The typical winter “seasonal slowdown” is now behind us. What can we expect as the year progresses?

First Quarter Results

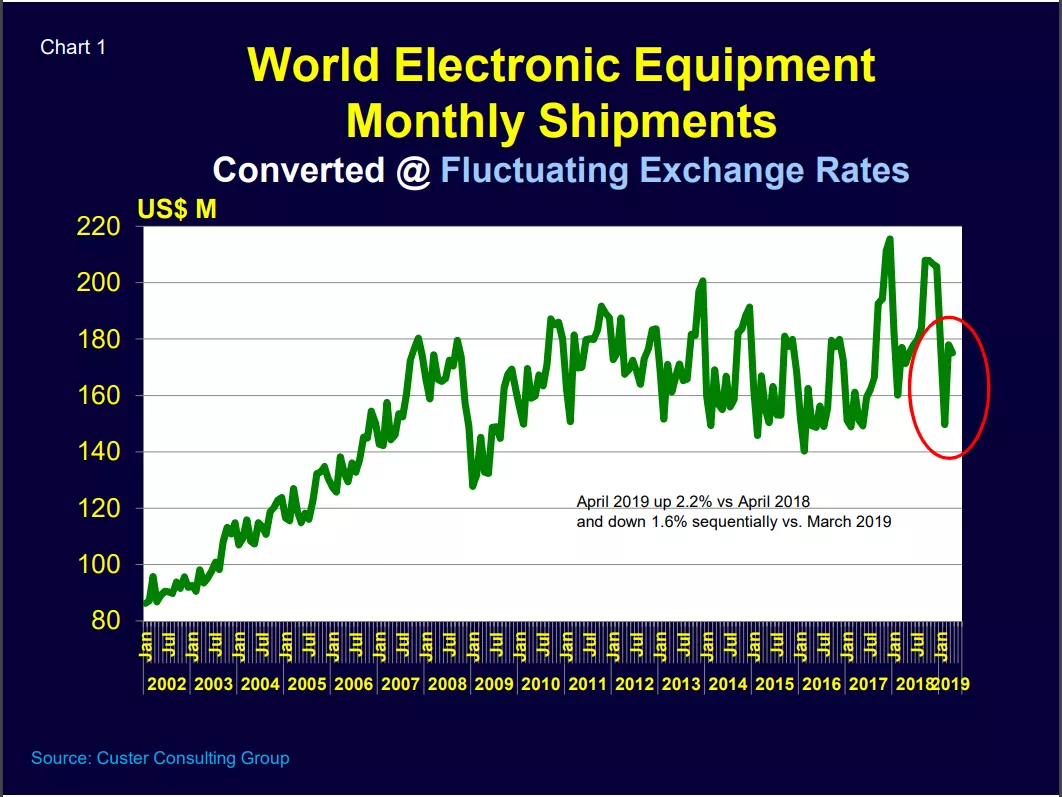

Global electronic equipment shipments were up 2.2% in April 2019 versus April 2018, but down 1.6% sequentially versus March 2019 (Chart 1). Seasonality provided an early spring rebound but year-over-year growth was minimal.

