The World Bank just released its updated Global Outlook for 2020 and 2021. The text is long but very worth reading.

Included in this outlook is a discussion of the financial impact of the current pandemic and a forecast for GDP growth by major region for 2020 and 2021 (Chart 1).

All major countries’ economies are projected to contract this year (with the exception of China, which will slip from its normal 6%+ annual GDP growth rate to only 1% in 2020).

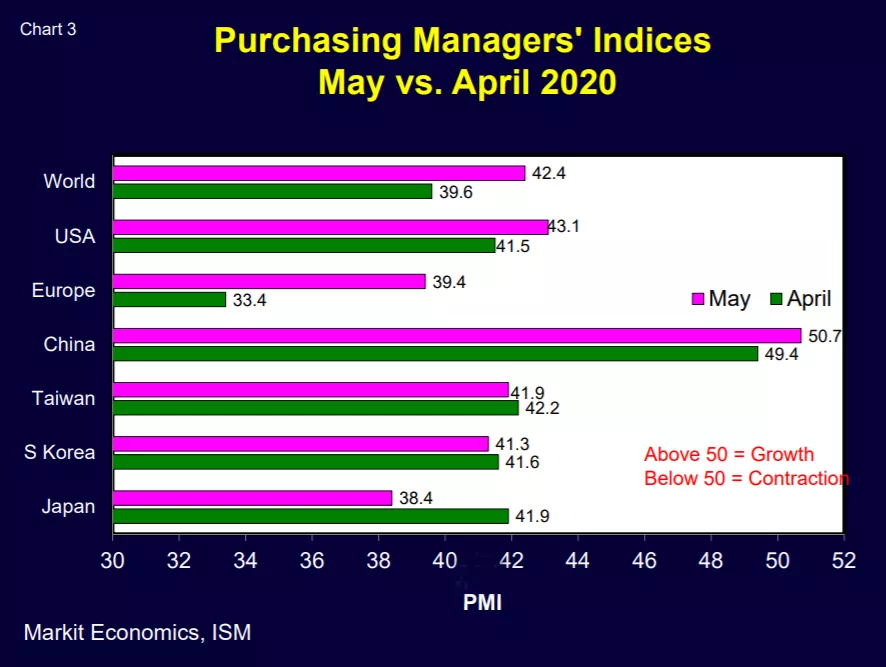

PMIs Indicate Further World Manufacturing Contraction

As noted in my earlier SEMI blogs, the manufacturing purchasing managers’ indices began dropping sharply in early 2020. This May’s Global PMI (Chart 2) recovered slightly from its April low of 39.6 but remained well in contraction territory (PMI <50). Not until the PMI rises above 50 will it indicate true manufacturing growth.

This manufacturing downturn is broad based. Per Chart 3 all major countries (except China) had manufacturing contraction in May (purple bars). And China’s PMI (which plunged in February) barely rose above 50 in May.

