Some of the worst supply disruptions occur because manufacturers run short of low-cost items or raw materials. During the pandemic, many hospitals could not secure masks, gowns, gloves, syringes, swabs, and other innocuous supplies. More recently, the inability to get a $5 semiconductor chip brought the automotive industry to its knees. And then there was Ford’s inability to procure its trademark blue oval emblem, resulting in delays for its customers, and revenue delays for Ford.

What do these items have in common? They all come from suppliers in the lower tiers of the supply chain.

Take, for example, a cancelation of a $10 part from a Tier-4 supplier: by the time the Tier-1 supplier finds out and notifies the main contractor, the connector has already been removed from rotation. This leaves the contractor scrambling for a small but essential part.

The root of the problem is that procurement organizations have been told for decades that their priority is cost savings, accomplished in part via strategies like Lean and Just-in-time (JIT) that reduce cash flow expenses.

A procurement change in mindset is required for resiliency

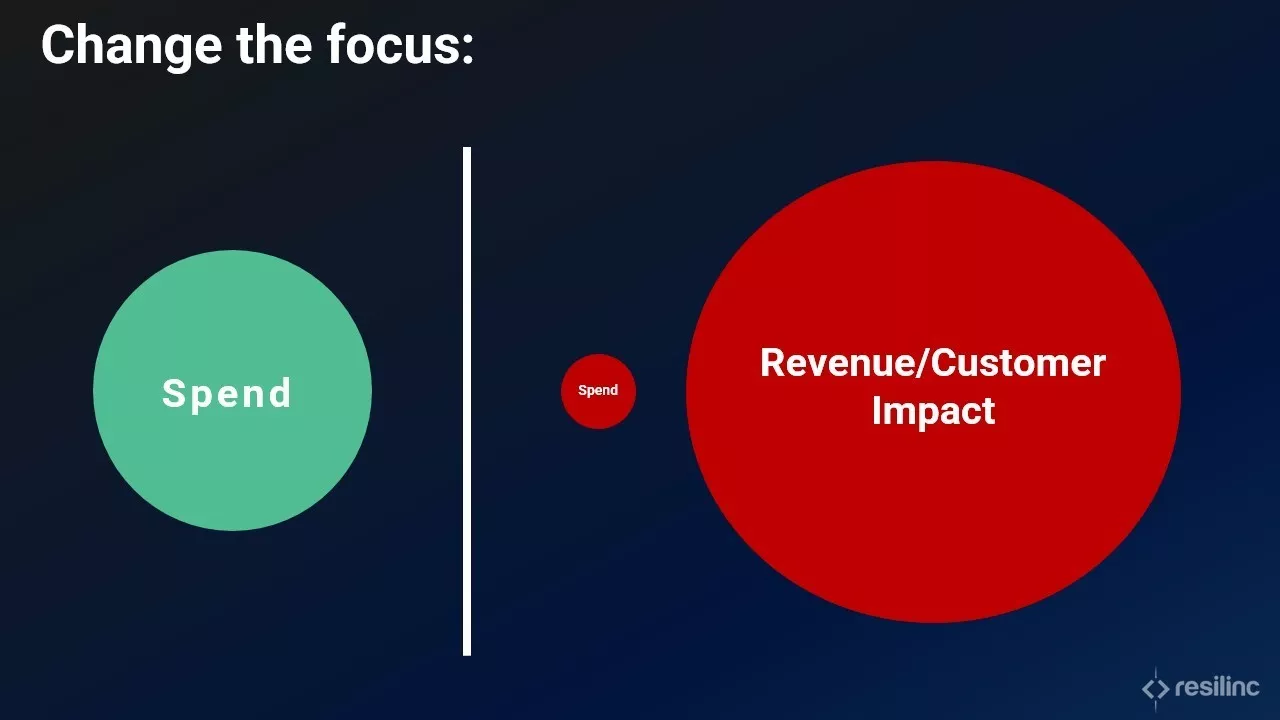

With the focus on cost savings, procurement teams typically pay attention to the top 20% of suppliers that make up 80% of the spend. Commonly deployed strategies are dual and multi-sourcing to maintain competitive pressures, working closely with those suppliers to track cost and negotiate savings, or consolidating material buys across the supply base. But these strategies can be extremely risky because they do not consider that every direct or indirect material item, regardless of spend, is required to produce and ship the final product. Think about it: if procurement teams only have visibility into 20% of their suppliers, that’s 80% of suppliers left to chance!

To build a more resilient supply chain, it’s vital to look at even the most inexpensive parts and materials when they are critical to products and revenues. This requires a change in mindset, from focusing the most attention on suppliers with the largest spend to focusing on those supplying products with the greatest potential to cut into your company’s topline. Overall revenue impact needs to be the new way to assess resilience and define critical suppliers.

