With DRAM and NAND accounting for about 25% of the total semiconductor market, a memory market rebound will help spark a global semiconductor industry recovery poised to take hold in the second half of 2023 after the downturn that came on the heels of the pandemic boom, SEMI and major market research firms projected at Strategic Materials Conference (SMC) Korea 2023, held last month in Seoul.

Market Forecasts and Technology Trends at SMC Korea 2023

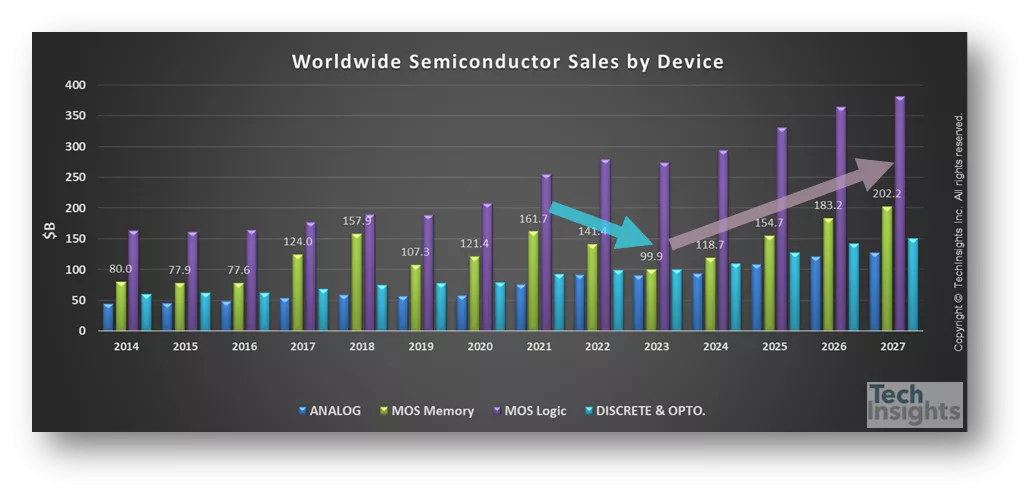

Notably, the implementation of production cuts for Double Data Rate 4 Synchronous Dynamic Random-Access Memory (DDR4 SDRAM) to address the substantial inventory surplus will fuel the memory market recovery, said Dr. Jeongdong Choe, Senior Technical Fellow at TechInsights in his talk at the conference. Dr. Choe sees both DRAM and NAND pricing bottoming and rebounding in the third quarter of 2023 and the chip industry logging robust growth until at least 2027, reaching $564 billion in sales this year and grow by 9% to $615 billion in receipts in 2024.

Dr. Choe said that while Samsung Electronics and SK hynix remain memory leaders, Wuhan, China-based YMTC is ascendant in the NAND market. One advantage for YMTC is that its 232-layer 3D NAND featuring Xtacking technology can be sourced easily in the consumer market, whereas competing products from Samsung Electronics and SK hynix are comparatively less accessible.

YMTC’s rise points to the shifting landscape of 3D NAND providers. Micron and YMTC have now overtaken Toshiba and Samsung Electronics as the top two players in the 3D NAND market, despite concerns that geopolitical issues will hamper YMTC's growth, Dr. Choe said. He emphasized that unlike DRAM, NAND production does not rely on extreme ultraviolet (EUV) technology, enabling YMTC to potentially use its existing facilities to manufacture one to two more generations of NAND. The company could possibly scale up to 400 layers, though whether it could achieve mass production is an open question.

More than 300 industry stakeholders attend SMC Korea 2023, the region's premier electronics materials conference.

Advanced Packaging Materials

Advanced packaging materials are growing prevalence across various applications, said E. Jan Vardaman, president and founder of TechSearch International, citing the remarkable shift in Apple’s adoption of advanced packaging for its iPhone series.

In 2016, advanced packaging accounted for 47% of the iPhone 7’s total packaging footprint, a proportion that surged to 69% with the introduction of the iPhone 13 Pro in 2021. Vardaman forecasts that the global semiconductor packaging materials market will reach $30 billion by 2027, up from $26 billion in 2022 – significant growth fueled by the rise of advanced packaging.

In 2016, advanced packaging accounted for 47% of the iPhone 7’s total packaging footprint, a proportion that surged to 69% with the introduction of the iPhone 13 Pro in 2021. Vardaman forecasts that the global semiconductor packaging materials market will reach $30 billion by 2027, up from $26 billion in 2022 – significant growth fueled by the rise of advanced packaging.