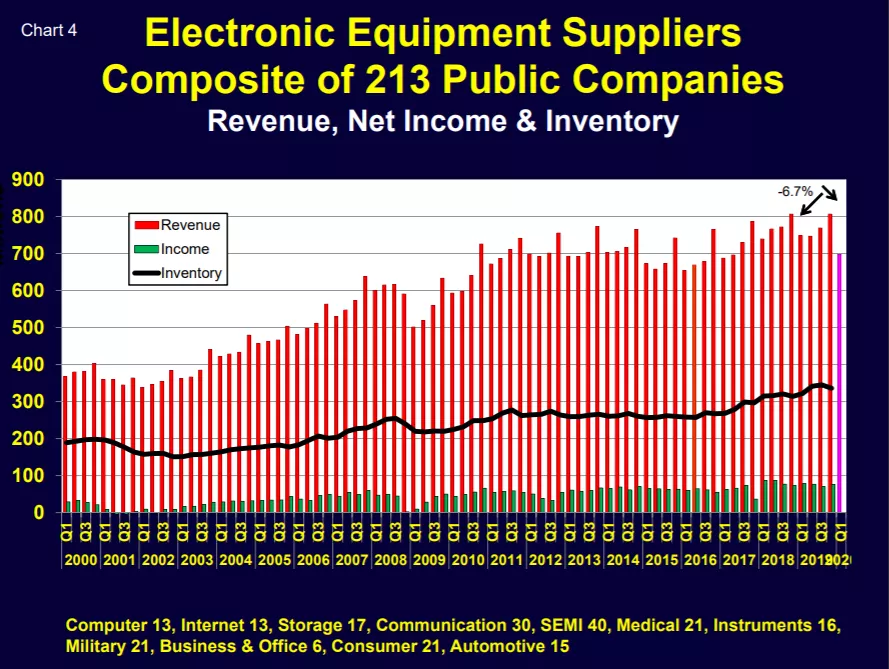

Global Electronic Equipment Sales Dropped in First Quarter

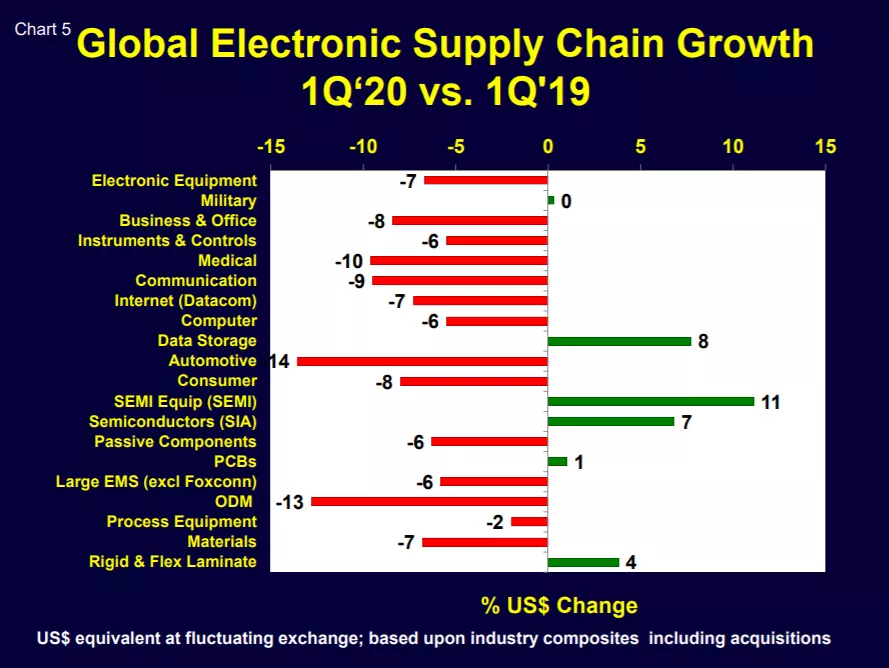

Composite sales (consolidated in U.S. dollars) of 213 world electronic equipment manufacturers dropped 6.7% in 1Q’20 vs. 1Q’19 (Chart 4). Globally most sectors of the electronic supply chain saw revenues decline in the first quarter (Chart 5).

Semiconductor Growth Slowing?

