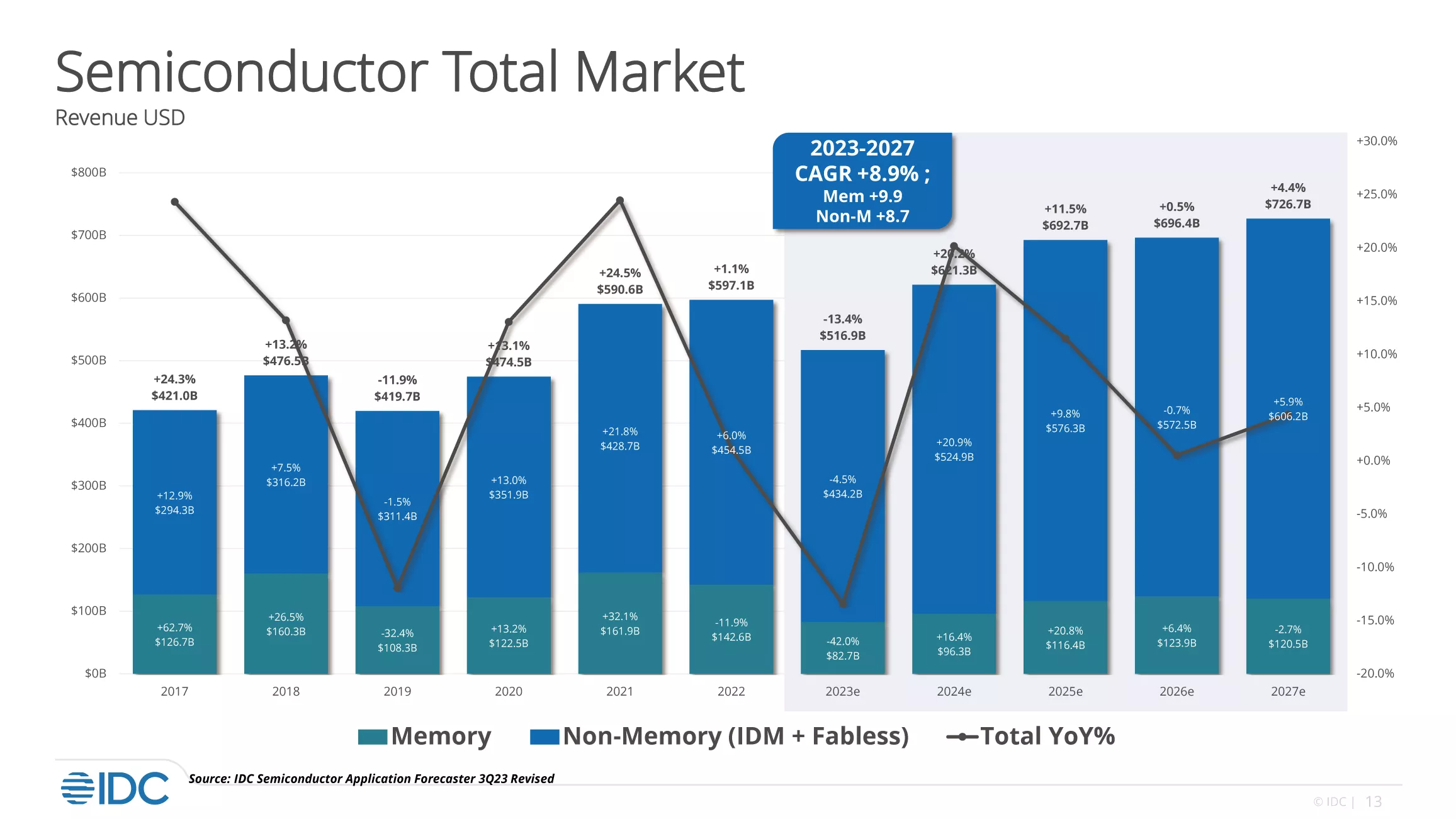

The global semiconductor market has hit the bottom of this cycle and will rebound next year, with memory poised for growth in the second of 2023 driven by a resurgence in server investments, Soo-Kyoum Kim, Vice President at IDC, predicted in a presentation to about 400 members gathered for SEMI Korea Members Day in mid-October at the Suwon Convention Center.

Kim expects the semiconductor market to grow to US$621.3 billion in 2024, a 20.2% increase from a projected US$516.9 billion this year to eclipse the previous record of US$597.1 billion in 2022. The 2023 estimate would mark a 13.4% year-over-year (YOY) decline. He forecasts that the non-memory market will grow 20% to US$524.9 billion next year, with memory expanding 16.4% to US$96.3 billion.

