The November Global Purchasing Managers Index moved back into expansion territory (Chart 1). Admittedly results varied significantly by country but world global manufacturing activity resumed growth at year end.

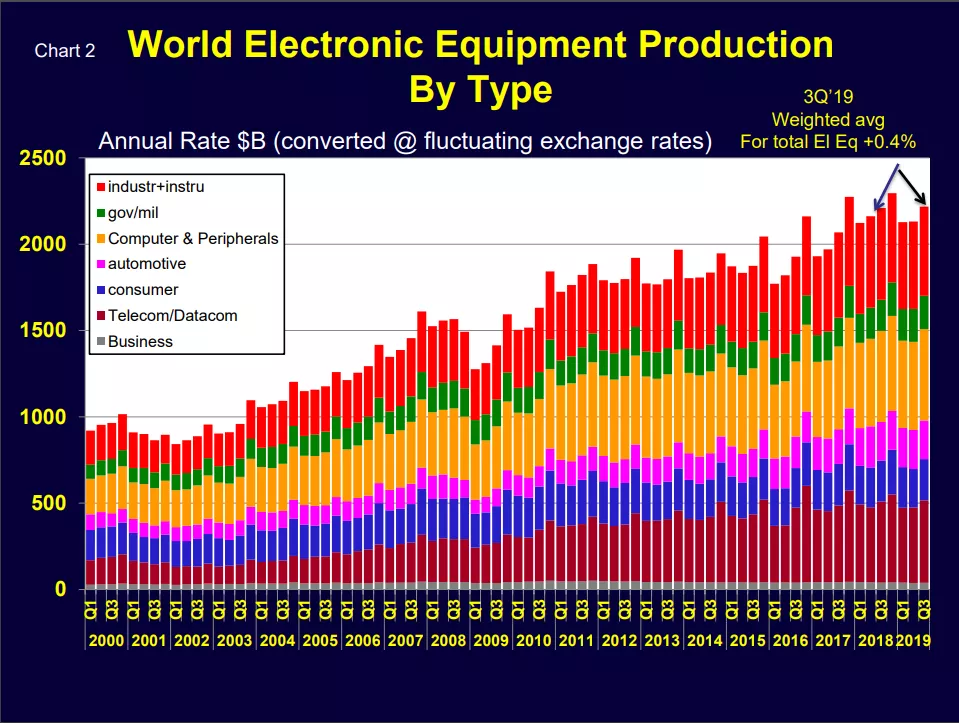

With all major global electronic equipment OEMs having now reported their third quarter financials, we estimate that combined equipment sales increased 0.4 percent in 3Q’19 versus 3Q’18 and 2 percent sequentially from the second versus the third quarter of this year (Chart 2). Note that these world sales results have been converted to U.S. dollars at fluctuating exchange. Growth rates will vary based on the currency used.