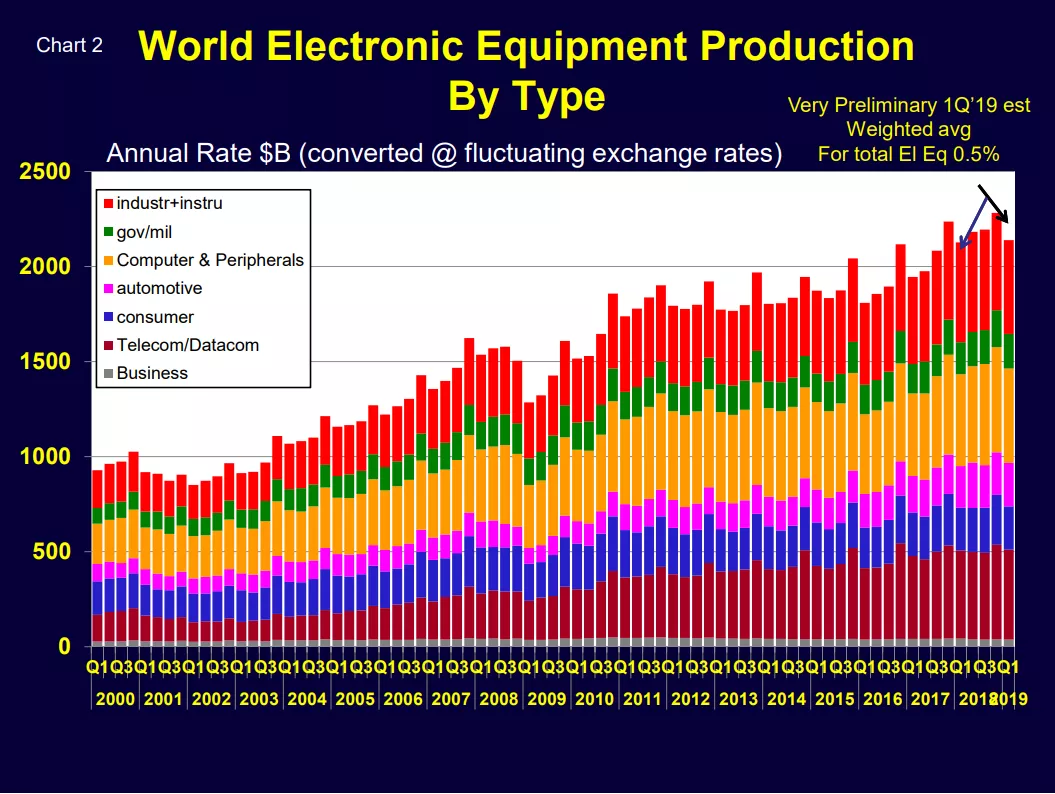

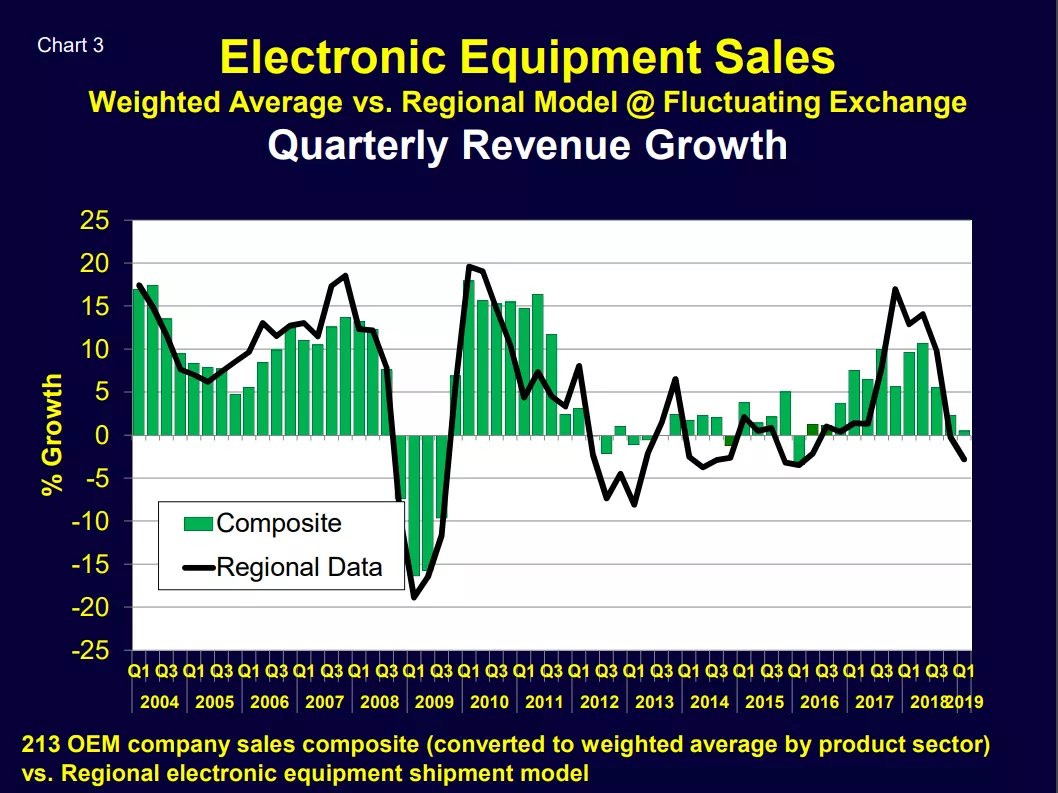

Based on a combination of actual and estimated first quarter company financial results, world electronic equipment sales were up only 0.5% in 1Q 2019 versus 1Q 2018 (Chart 2). End market growth had clearly weakened (Chart 3).

These comments are based on combined actual consolidated first quarter company sales results and Custer estimates that historically have yielded reasonable forecasts.

Timing and Magnitude of Current Business Cycle

Electronic industry business cycles (corrected for seasonality) have historically been strong and often disruptive. The recent 2017/2018 industry growth spurt is now behind us. 2019 started out on weak footing and appears to be headed towards further contraction.