“The server market is important for memory, the main business area of Korean semiconductor supply chain, to return to growth,” Kim said. “We expect the server market to pick up from the end of the second quarter of next year. When prices start to rise, we project that DRAM prices will jump by close to 10%.”

“The server market is important for memory, the main business area of Korean semiconductor supply chain, to return to growth,” Kim said. “We expect the server market to pick up from the end of the second quarter of next year. When prices start to rise, we project that DRAM prices will jump by close to 10%.”

With artificial intelligence (AI) applications driving growth of high-bandwidth memory (HBM) usage, Kim said HBM is now the hottest memory technology. The HBM market is expected to grow 31.3% over the next five years.

More Key Takeaways from SEMI Korea Members Day

As the global semiconductor eyes a rebound starting next year, Korea’s position as a global memory powerhouse took on even greater importance at SEMI Korea Members Day. Presentations on cutting-edge technology innovations, the latest market insights and critical industry issues highlighted the event as members sought out business expansion opportunities.

As the global semiconductor eyes a rebound starting next year, Korea’s position as a global memory powerhouse took on even greater importance at SEMI Korea Members Day. Presentations on cutting-edge technology innovations, the latest market insights and critical industry issues highlighted the event as members sought out business expansion opportunities.

In his opening remarks, HD Cho, President of SEMI Korea, extended his deep appreciation to SEMI Korea members for their remarkable resilience in the face of challenging macroeconomic fluctuations and global uncertainties in recent years. He also reiterated SEMI’s unwavering support for SEMI Korea member company growth and innovation as they remain critical to the health and resilience of the global semiconductor supply chain.

Achieving Net Zero Requires Semiconductor Industry Solidarity

While initially “net zero was an effort to reduce carbon emissions through global cooperation between governments,” now there’s a much stronger push among companies in the semiconductor and other industries to reduce carbon emissions, said Chang-Wook Kim, Semiconductor lead at Boston Consulting Group (BCG). “Companies around the world are carrying out various activities to reduce carbon emissions to achieve net zero,” he said, adding that a recent BCG survey found that more than 80% of companies remain focused on scope 1 and 2 activities and that organizations are exploring a host of ways to increase energy efficiency and decarbonize.

Kim said that to overcome the formidable challenge of reducing carbon emissions to net zero across the entire supply chain (Scope 3), the semiconductor industry must establish common industry data and benchmarks.

Samsung Electronics Remains DRAM Leader Despite Fierce Competition

Highlighting memory technology trends, Dr. Jeongdong Choe, Senior Technical Fellow and SVP at TechInsights, said in his analysis of chips installed in the recently released iPhone 15 series that the products use both Micron’s most advanced D1b products and SKhynix’s D1Z DRAM devices – two generations older than the Micron device – while the Galaxy smartphone series from Samsung Electronics uses 15-14 nanometer D1a DRAM.

Dr. Choe said that the competitiveness of DRAM should not be judged by generation alone. Micron applied D1b to the iPhone 15 and launched the latest generation of DRAM products that are ahead of competitors, yet many innovations are led by Samsung Electronics. For example, in a comparison of same-generation DRAM products, the cell size of Samsung Electronics devices is smaller than Micron’s. He explained that Samsung is reducing cell size while leading advances in cutting-edge technologies such as Extreme Ultraviolet Lithography EUV) and High-K Metal Gate (HKMG) for DRAM.

Power Semiconductor Market to See Steady Growth

KS Park, Director of Onsemi, a global power semiconductor market leader, said that the power semiconductor market share of the overall chip market is expected to be a modest 4.5%, or US$29.9 billion, this year though the power market is expected to grow by a healthy 19% during the same period despite the semiconductor industry downturn. He expects the market to see a steady expansion to US$37.1 billion in 2026.

Park noted that market share of SiC and GaN power semiconductors is expected to increase 1.32% and 4.4%, respectively, through 2026. Of the total power semiconductor market, Si-based power semiconductors last year accounted for 94.9% share, SiC devices 6.1%, and GaN products 0.8%.

This year, GaN power semiconductors will be used for 70% of mobile and customer applications and 22% of telecommunications and infrastructure applications, though those shares are to expected to drop to 48% and 32%, respectively, in 2027, as automotive and industrial applications experience rapid growth.

In 2022, 86% of the total SiC power semiconductor capacity was based on 6-inch wafers. However, the capacity of 8-inch wafers, which can produce 1.8 times more dies, is gradually increasing, with capacity share of 8-inch wafers projected to grow from 15% in 2025 to 30% in 2027, Park said.

