Memory devices must combine new levels of capacity and power efficiency with higher performance to process the vast amounts of data required to support AI training and inference, heralding a new era of computing, said Choonhwan Kim, Senior Vice President and Head of R&D Process at SK hynix in his keynote at SEMICON Korea, January 31-February 2 at COEX in Seoul.

DRAM and NAND flash technology has seen innovations to overcome the technical limitations of traditional 2D architectures. And in the future, Kim said, one key to increasing memory processing speed will be the development of sub-10nm DRAM and NAND with up to 1,000 layers by leveraging a next-generation platform that integrates High Aspect Ratio Contact (HARC) etching process via wafer bonding.

Packaging Innovations Key to Driving Higher Memory Device Performance

In order to meet AI computing requirements while preserving the ability to customize memory, the industry will need to develop not only wafer bonding technology capable of forming heterogeneous and homogeneous bonding but also stacking methods that use Trough Silicon Via (TSV) and chiplet technology, Kim noted. With High Bandwidth Memory (HBM) products seeing explosive demand, continuing packaging technology innovations are critical to keep pace with increasing processing speeds. So important are packaging and memory technology innovations in supporting AI and other data-intensive applications that innovations across both areas should take place in parallel, Kim said.

“High Bandwidth Memory is projected record an average annual growth rate of 40% until 2026,” Kim said. “SK hynix plans to release HBM3E this year and HBM4, which is three times more powerful, in 2026.”

Kim also noted that the memory industry will face technological limitations as its moves to mass production of cutting-edge semiconductors such as 3D DRAM and 400-layer NAND. He expects SK hynix to overcome these barriers using next-generation processes such as high-Numerical Aperture (NA) extreme ultraviolet (EUV) and hybrid bonding.

Merck Keynote – Data and Digital in the Materials World

Another industry push requiring close industry collaboration is the drive towards new data and materials advances as it works to clear hurdles including scaling, evolving technologies, and broadening the adoption of data-driven best practices, said keynote speaker Anand Nambiar, Chief Commercial Officer of Electronics Business Sector at Merck. The company is developing memory defect detection solutions that can scale with industry growth and will remain at the forefront of technological advancements, he noted.

One key focus area for Merck is to increase manufacturing productivity through automation and using advanced analytics to optimize production and meet rising quality requirements. Data science will also play an important role in detecting defects, improving device quality and helping to accelerate the development of materials to drive higher performance and meet the industry's sustainability goals, Nambiar noted.

Eliyan Unleashed: Elevating Package Performance and Accelerating Memory Chiplets Adoption

Exponential demand for semiconductors that support AI and high performance computing (HPC) applications has increased chip size to a point where it now exceeds the maximum chip manufacturing dimensions, Sean Lundy, Vice President of Global Sales at Eliyan, said in his keynote.

To overcome this barrier, the chiplet system-in-package (SiP) has been developed to operate like a single chip by connecting multiple small chiplets that combine high bandwidth and low power consumption, enabling the implementation of very large processor chips. However, advanced packaging technologies like silicon interposers, developed to connect chiplets with various target bandwidth and power requirements, come with significant costs and various limitations, including supply chain continuity issues due to geopolitical risks, Lundy said.

“Chip manufacturers around the world are turning to chiplets as they offer many advantages in improving power, cost, and yield,” Lundy said.

Naver’s Strategy in Era of Paradigm Shift by Frontier AI

Since the release of ChatGPT, the world has been swept up in the craze of hyperscale generative or frontier AI, Jung-Woo Ha, Head of AI Innovation and Head of Future AI Center at Naver, said in his SEMICON Korea keynote, adding that “Generative AI has already changed the way people live and work.”

Ha observed that as a base technology, Generative AI will create enormous commercial opportunities once the technology has been geared toward international users. The reason: Unlike traditional AI, Generative AI blends knowledge with culture, historical values, and social norms during the learning process, enabling results relevant to users in different cultures.

He also emphasized that the massive amount of data accumulated by search engines can be used to deliver Generative AI services that learn Korean culture, and that about 200 services can be commercialized using the technology.

Ha also noted that “AI has not yet spread to all industries. As its adoption increases, semiconductor technology, including memory, must evolve to manage increasing data traffic loads.”

Market Trends Forum

The near-term semiconductor industry cyclical downturn has come to an end, and the industry is on course for a gradual 2024 recovery driven by improvements in end demand and the normalization of inventory, said Clark Tseng, Senior Director of the Market Intelligence Team (MIT) at SEMI, said at the SEMICON Korea market research press conference.

Tseng noted that AI, HPC and automotive applications remain among the key drivers of semiconductor industry growth, with global chip sales expected to experience double-digit growth this and next year. What’s more, Tseng said, semiconductor investment worldwide remains robust. Thirty-five new fabs are expected to begin operation in 2024, while 28 new fab projects are set to start construction this year. Notably, China’s capacity share is projected to continue to expand in the next two years.

Tseng also noted that 2024 growth for the semiconductor equipment sector will be muted as sales increase about 4% to $105 billion. By contrast, assembly and packaging equipment sales are projected to grow 24% this year, with test equipment receipts forecast to expand 14% during the same period. Next year is expected to see a strong rebound with double-digit growth across all equipment segments – wafer fabs, test, and assembly and packaging. Tseng said all wafer fab materials segments are expected to rebound to $43 billion in 2024 and grow to nearly $50 billion next year.

