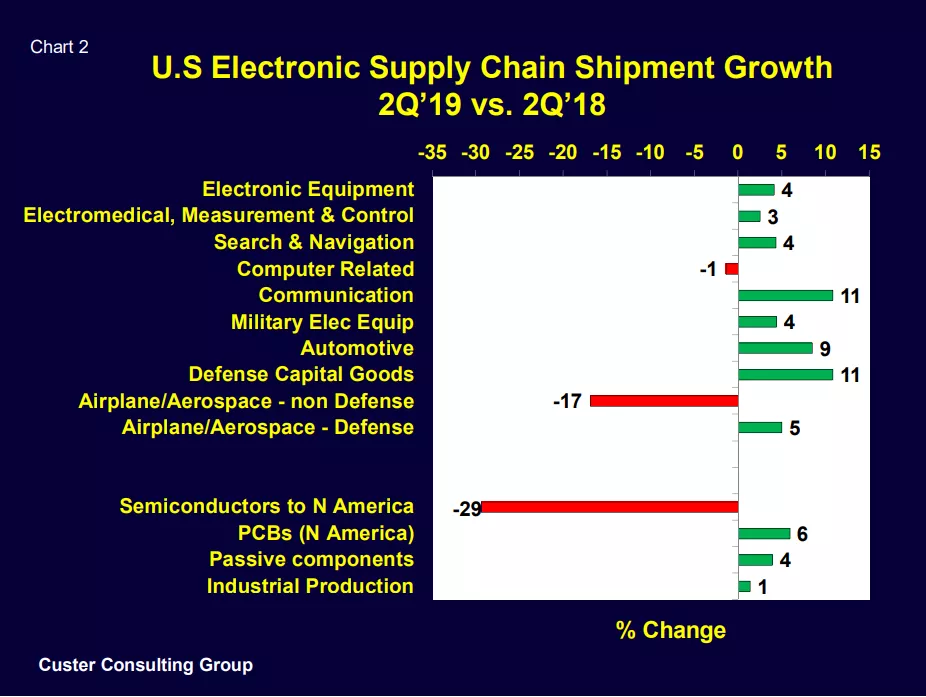

U.S. Outperforming World, but Electronic Industry Slowdown is Widespread

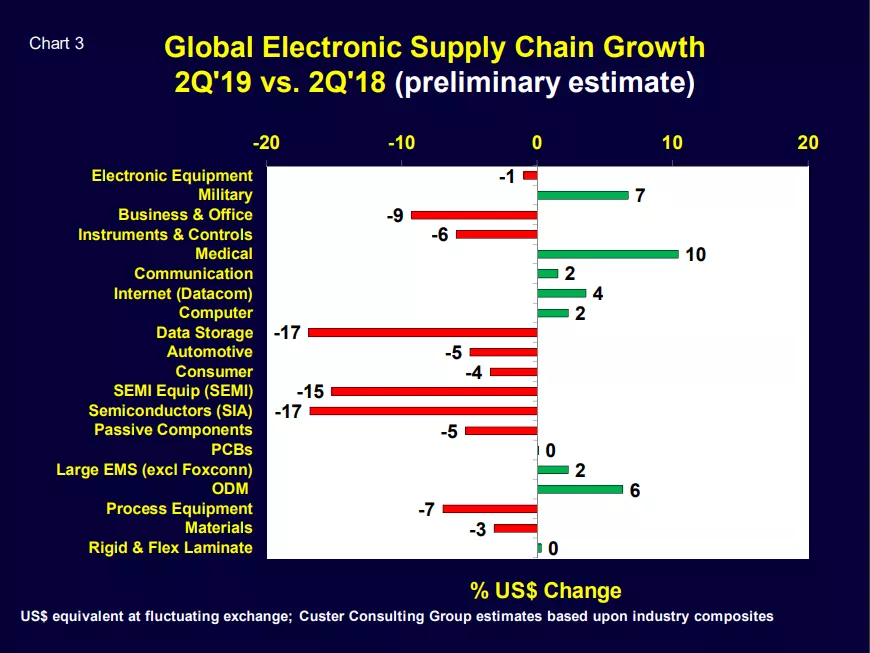

Second quarter electronic supply chain growth by sector is now available for the U.S. (Chart 2) and on a preliminary basis for the world (Chart 3). The present slowdown is widespread globally but more severe and broader outside the United States, and is especially pronounced for semiconductor chips and SEMI equipment.