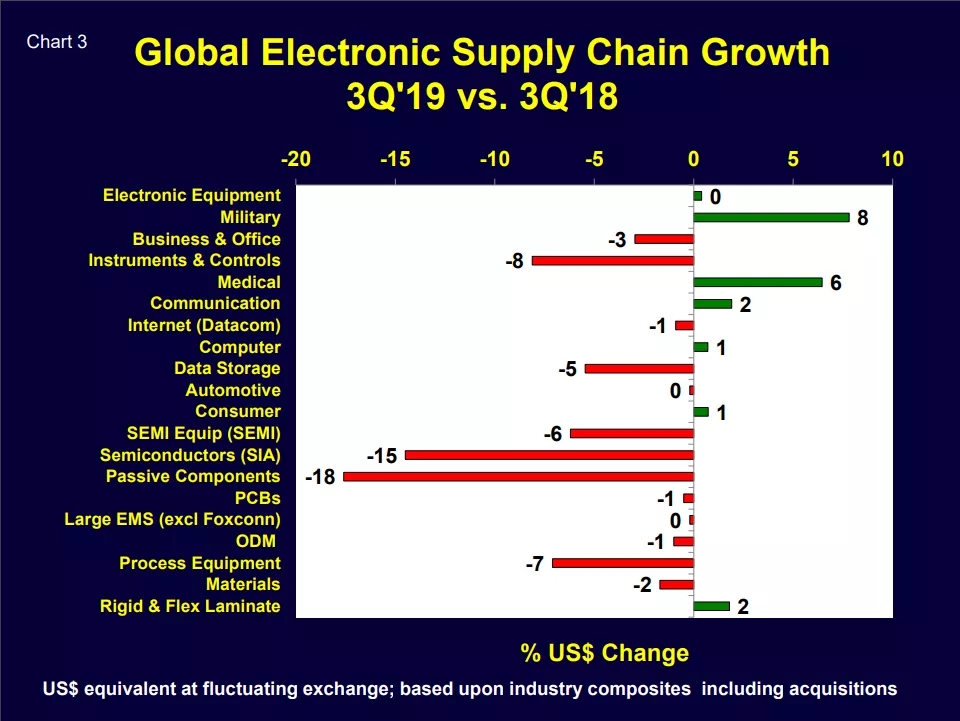

3Q’19 world electronic supply chain industry growth varied significantly by sector (Chart 3). The volatile semiconductor and passive component groups are fluctuating more than the various equipment end markets.

Fourth Quarter Initial Results

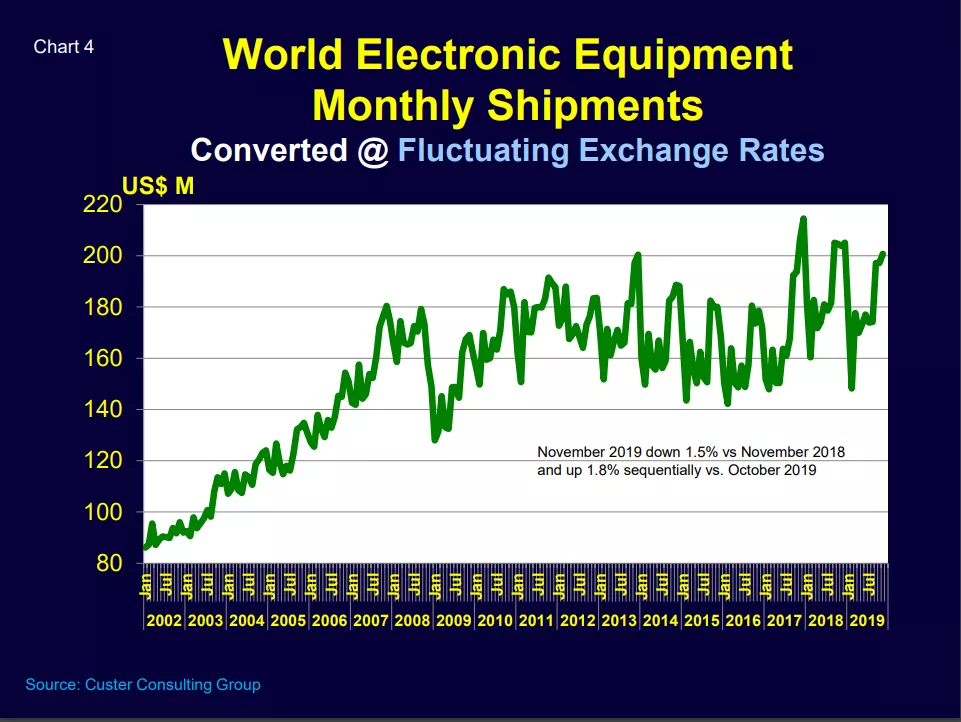

In the fourth quarter, world electronic equipment sales sequential growth continued. An early estimate is that November 2019 global sales were down 1.5 percent versus November 2018 but up 1.8 percent sequentially versus October 2019. It is likely that 2019 end market shipments have now peaked and will begin their normal seasonal plunge heading into the winter months (Chart 4).