Supply Chain Challenges

Addressing inherent risks associated with the concentration of global chip industry supply chains, Inji Yeom, an Associate Partner at McKinsey & Company, said about 80% of supply chains are concentrated in key regions such as the U.S., China, Taiwan, Japan, and Korea, posing a significant vulnerability to the industry worldwide. Yeom also pointed to potential supply chain risks stemming from the concentration of specific technologies, citing Taiwan’s dominance in high-tech fabs, the Netherlands’ hold on EUV equipment, and Japan’s position as a major hub for photoresist materials.

Drawing insights from successful cases such as Toyota, Biogen, and Nike, Yeom posed four crucial self-assessment questions for semiconductor industry leaders to address in order to effectively address and manage supply chain challenges.

- Do we have visibility to the vulnerabilities that exist for the entire supply chain - from our suppliers to our customers and everything in between?

- Is my organization reimagining the way we evaluate and mitigate SC vulnerabilities – are we reoptimizing or pushing to reimagine? Are we taking advantage of Industry 4.0 levers?

- Is supply chain resilience a topic discussed at the highest levels in the organization, and are you evaluating trade-offs to make informed decisions on the type and speed of mitigation plans?

- When making strategic decisions for the organization in areas such as supply chain network footprint and sourcing strategies) do you proactively consider supply chain risks in addition to financial implications?

Addressing an anticipated bottleneck in supplies of semiconductor materials market this year, Mark Thirsk, Managing Partner of Linx Consulting, said supplies of noble and rare gases such as helium (He), neon (Ne), krypton (Kr), and xenon (Xe) are a particular concern.

Addressing an anticipated bottleneck in supplies of semiconductor materials market this year, Mark Thirsk, Managing Partner of Linx Consulting, said supplies of noble and rare gases such as helium (He), neon (Ne), krypton (Kr), and xenon (Xe) are a particular concern.

The ongoing Russia-Ukraine conflict, along with restrictions in production capacity, are expected to exacerbate the supply issues for these gases, Thirsk said. He also anticipates that limitations in production capacity for bulk wet chemicals will lead to an undersupply of anhydrous hydrogen fluoride (HF) and anhydrous hydrogen chloride (HCl).

Thirsk also highlighted the semiconductor industry’s vulnerabilities stemming with materials heavily sourced from Russia and China. The global chip industry relies heavily on Russia for the rare gases helium, neon, krypton, and xenon as well as metalorganics, while China is also significant provider of rare gases along with the chemicals ceria carbonate and silicon, he said.

Sustainability

With sustainability a key topic at SMC Korea 2023, representatives from a number of companies shared their decarbonization plans and goals. For example, Sung-Ho Kim, Head of Global Marketing at Merck, highlighted the three pillars of the company’s sustainability initiative – Dedication to Human Progress, Creation of a Sustainable Value Chain, and Reduction of Our Ecological Footprint – and provided an overview of its sustainability targets including:

- 50% reduction in scope 1 and 2 greenhouse gas emissions by 2030

Sourcing 80% of purchased electricity from renewable sources by 2030

Sourcing 80% of purchased electricity from renewable sources by 2030- 52% decrease in scope 3 intensity per € gross profit by 2030

- Improving water efficiency by achieving a 10% reduction in Merck's water intensity score by 2025

- 5% reduction in environmental waste impact by 2025 (compared to 2016) based on the Merck Waste Score while underscoring its ambitious commitment to lead the industry in reducing emissions from process gases across its entire semiconductor value chain through materials innovations.

Samjong Choi, Corporate VP and Group Leader at Samsung Electronics, summarized the company’s sustainability strategy by stressing that “no resource is used only once.” He noted that, among other recycling measures, the company now uses a pre-wet process to improve the efficiency of photoresist usage. Samsung also plans to increase the amount of gas deposited during deposition, now at about 5%, up to 50%, and recycle used chemical mechanical planarization (CMP) pads through refilling.

Choi also highlighted novel ideas Samsung Electronics is considering to extend its sustainability focus to other industries:

Using materials with a purity of 99.9999% for Industry 4.0

Using materials with a purity of 99.9999% for Industry 4.0- Reusing materials with 99.999% purity for in Industry 3.0 (IT, automation, display)

- Recyling materials with 99.99% purity for Industry 2.0 (manufacturing, construction, electricity)

- Repurposing materials with 99.9% purity for Industry 1.0 (agriculture, fishing, mining, forestry)

As SMC Korea 2023 made clear, semiconductor materials innovations are not only a key driver of industry growth but also vital to helping the industry elevate its sustainability efforts including its development of low-Global Warming Potential (GWP) and reusable materials. And the work appears to be paying off as several companies at the event have their sights set on reaching their GWP goals in the coming years.

Jaegwan Shim is a marketing specialist at SEMI Korea.