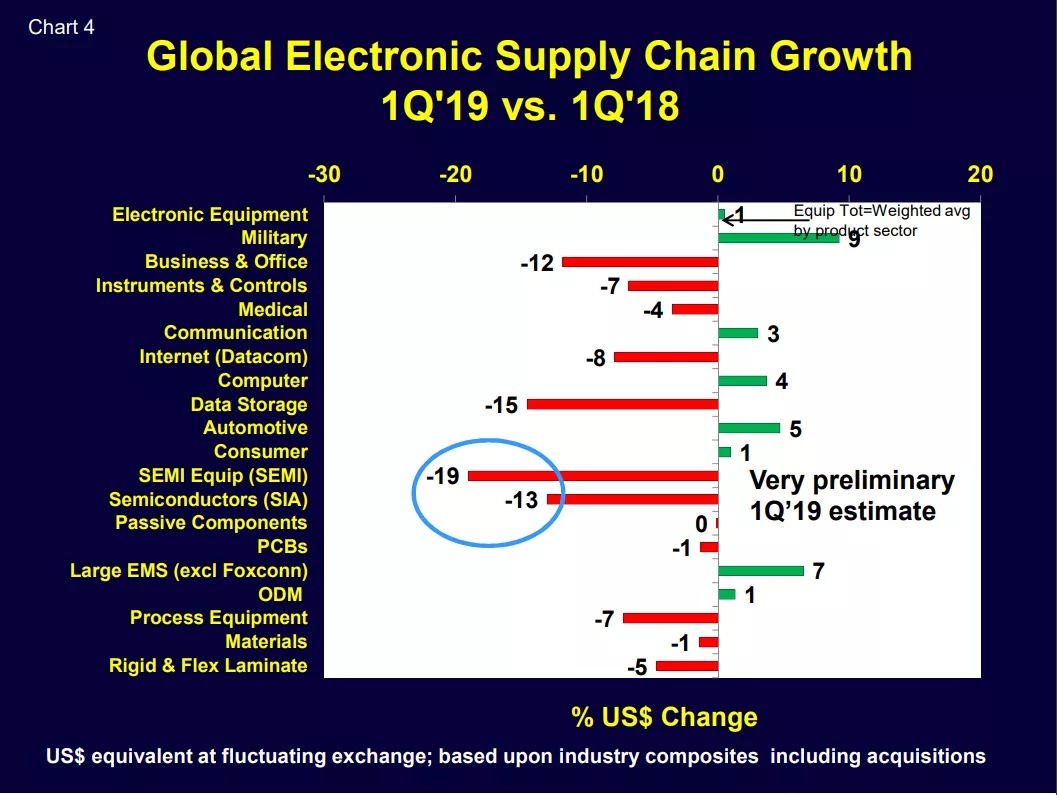

Not all sectors of the global electronic supply chain are affected equally in a business cycle.

The semiconductor sectors (chips and semiconductor capital equipment) experienced amplified growth in the last upturn but are also seeing strong contraction in this current downturn (red circle on Chart 4).

Semiconductor industry currency-denominated sales have been negatively impacted not only by weaker end market demand but also lower memory chip pricing, corrections to inflated prior ordering and efforts to reduce inventories.