Semiconductor Industry Performance & Outlook

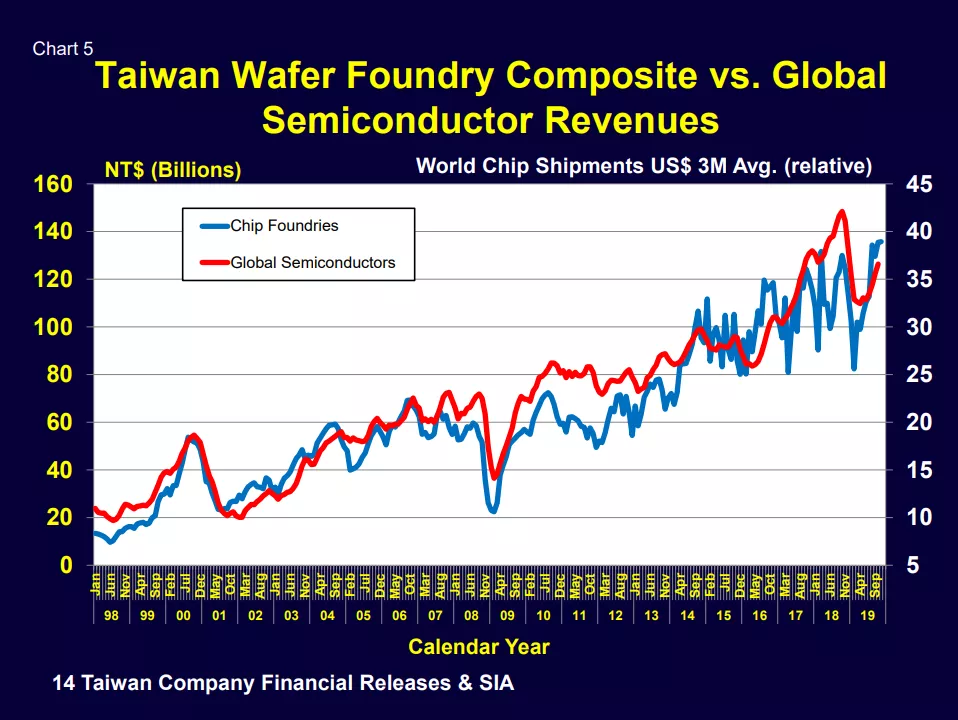

In the semiconductor industry, both recent global chip shipments and Taiwan wafer fab sales showed growth from their year-end 2018 troughs (Chart 5).

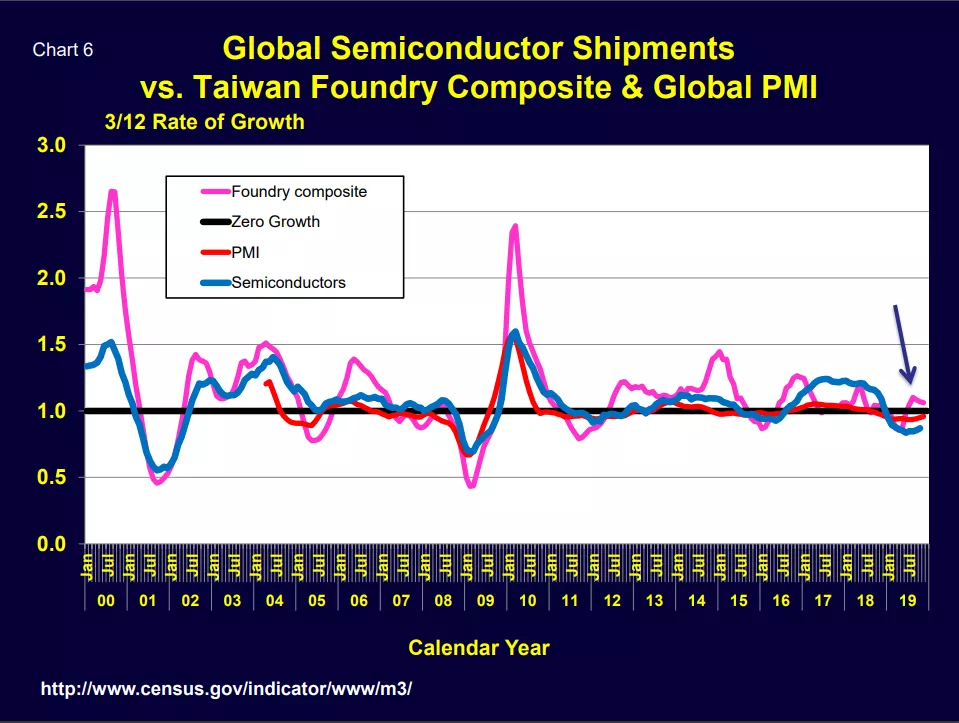

A look at 3/12 growth rates for world semiconductors shows that a recovery appears to underway for Taiwan foundries and the global PMI (Chart 6).

