The march of innovation in semiconductor microfabrication technology over the past 60 years has produced electronic devices and information systems that have transformed industries and lives around the world. And while advances in chip technology continue to make it possible to collect, transmit, store and process more data for a rapidly growing universe of applications, the pace of innovation is now facing strong headwinds.

Powered by chip innovation, data centers have become massive centers of information processing but, on the downside, enormous consumers of electricity. Today, the power-hungry hubs account for five percent of the world's electricity usage, a proportion that is growing every year, raising important questions about sustainability. Compounding the challenge, the pace of Moore's Law, for decades the engine of electronic device and information system innovation, has slowed. While the research and development of state-of-the-art semiconductor fine processing technology remains robust, developing the advanced manufacturing technology for mass-producing more sophisticated electronics devices is becoming harder, as is ensuring business profitability.

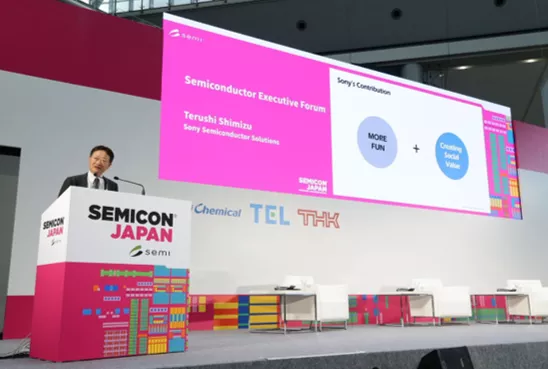

"It has become difficult for semiconductor technology to continue to evolve as it has in the past," said Akira Minamikawa, Research Director of Technology Research at IHS Markit, who moderated the Semiconductor Executive Forum – View by Top Two in the Era of Digitalization on opening day of SEMICON Japan 2019 at Tokyo Big Sight. Held at the SuperTHEATER, the forum featured Terushi Shimizu, representative director and president at Sony Semiconductor Solutions, and Atsuyoshi Koike, president at Western Digital Japan, two industry powerhouses that could figure heavily in the future of digital technology.

SuperTHEATER, the main stage at SEMICON Japan 2019

Image sensors evolve to become eyes of AI

Image sensors are becoming eyes of artificial intelligence (AI) and intelligent systems that monitor people and events worldwide, collecting data that one day could help puzzle out growing social challenges such as energy conservation and traffic congestion. With 51 percent market share on the strength of its industry-leading technology, Sony Semiconductor Solutions dominates the image sensor market. Despite last year’s global semiconductor industry slump, the company’s “business continues to enjoy strong growth and we are very busy,” said Shimizu, who attributed the company’s robust performance to the rising importance of the social role of image sensors and the expanding number of applications they support.

The success of the company’s image sensors can also be traced to its division of the image sensor market into two application categories: "Imaging" focuses on capturing beautiful image data, while "sensing" aims to collect data that accurately describes the state of a subject and its surroundings.

"In 2019, sales of imaging products for smartphones grew rapidly,” Shimizu said in his market overview. “This is due to the average annual 15 percent growth rate of multi-camera smartphones, with some phones today featuring seven cameras, and an average annual growth rate of 20 percent in sensor size to produce higher image quality."

But Shimizu cautioned that Sony Semiconductor Solutions doesn’t expect the smartphone sensor market to maintain that fast growth rate.

"The imaging market is expected to grow until 2022, but after that, the sensing market will drive market growth,” he said, adding that the company’s “capital investment plan is based on this scenario."

AI will be key in catalyzing growth of the sensor market as integrations of AI processing engines and sensing images grow in sophistication to capture images undetectable by the human eye, Shimizu said. AI will extract insight from captured image data. For its part, Sony will apply its layer stacking technology to sensing products.

"By stacking an AI processing engine, we want a significant portion of the recognition processing done within the sensor chip," Shimizu said.

One sensor the company already offers collects in-depth information for indirect time-of-flight (ITOF) 3D ranging for new user interfaces relying on autonomous or gesture control for robotics. The sensor “was first used in smartphones in 2018 and saw widespread adoption in 2019," Shimizu said.

Sony Semiconductor Solutions plans to focus on developing new sensors for integration with their ultrasonic cousins. Aided by optical deflection technology, the sensors will be used for product quality inspections during manufacturing.

With the company’s growing strengths in sensor technology, it hopes “to increase sales of sensors from a few percent of the company’s total sales in 2018 to 30 percent in 2025,” Shimizu said, pointing to its goal "to capture 60 percent share of the image sensor market by 2025."

Data as one way to spread happiness

At the heart of consumer devices such as smartphones and computers and also cloud servers, NAND flash has made it possible to process vast troves of data anytime, anywhere. In recent years, the technology has enjoyed stronger adoption for use as the storage medium of choice for edge computing, stationed between end devices and the cloud to help streamline data utilization. But the technology isn’t merely about making smarter use of bits and bytes.

"We would like to promote the technology development that can support the use of data to bring happiness to people around the world," Koike of Western Digital Japan said. The company calls data that contributes to individual happiness and helps solve social issues "data for good" and, like the Sony Semiconductor Solutions bifurcated classification of the image sensor market, categorizes information into “big data” and “fast data.”