Andrea Lati, Director Market Research at TechInsights, emphasized that secular chip industry growth drivers including, AI, electric vehicles and Internet of Things (IoT) remain robust, propelling the global semiconductor industry to $1 trillion in revenue in early 2030s. He projected a 15% increase in hyperscale capex for 2024 due to strong investment in AI infrastructure.

Lati noted that, in China, wafer fab equipment sales soared 35% in 2023, with spending on mature nodes driven by Chinese IDMs and foundries, adding that several expansion projects by Chinese IDMs and foundries will keep the region’s wafer fab equipment spending levels elevated this and next year.

In the automotive semiconductor market, sales are forecast to double to more than $84 billion by 2028, and power semiconductors will show an average annual growth rate of 15.4% as automobiles become electrified, said Ezgi Dogmus, Compound Semiconductors Team Lead Analyst at Yole Group. Dogmus said that 800V Battery Electric Vehicles (BEV) are increasing market share, opening more opportunities for power semiconductors. He predicted a 20.5% CAGR for electric vehicle power semiconductors from 2022 to 2028 as total market size exceeds $10 billion.

Supplier Search Program and Workforce Development Programs

In SEMICON Korea’s iconic Supplier Search Program, now in its 13th year, representatives from GlobalFoundries, Infinion, Kioxia and Micron held nearly 100 meetings with Korean equipment, materials and parts companies. The program continued to enable key connections for suppliers across the Korea semiconductor supply chain to expand their businesses overseas.

The workforce development and diversity, equity and inclusion sessions drew about 1,000 university students, junior engineers and other young workers as experts provided insights into career development in the chip industry as it continues the critical work of expanding its talent pipeline.

To improve the skills of junior engineers and deliver more detailed knowledge to university students, the sessions included semiconductor manufacturing tutorials with academics and senior engineers at leading semiconductor companies participating as speakers. The experts shared the basics of the semiconductor manufacturing process and the latest trends to prospective talent and young workers just starting their careers.

Meet the Experts! program

In the Meet the Experts! program, a mentoring program for university students, 10 engineers from leading global semiconductor equipment and materials companies discussed the progression of their careers and offered advice on university courses for aspiring industry workers to complete. With the widespread interest in working in Korea’s chip industry, Meet the Experts! is a big draw for university students. Only minutes after the doors opened, the conference room had reached capacity. Engineers from Applied Materials, ASML, Entegris, KLA, Lam Research, Merck, PSK, TEL, Wonik IPS and YIKC presented at the event.

Women-in-Technology program

In the Women-in-Technology program, four female semiconductor industry leaders offered perspectives on how to enhance the diversity of the industry’s workforce. The session targeted not only women but also colleagues and managers of women engineers to help expand awareness of the need for greater diversity. The program featured Jungsun Jessie Kim, Software Engineering Manager at Applied Materials; Hyocheon Kwon, Applications Engineer at KLA; Seungjoo Yoo, Field Process Engineer at Lam Research; and Youn Joung Cho, Master and VP of Technology at Samsung Electronics.

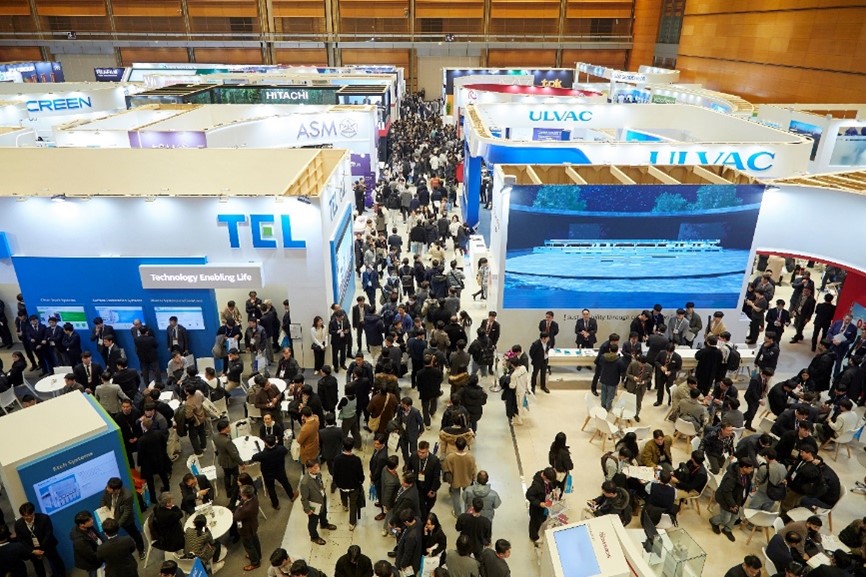

SEMICON Korea 2024, the region’s premier microelectronics event, gathered innovative companies and visionaries that are helping shape the future of the semiconductor industry. The exhibition and conferences at COEX in Seoul drew 435 exhibitors and more than 65,000 attendees.

Jaegwan Shim is a Marketing Specialist at SEMI Korea.