2024 Growth in Store for All Semiconductor Equipment and Materials Markets

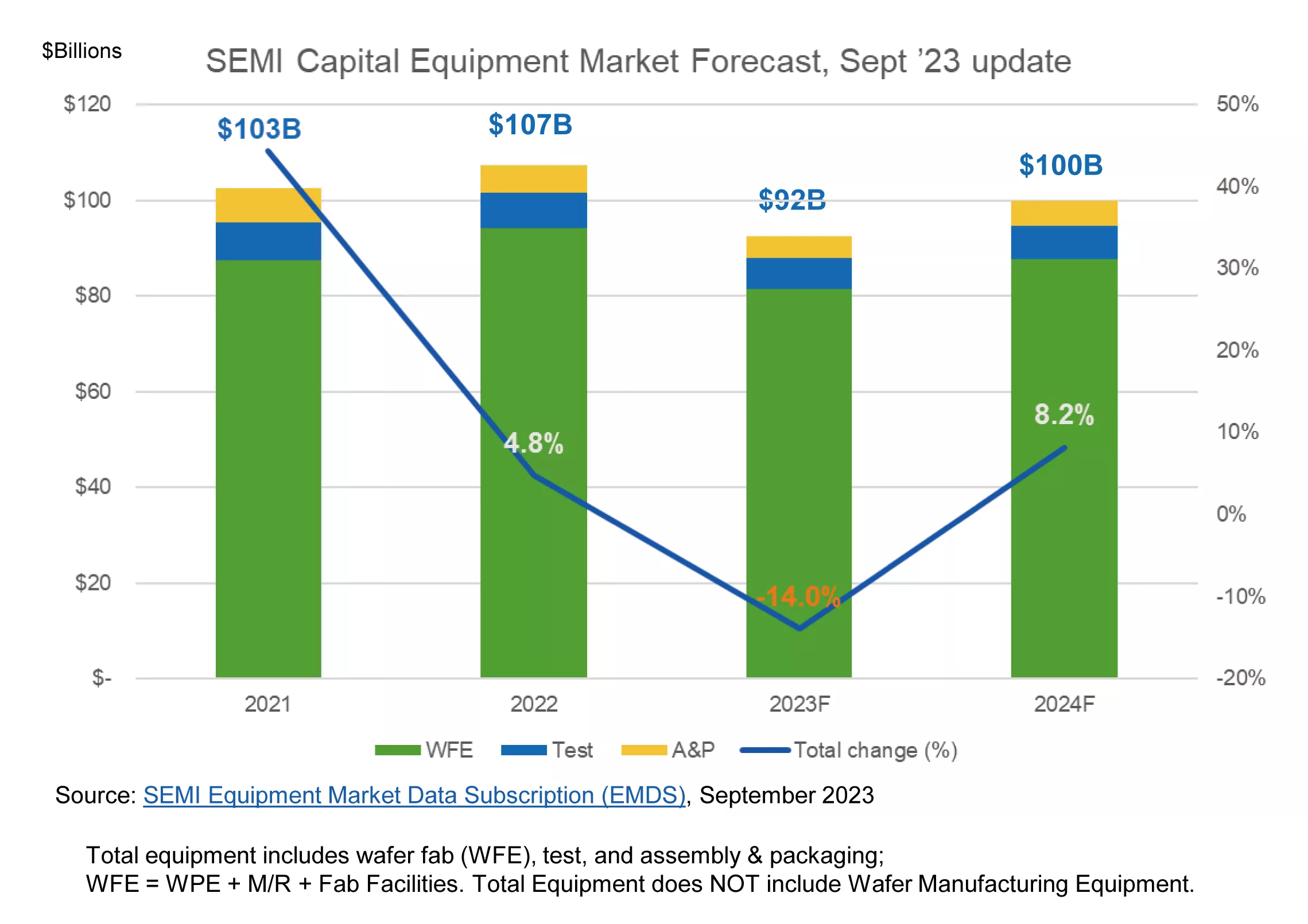

Clark Tseng, Sr. Director of SEMI Market Intelligence Team, said the semiconductor equipment and materials markets are projected to post notable growth next year fueled by the memory market recovery, with the semiconductor equipment expanding 8.2% to $100 billion in 2024 after a projected YOY drop of 14% to $92 billion in 2023. Tseng noted that as demand began a gradually recovery in 2023 from its bottom in the second quarter of the year, overall memory prices began to rise slightly starting in the third quarter of 2023. NAND demand and prices are also expected to increase in the second half of 2023, while smartphone and server memory demand is forecast to begin to recover starting in the third quarter of 2023, Tseng said.