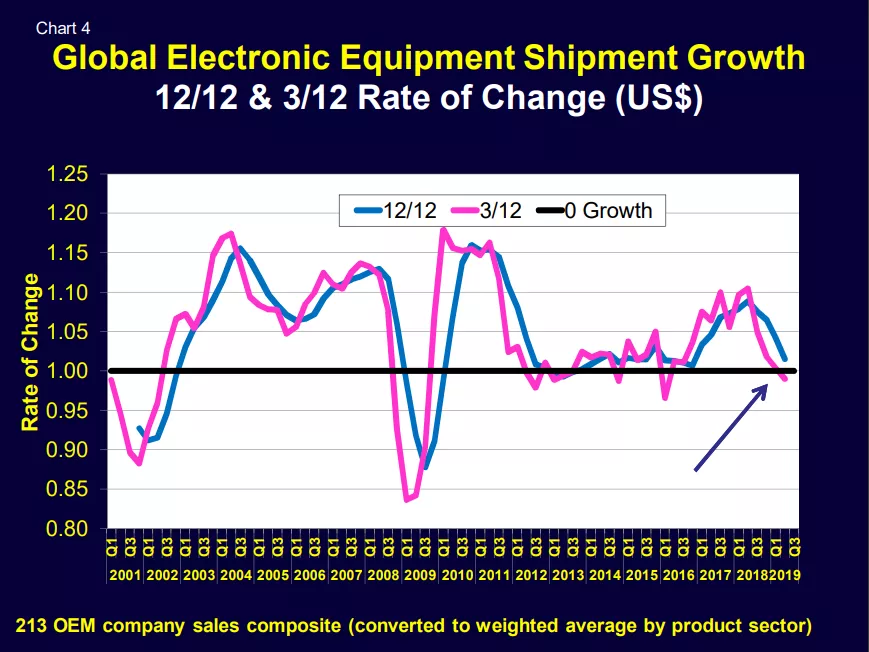

The current world electronic equipment growth cycle (Chart 4) peaked in 2018, has now declined to zero growth and is likely to continue contracting though year-end 2019. Many of the traditionally stronger electronic equipment end markets are currently seeing softer demand – including automotive, instruments, PCs, mobile phones and data storage. Semiconductors and passive components have been hit especially hard because of robust (over) ordering in 2018 followed by inventory buildups and also sharp memory price degradation this year.

There is definitely light on the horizon (especially as 5G ramps) but 2019 still looks challenging.

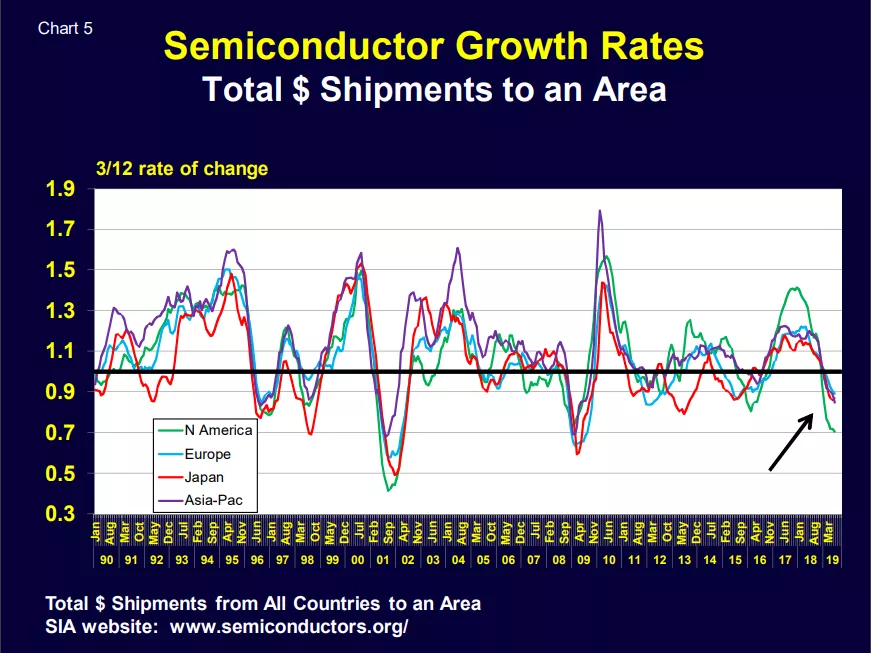

Global Semiconductor Shipments – Still Contracting

Semiconductor shipment growth continues to contract in all regions (Chart 5). The bottom of this current chip cycle is near – but we have not reached it yet. Although the semiconductor shipment 3/12 curves in Chart 5 will hit bottom in a few months, real growth will not resume until these 3/12 curves not only turn north but also cross the 1.0 line.

