In Tokyo, Shanghai, Moscow, London, Paris or New York – wherever you are in the world –Japanese vehicles passing by on the roadways are a common sight. Three big reasons are their high quality, reliability and engineering. But Japan’s automakers are also legendary for their industry breakthroughs. A few highlights:

- In 1981, Honda introduced the first commercially available map-based car navigation system. The carmaker’s Electro Gyro-Cator used a gyroscope to detect rotation and other movements of the car.

- In 1990, Mazda equipped its COSMO Eunos with the world’s first built-in GPS-navigation system.

- In 1997, Toyota launched the world’s first mass-produced hybrid car -- Prius.

- In 1997, Toyota unveiled the world’s first production laser adaptive cruise control on its Celsior.

- In 2009, Mitsubishi rolled out the world’s first mass-produced electric car – i-MiEV.

Off the roadways and often unheralded, it is supply chain companies including Japanese semiconductor makers that were a key engine of these innovations as they continue their rich history of driving automotive advances. Here’s a closer look at some of the key players and why they matter.

Who Makes Automotive Semiconductors?

Unlike other semiconductors, automotive chips are manufactured not only by integrated device manufacturers (IDMs) but also by captive fabs and automotive components makers such as Toyota and Denso.

Denso, headquartered in Aichi prefecture, started in 1949 as a spin-off of Toyota’s electric components unit. Since 2009, the company has been the world’s largest automotive components supplier. Because Denso’s chips are mostly consumed internally, the company’s manufacturing revenue is not publicly available, but analysts estimate Denso’s chip business exceeds 200 billion JPY or USD $1.9 billion.

Denso manufactures semiconductor components at two locations. Its Kota plant in Aichi prefecture manufactures power and logic chips, and the company’s Iwate (Iwate prefecture) facility, acquired from Fujitsu in 2012, produces semiconductor wafers and sensors.

Denso Fab (Photo: Denso)

Denso is developing SiC wafers for its power chips and plans to manufacture SiC inverters by 2020. Recently, the company announced joint research on Ga2O3 for power devices with FLOSFIA, a tech startup spun off from Kyoto University. In 2017, Denso established a semiconductor IP design company, NSITEXE, in Tokyo to design semiconductor IP cores – the semiconductor components that are key to autonomous driving.

Toyota has been manufacturing semiconductor chips at its Hirose Plant since 1989. The semiconductor fab design and manufacturing technologies originated at Toshiba and moved to Toyota under a technology transfer agreement signed in 1987. In the power semiconductor arena, Toyota is jointly developing SiC devices with Denso and Toyota Central Research and Development Labs.

Other car and component makers like Honda, Nissan, Hitachi Automotive Systems, Aishin Seiki and Calsonic Kansei are also developing and designing semiconductor chips.

Microcontroller Units

Microcontrollers (MCUs) were first employed in automobiles in the late 1970s to electronically control engines for higher fuel efficiency. Today, up to 80 MCUs are typically used in a car for powertrain controls (engine, fuel management and fuel injection), body controls (seat, door, window, air conditioning and lighting), safety controls (brake, EPS, suspensions, air bags and anti-collision) and infotainment.

In December 2015, the microcontroller unit (MCU) supply chain experienced a major consolidation with the nearly $12 billion acquisition of Freescale Semiconductor by NXP Semiconductors, catapulting NXP to the top of the MCU market. NXP and Freescale were ranked second and third in global market share, after Renesas Electronics, at the time.

Renesas held 40 percent global market share before its Ibaraki fab suffered severe earthquake damage in 2011 and hemorrhaged share after the loss of production capacity. Renasas continues to recapture market share at a rapid clip, with a growth rate of 5.2 percent and 24.6 percent, respectively, in the first two quarters of 2017, and claims it still leads the global MCU market for automotive applications with 30 percent share (source: Diamond Online, August 2017).

Renesas was established as a joint venture of Hitachi and Mitsubishi and later merged with NEC Electronics. Consequently, Resesas’s MCUs, designed with Hitachi’s SH MCU cores, recently began a gradual shift to Arm cores. Renasas MCUs designed at 40nm or less nodes have been manufactured at TSMC, a Taiwan foundry, since 2012.

