Part 1 of this article discussed the Memory Inventory Cycle Index and compared it with memory device sales and memory fab equipment investments. This article, the second of the two-part series, illustrates how the Memory Inventory Cycle Index starts to weaken before memory sales of the top three memory suppliers decline. It also shows how the Memory Inventory Cycle Index peaked in the fourth quarter of last year along with YoY growth rates for both memory sales and memory fab equipment investments.

In addition to the weakening signaled by the Memory Inventory Cycle Index, memory suppliers are facing headwinds in the form of tariffs as mentioned in Micron’s most recent earnings call. The U.S.-China trade dispute could reduce Micron’s profitability; China granted a preliminary injunction to prevent Micron’s Chinese subsidiary from manufacturing and selling in China this July. However, it is very difficult to quantify the risk the tariffs pose to the future of the memory market.

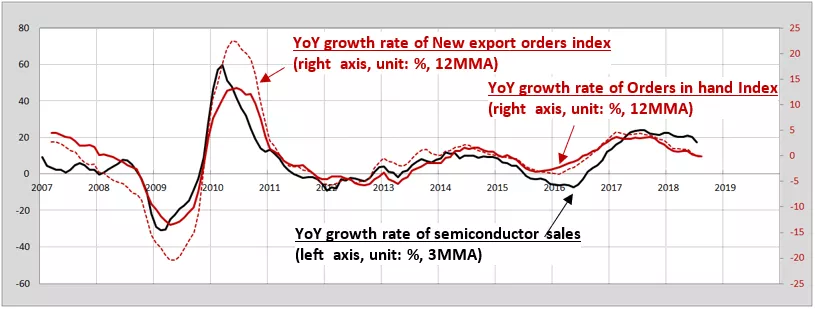

On the other hand, the YoY growth rate of semiconductor sales according to the World Semiconductor Trade Statistics is closely tied to China’s manufacturing sector as shown by the Purchasing Managers Index (PMI) New export orders and Orders in hand sub-indexes. Figure 3 shows that as the growth rate of new exports and order backlog slows, the YoY growth rate of semiconductor sales will be adversely impacted. As the largest consumer of semiconductors in the world, China will bear the brunt of the slowing market.

Figure 3. Memory Inventory Cycle Index & China manufacturing sector PMI’s sub-indices

* Remarks

China PMI’s sub-indices are on the basis of the data published by NBS (National Bureau of Satistics of China). Also those data were calculated based on 12MMA (12-month moving average) to minimize seasonal fluctuation.

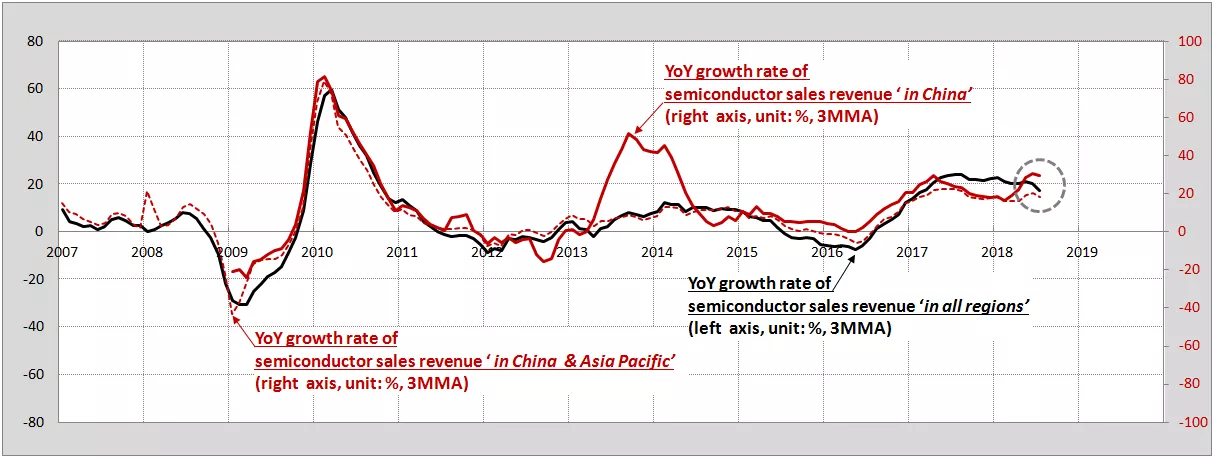

The YoY growth rate of the 3-month moving average of semiconductor sales in China alone, China and Asia Pacific, and all regions showed additional declines in July (Figure 4). Monitoring the Orders in hand and New export orders sub-indices for China and China’s semiconductor consumption and WSTS sales revenue in China can help track the risk of trade disputes.