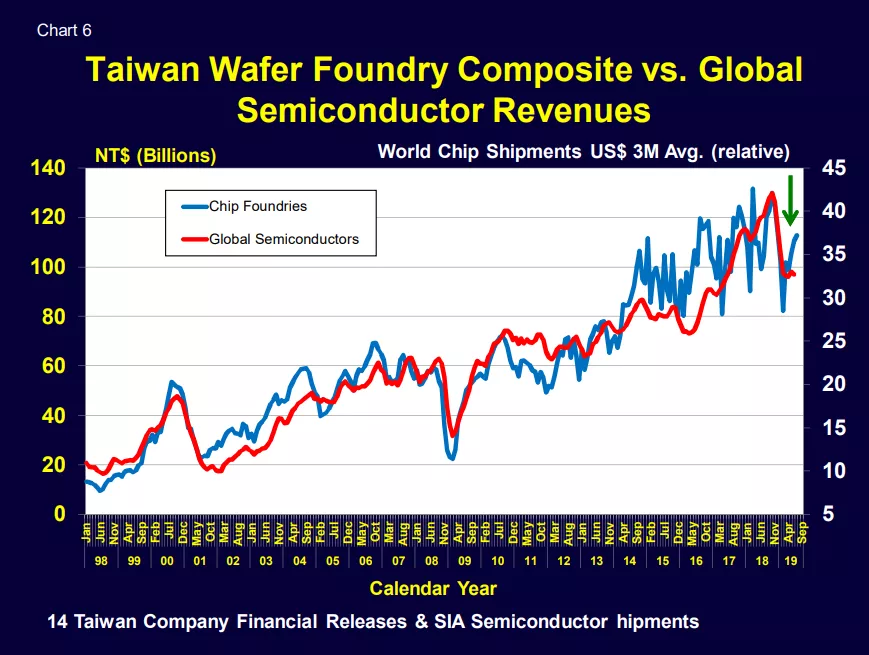

Wafer Foundry Growth

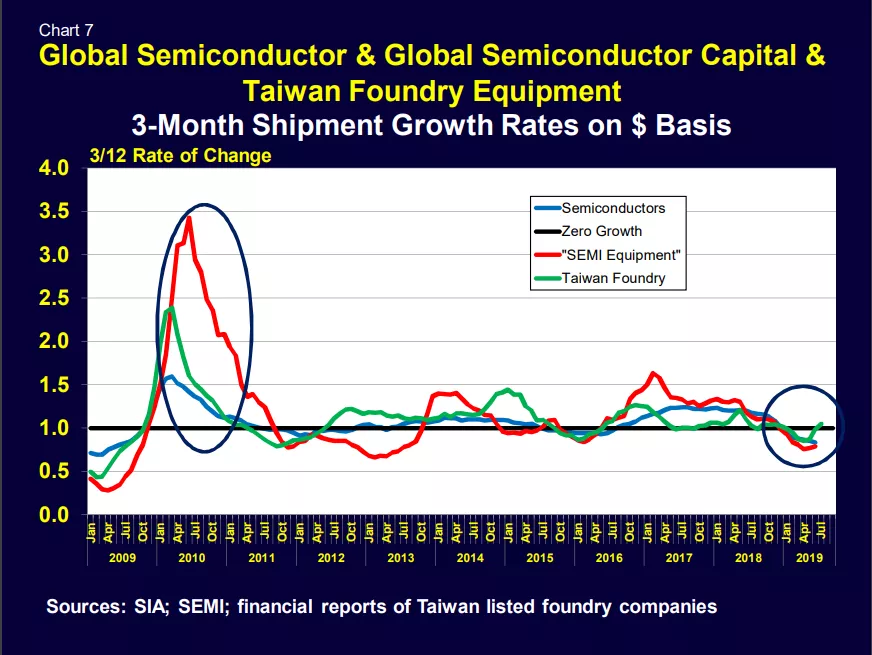

Taiwan wafer foundry sales are often a leading indicator for world semiconductor shipments. They turned up this summer (Chart 6). On a 3/12 basis chip foundry shipments are now pointing to future recovery for semiconductors and SEMI equipment (Chart 7).

The electronics markets (and global economies in general) remain fragile, but there is some glimmer of hope on the horizon.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.