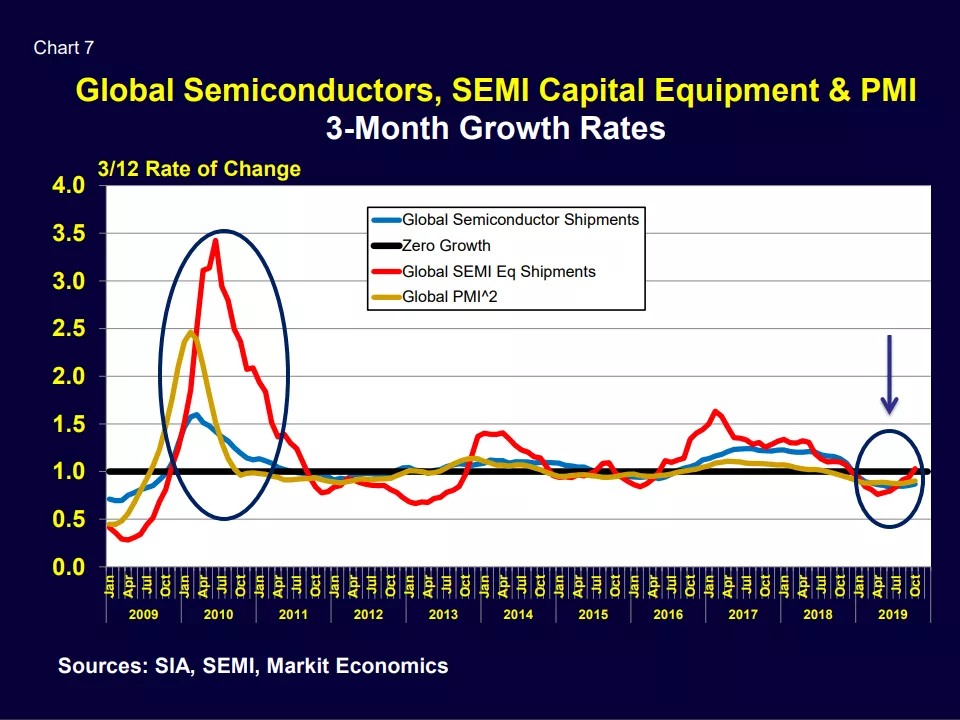

Global SEMI equipment growth appears to be on the same recovery path (Chart 7).

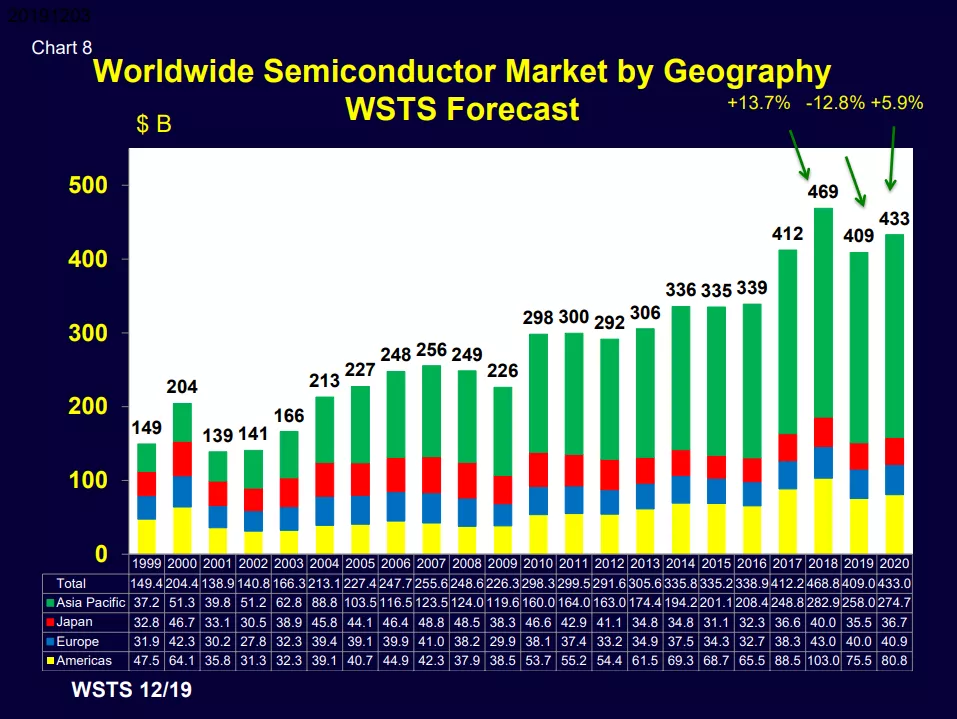

Looking forward, the WSTS and SIA have recently issued an updated world semiconductor shipment forecast (Chart 8) showing a 12.8 percent decline this year followed by 5.9 percent world chip growth in 2020.

A modest expansion is looking promising for next year.

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.