Figure 4. YoY growth rate of semiconductor sales revenue in China and Asia Pacific

* Remarks

1) Regions as defined by WSTS’ Bluebook.

2) Sales revenue were calculated based on 3MMA (3-month moving average value).

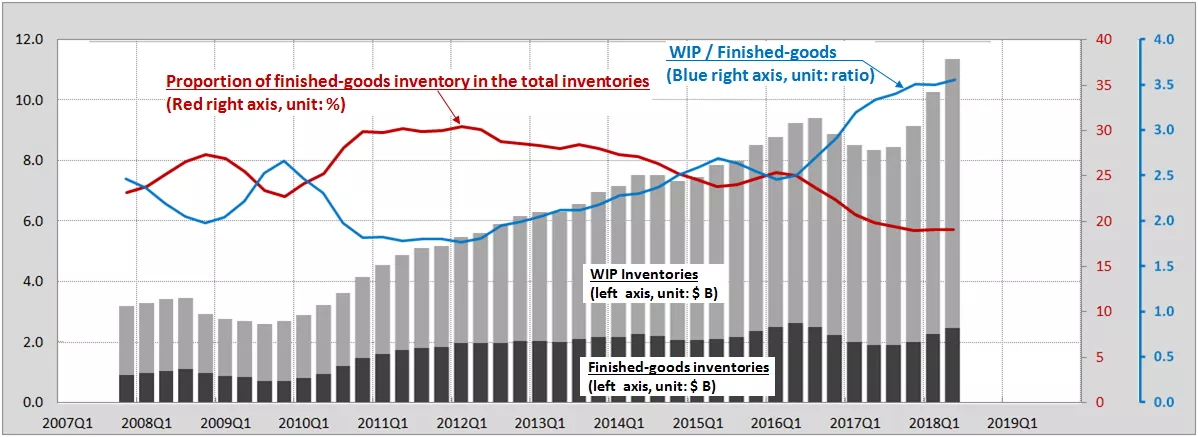

A review of the relationship between the Memory Inventory Cycle Index, semiconductor sales, and memory fab equipment investment growth rates suggests we have passed the peak in the current cycle. However, bear in mind that the Work In Process (WIP) to Finished-goods inventory ratio has sharply increased since 2017 as shown in Figure 5. The increase in WIP inventory could be attributed to the increasing technical challenges associated with 3D NAND stacking and DRAM scaling. As a result, the proportion of finished-goods inventory in total inventory remained low until the second quarter of 2018, possibly implying that memory demand remained healthy in spite of the contraction modeled by the Memory Inventory Cycle Index.

Figure 5. The proportion of finished-goods inventory in the total inventories

* Remarks

1) All inventories data from 3 companies’ financial reports were calculated based on 4-quarter moving average.

2) Total Inventory accounts for the sum of Finished-Goods, WIP, and Raw materials inventory.

3) Company data complied by SEMI.

The Memory Inventory Cycle Index has entered a period of contraction, which is supported by Micron’s weak guidance for its fiscal first quarter of 2019 (September to November). The outlook for memory sales and memory fab equipment investments reported by WSTS and SEMI, respectively, also suggests that a market correction is underway. While the low proportion of finished-goods inventory does not threaten the market yet, it should remind industry observers to view high WIP inventories with caution. Unlike past inventory cycles, the high inventory levels could burden the memory market in the absence of sustainable demand.

Sungho Yoon is a senior market research analyst in Industry Research and Statistics at SEMI.

SEMI China IC Ecosystem Report

Learn more about 30 new fab construction projects underway or planned in China in the newly released SEMI China IC Ecosystem Report. The research report is a comprehensive update and analysis of China's IC manufacturing ecosystem with charts, graphs, tables and maps.