Procurement teams often focus only on high-spend materials and parts. To build a more resilient supply chain, low-spend, high-impact materials and parts should be prioritized.

This shift in mindset is easier said than done, especially because companies have spent years hiring procurement people who are comfortable with contentious supplier price negotiations and who have excelled in quantifying anticipated changes in cost, schedule, and performance when comparing different vendors. But this approach breaks down when continuity of supply is impacted and when there is not a collaborative manufacturer-supplier relationship. During disruptions, these procurement teams are often forced to pay high premiums to get parts in the door. I’ve heard about one company paying $50 million in additional fees to secure inventory that typically cost $5 million.

Procurement needs to transform the very nature of the manufacturer-supplier relationship, rewarding supplier transparency with collaborative problem-solving, future business, and strategic status. It’s a win-win because supply continuity to a manufacturer equates to revenue assurance for the supplier. Both parties can identify areas of investment the supplier needs to make to ensure continuity of supply – and what the manufacturer will provide in exchange, such as:

- Favorable pricing

- Preferential/trusted partner status

- Longer-term contracts

- Single-sourced status, and other advantages

Metrics and KPIs

More proactive supplier relationship metrics should measure teams for how much visibility and transparency their suppliers provide; how well suppliers respond to assessment requests; the speed with which suppliers confirm impact of disruptions; how quickly disruptions are resolved; and if suppliers were overpaid to secure constrained parts. These new metrics need to be added to the procurement organization’s operating models and operational review meetings, and targets need to be factored into incentive compensation plans.

Sub-tier mapping and monitoring as the foundation

To protect continuity of supply, procurement teams need to know where parts come from and what they mean to revenue and resilience. They also need to keep abreast of the latest developments that could impact the broader market and, ultimately, their supply chains: factory fires, geopolitical events, commodity constraints, M&A, and ESG legislation are all examples. To solve these challenges, many companies (including IBM, Western Digital, GM and Micron) have invested in AI-based disruption monitoring and multi-tier visibility into their supply chains.

One success story, stemming from the early days of the pandemic, involves a global electronics manufacturer. The company had recently expanded its mapping capabilities, from about 100 of its largest suppliers, prioritized by spend, to 650 suppliers ranked by strategic factors including whether a supplier was a sole source of a part, and the revenue impact of a delay or loss of that part at a specific site. With this capability, the supply chain team had precise knowledge of the sites where more than 7,500 parts and materials were produced.

One success story, stemming from the early days of the pandemic, involves a global electronics manufacturer. The company had recently expanded its mapping capabilities, from about 100 of its largest suppliers, prioritized by spend, to 650 suppliers ranked by strategic factors including whether a supplier was a sole source of a part, and the revenue impact of a delay or loss of that part at a specific site. With this capability, the supply chain team had precise knowledge of the sites where more than 7,500 parts and materials were produced.

When Wuhan began to shut down, the company quickly identified the specific Wuhan-area sites where its parts and raw materials were sourced, enabling procurement to concentrate on communicating with the most critical suppliers, especially those that had reported impacts. Later, when California implemented its shelter-in-place order, the company identified within minutes one site that was storing a significant quantity of parts. With the duration of California’s lockdown unknown, the supply chain team worked with the supplier to ship 12 months of supplies from the California site to another state with less stringent restrictions.

Today, the sense of urgency to protect continuity of supply across the semiconductor supply chain is still incredibly high. From semiconductor constraints and geopolitical concerns to extreme demand shifts and legislation, companies have been operating in an increasingly disruptive environment. Procurement teams that collaborate with their direct and sub-tier suppliers to identify problems quickly and mitigate issues proactively are the key to supply chain resilience.

I look forward to participating as a panelist in the session Navigating Uncertainty – How Do You Build Agile Supply Chains on July 11 at SEMICON West 2023. Moderated by Bettina Weiss, Chief of Staff and Corporate Strategy at SEMI, the panel will also include experts from Dell, Intel, KLA and McKinsey & Company.

Resilinc CEO and founder Bindiya Vakil is credited with bringing supply chain risk management into the mainstream. Vakil has helped transform how global organizations approach risk and resiliency, driving them to shift from reactively addressing catastrophic events to putting preventative, data-backed solutions in place. She is a founding member of the Global Supply Chain Resiliency Council, a member of the Advisory Board of MIT Center for Transportation and Logistics, and a member of the SEMI Supply Chain Management (SCM) Industry Advisory Council.

Resilinc CEO and founder Bindiya Vakil is credited with bringing supply chain risk management into the mainstream. Vakil has helped transform how global organizations approach risk and resiliency, driving them to shift from reactively addressing catastrophic events to putting preventative, data-backed solutions in place. She is a founding member of the Global Supply Chain Resiliency Council, a member of the Advisory Board of MIT Center for Transportation and Logistics, and a member of the SEMI Supply Chain Management (SCM) Industry Advisory Council.