CMOS Image Sensors

CMOS image sensors serve as eyes of cars, performing camera functions on-chip. Today, automobiles typically are fitted with about 10 CMOS image sensors, a number forecast to grow to almost 20 by 2020 (source: Monoist, 2016). The sensor was originally used as a backup monitor but deployments grew with the advent of Advanced Driver-Assistance Systems (ADAS). The CMOS image sensor market is estimated to reach $2.3 billion USD by 2021, according to IC Insights. Sony is the global CMOS image sensor market leader, and ON Semiconductor and OmniVision Technology are big players in this growing segment.

In 2016, Denso started using Sony’s CMOS image sensors to detect pedestrians during night driving. Sony manufactures CMOS sensors at Kumamoto TEC and Nagasaki TEC on Kyusyu Island. In 2017, Sony acquired Toshiba’s Oita plant to increase the capacity to respond to the growing demand for backside illumination CMOS image sensors for higher resolution images at a low-light environments.

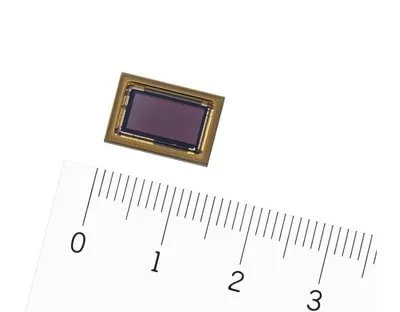

Sony’s 7.42 megapixel CMOS image sensor for automotive cameras (Photo: Sony Corporation)

Power Devices

Power semiconductors provide electrical control functions such as rectification, voltage regulation (boost/step-down), and DA/AD conversion. The automotive industry’s migration from fossil fuel vehicles to hybrid and electric vehicles is driving strong demand for power devices. The leading power device makers are competing to develop higher performance devices on new materials such as SiC and GaN.

For the past five years, the Japan government has funded SiC power device research and development (R&D) projects and, in 2016, the National Institute of Advanced Industrial Science and Technology (AIST) and Sumitomo Electric Industries built a 150mm SiC wafer line at AIST’s Super Clean Room Facility in Tsukuba, Ibaraki. The facility supports volume manufacturing, reliability testing and quality assurance.

Rohm is driving the Japan SiC power device industry. Rohm manufactures SiC power devices on 75mm, 100mm and 150mm wafers. In 2009, Rohm acquired a German SiC wafer maker, SiCrystal, which started supplying 150mm wafers to Rohm in 2013. Rohm also acquired Renesas Electronics’s Shiga plant (200mm line) in 2016 to manufacture SiC power and other discrete devices.

Fuji Electric manufactures various power products including SiC power devices. Fully 30 percent of its products ship to the automotive industry. In 2013, the company built a new SiC line in its Matsumoto plant that includes both wafer process and packaging facilities. Fuji Electric now develops high-performance SiC devices on the latest 150mm SiC wafer technology.

Toyota and Denso round out the Japan SiC power device industry. Denso markets its 150mm SiC technology under the “REVOSIC” brand. In 2013, Toyota built a SiC R&D facility at its Hirose plant for future SiC captive manufacturing.

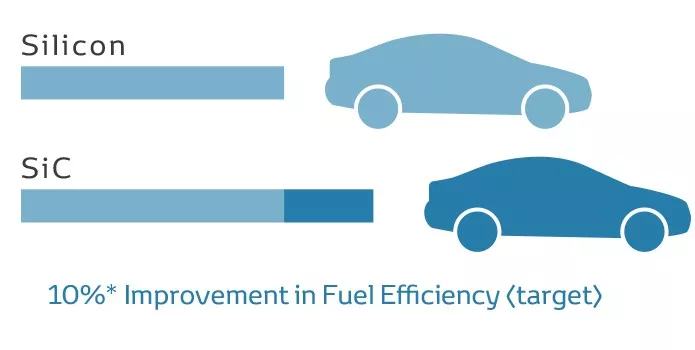

SiC power semiconductors to improve vehicle’s fuel efficiency by 10 percent (target) (Photo: Toyota Motor Corp.)