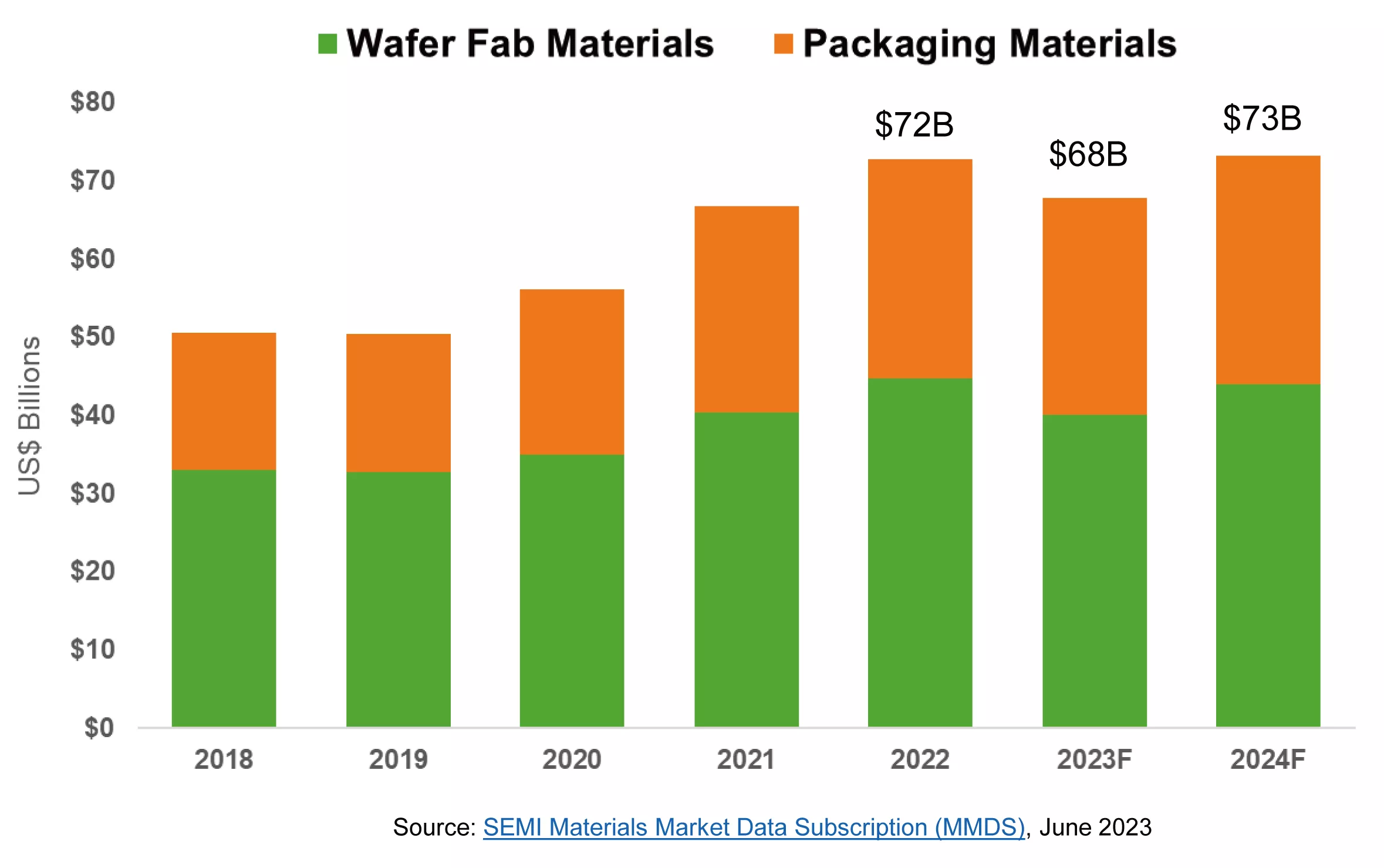

The materials market is expected to grow by 7.4% and reach US$73 billion in 2024, setting a new industry record, after declining 5.5% from US$72 billion in 2022 to US$68 billion in 2023, Tseng said. According to the SEMI World Fab Forecast report, 20 new 200mm fabs and lines and 71 new 300mm fabs and lines are expected to be added from 2022 to 2026, catalyzing growth in the semiconductor equipment and materials market.

Join SEMI for more industry insights January 31-February 2 at COEX for SEMICON Korea 2024, the region’s premier microelectronics event, as visionaries and industry leaders gather to discuss the latest microelectronics ecosystem developments, innovations and business opportunities. The event is expected to draw 65,000 attendees and 500 exhibitors while featuring 130 speakers, 2,100 booths and 25 programs. More event information, including registration details, will be available soon.

Jaegwan Shim is a marketing specialist at SEMI Korea.