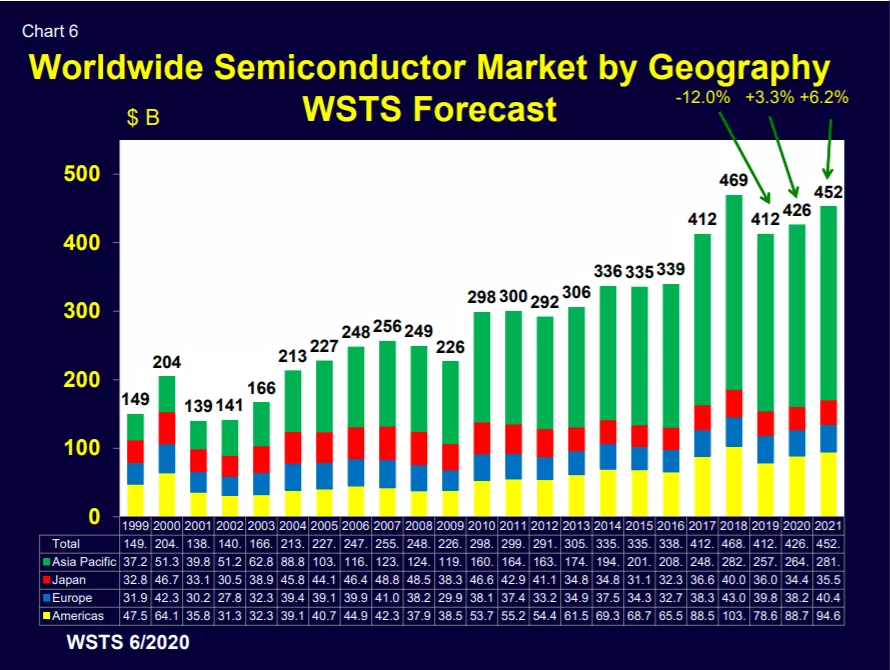

Semiconductors and semiconductor capital equipment had positive first quarter growth (Chart 5) but there are signs of slowing. While the WSTS just forecast a 3.3% increase in global semiconductor shipments for 2010 (Chart 6), the monthly chip shipment data seem to signal a recent weakening.

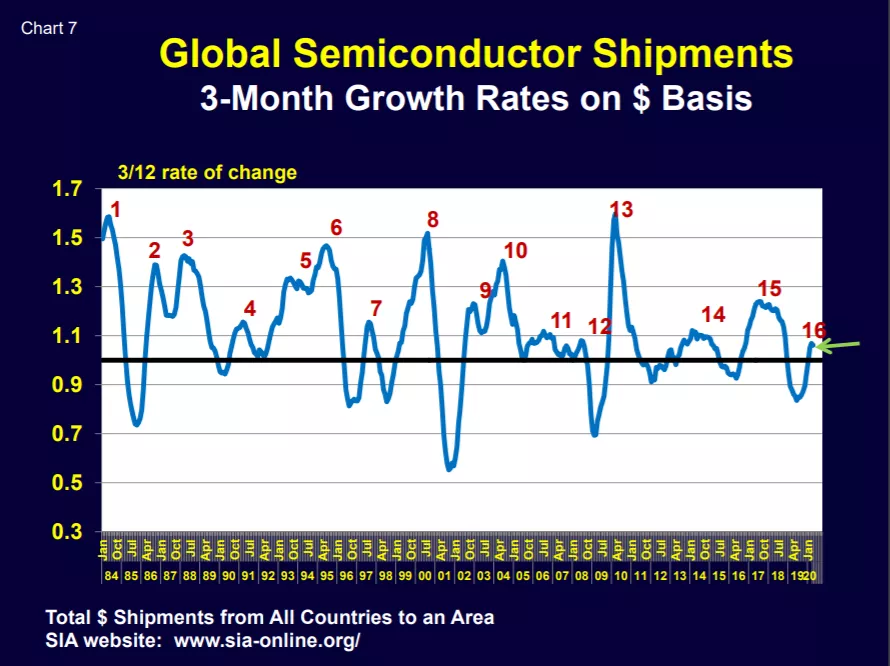

Chart 7 shows the 16 world semiconductor business cycles (on a 3/12 growth basis) from 1984 to today. Notice what appears to be the beginning of a possible peak (to be followed by subsequent downturn) in the April growth.