A Forecast

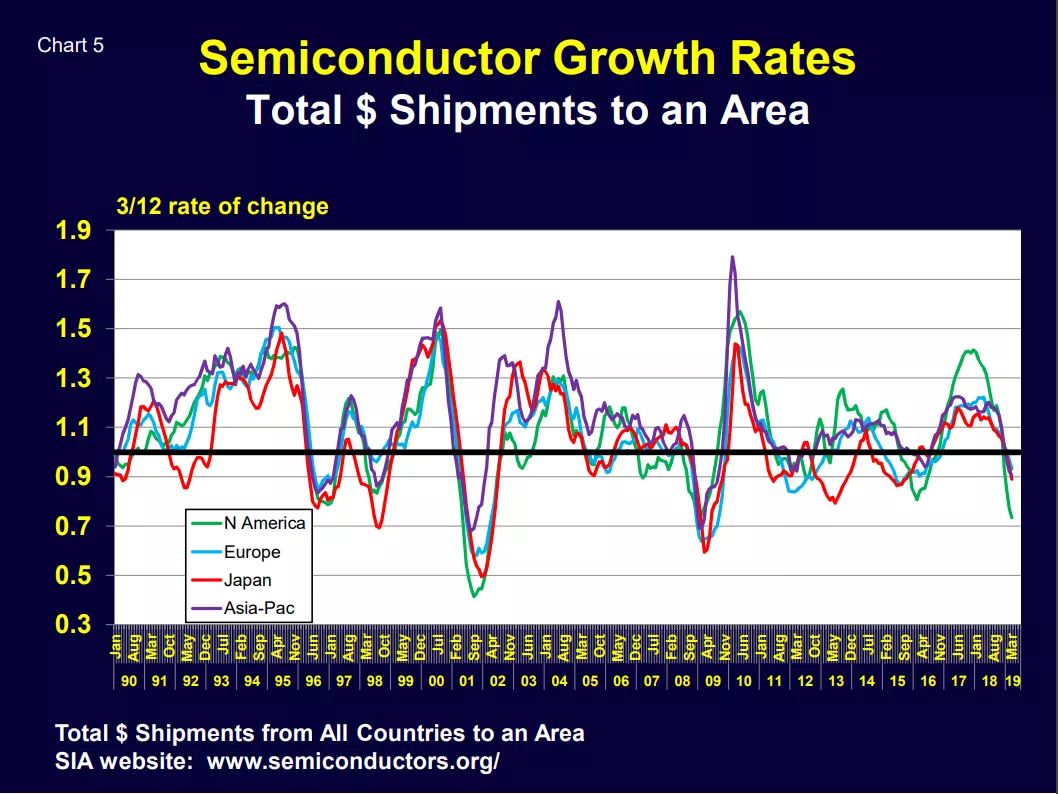

Semiconductor shipments have been historically volatile and their current growth rates are negative (3/12<1) in all regions (Chart 5).

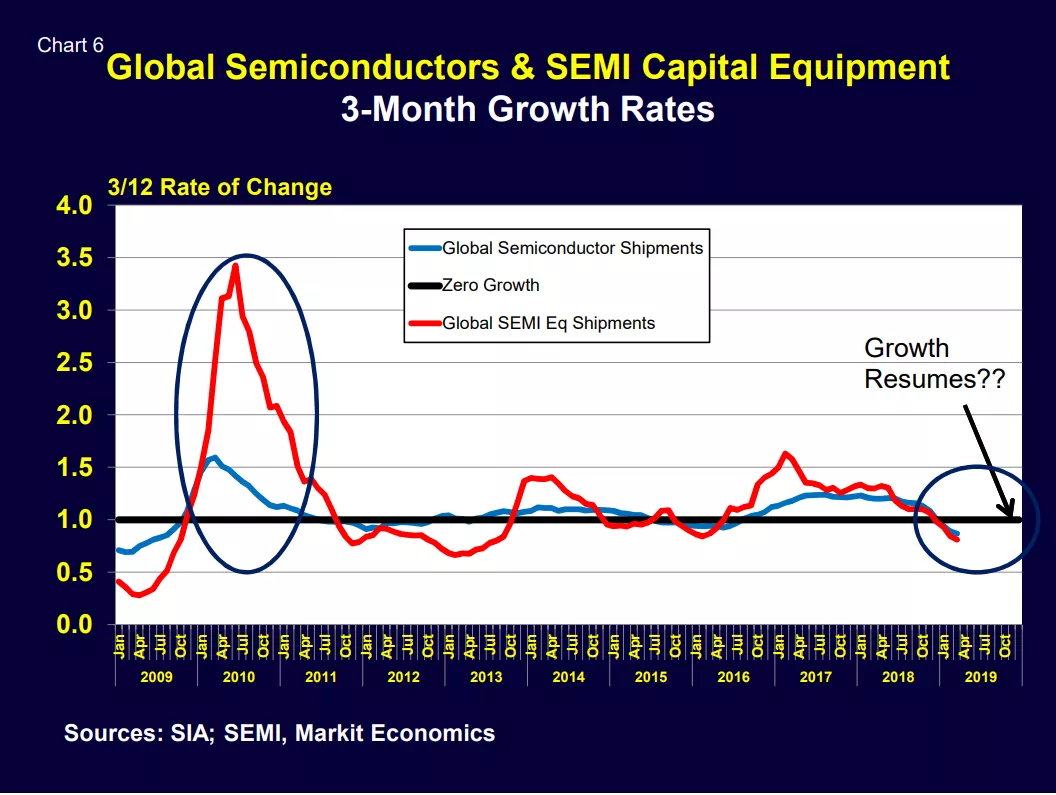

When will industry growth resume? Chart 6 compares the global growth of semiconductors and semiconductor capital equipment. Both chip and SEMI equipment 3/12 growth curves continue to deteriorate - but they appear to be nearing bottom. However, after reaching bottom, real growth will not resume until the 3/12 rates again exceed 1.0

As a very rough estimate these 3/12s will cross 1.0 again in late 2019 or early 2020 – and then real growth will resume. There will be regional differences. This timing is a global estimate – with regional difference likely.

We will continue to update this chart as the year progresses. Stay tuned!

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.