For example, big data can leverage AI to drive dramatic improvements in the interpretation of test data and, ultimately, the diagnostic accuracy of mammography for breast cancer screening, aiding in early detection to help save lives, Koike said. Fast data can be harnessed to analyze data collected from a manufacturing equipment line in real time to improve production efficiency. The company’s plant in Yokkaichi, Mie Prefecture, which the company operates in cooperation with Japanese memory manufacturer Kioxia, already uses fast data to bolster production.

More NAND flash innovation and greater supply capacity are critical to developing "data for good," Koike said. "It is difficult to expand clean rooms at the same pace as data usage grows. In order to continue to advance technology and enhance supply capacity, we need to adopt new ideas for building production lines. We need a smaller equipment footprint, shorter cycle time and higher throughput."

Semiconductor market shows signs of recovery

In their discussion of the short-term outlook for the semiconductor market, Shimizu and Koike pointed to the importance of strengthening the talent pool of Japan’s semiconductor industry as global competition heats up with China’s pursuit of semiconductor independence and the industry pulls out of the 2019 slowdown fueled by weak memory prices. While Sony’s business has been buoyed by strong image sensor demand for smartphones, the devices “did very well, but other applications didn't," Shimizu said. Even the image sensor market stagnated.

Despite the 2019 slump, market conditions and capital investments by semiconductor manufacturers have been on the upswing.

"In the second half of 2019, the Chinese market showed signs of recovery triggered by 5G,” Shimizu said. “In 2020, this movement is going to be in full swing around the world and we will be busier than last year."

Koike agreed: "The semiconductor market for data centers will recover with 5G. The hard disk shortage is already an indication of a recovery, a turnaround that will undoubtedly extend to solid state drives (SSDs). In addition, advances in autonomous driving technology will ensure continued growth of the automotive semiconductor industry.”

Japan should embrace international competition, not fear China's pursuit of chip independence

It's no secret that China is investing heavily in its semiconductor development capabilities to move up the microprocessor value chain. Minamikawa posed the question: How should Japanese chip companies navigate the shifting regional balance of power?

"It is natural for China to strive to establish domestic procurement of semiconductors that are fundamental technologies for various industries,” Koike said, “I think the efforts of Chinese companies are outstanding in that they are not pursuing short-term results, such as improving yields in the near future, but are making efforts with an eye to achieving results in 10 years. Japan has a variety of options including working with China to create joint ventures and competing head-on. Regardless of which choice we make, however, it is imperative for the survival of domestic companies that Japan maintains its technological competitiveness to remain ahead of China."

Shimizu said that Sony’s “Chinese customers are quick to take action and study extremely hard. We often have opportunities to share our roadmap with them and explore innovation opportunities together. Before, they were passive and relied on us for insights into new technologies, but now they are more assertive and I sense that they will start to drive innovation.”

Koike added that "although Japanese companies often talk about business globalization, neither Chinese nor American companies say much about it. While global expansion is a major requirement for business, I think Japanese companies need to focus more on the Japanese market overall, not just when they think about the growing competitiveness of Chinese companies."

L-R: Akira Minamikawa, Research Director of Technology Research at IHS Markit; Atsuyoshi Koike, president at Western Digital Japan; Terushi Shimizu, representative director and president at Sony Semiconductor Solutions

Talent key to bolstering competitiveness of Japan’s semiconductor industry

Minamikawa of IHS Markit didn’t mince words in describing the talent shortage in the Japanese semiconductor industry as “grave,” saying that “the workforce challenge is not endemic to the electronics industry as evidence grows that the number of people obtaining doctorates in Japan is falling and the educational level of the Japanese population as a whole is in decline.”

Three years ago, Shimizu interviewed professors on Kyushu island for insights into Japan’s talent shortfall. He came away feeling that “Japanese semiconductor companies were not sufficiently communicating the industry's talent and innovation needs to professors. To help professors and students better grasp the appeal and potential of the industry, we have started to send frontline engineers to universities to educate students and instructors about their work and careers. Expecting corporate HR departments to alone solve the talent shortage won’t work.”

"In Japan, if you advance to a doctoral course, you will have a hard time getting a job, which is a strange situation,” Koike said. “Companies and universities need to work together more closely to better understand how to attract and hire doctoral graduates."

Minamikawa said companies must have strong leaders with clear missions to attract the right talent, but Koike pointed to the drawbacks: "The image of a company with a strong leader seems to be cool, but it also has a downside because engineers stop thinking for themselves and wait for instructions from the top. I believe it is important for company leaders to have ongoing discussions at all organizational levels and lead the way in times of confusion."

Shimizu agreed, citing his own company as an example.

"Thankfully, our company is very busy right now,” he said. “However, some employees are starting to request more time to think about how to improve the quality of their work. To maintain and strengthen our competitiveness and continue business growth, I believe it is important to cultivate an environment that encourages each employee to take more time to think for themselves."

Motoaki Ito is the CEO of Enlight, Inc. and a reporter for SEMI. Mayumi Amagai is a marketing manager at SEMI Japan.