Chip Foundries and Leading Indicators also Point to Slowing Ahead

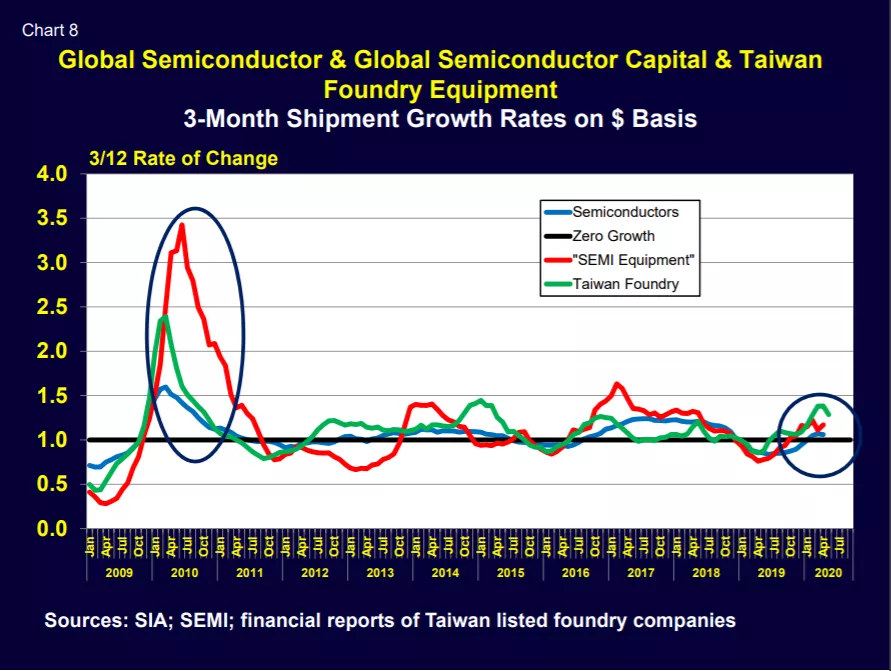

Chart 8 compares the 3/12 sales growth of global semiconductors, SEMI capital equipment and Taiwan wafer foundries. The foundries appear to be signaling slower growth in the semiconductor industry – at least short term.

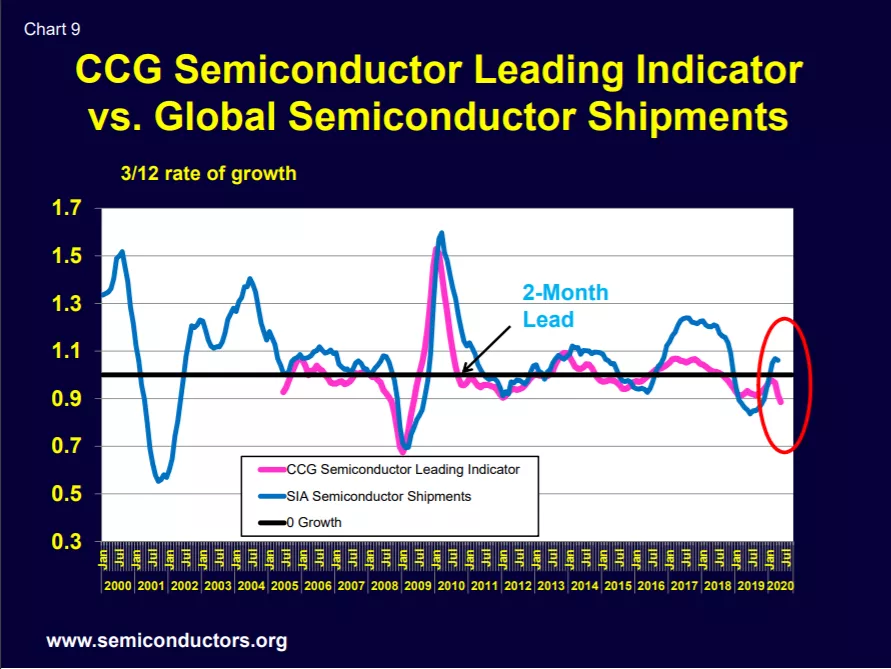

Custer Consulting Group’s PMI-based semiconductor leading indicator suggests a chip shipment slowdown in the near future (Chart 9).

Final Thought

A semiconductor industry contraction is consistent with the current global pandemic and also the GDP downturn predicted in Chart 1. Things could change but the outlook for 2020 remains sobering.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.