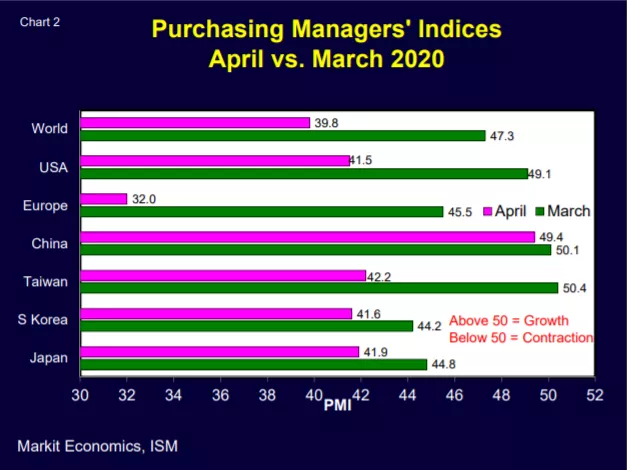

March and April world data clearly showed the impact of the global manufacturing slowdown driven by COVID-19. The world purchasing manager’s index plunged from 47.3 in March to 39.8 in April (Chart 1). Values below 50 indicate a manufacturing contraction. April’s global PMI was its lowest since the financial crisis of 2008 and its trajectory was still headed down as the month closed.

All countries and regions have seen a sharp manufacturing slowdown (Chart 2). China, hit hard in February, recovered in March and then dipped in slightly but the balance of the world saw manufacturing plunge in April as COVID-19 forced factory closures. Unemployment skyrocketed and GDPs plunged.

Electronic Supply Chain Response

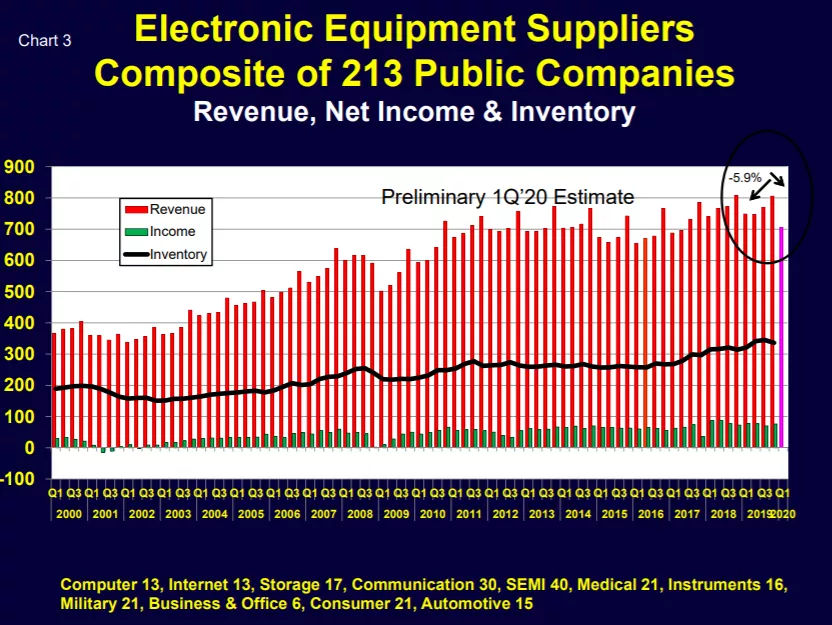

The entire global electronic supply chain has been affected by this current large, sharp downturn. Based on preliminary financial data from 213 global electronic equipment manufacturers, revenues in U.S. dollars were down almost 6% in 1Q’20 vs 1Q’19. (Chart 3). A group of 52 public EMS and ODM companies saw its sales drop over 10% in the same period.

In this first quarter the U.S. GDP declined 4.8% and the domestic civilian unemployment rate rose to 14.7%. Times are tough!

Looking Forward

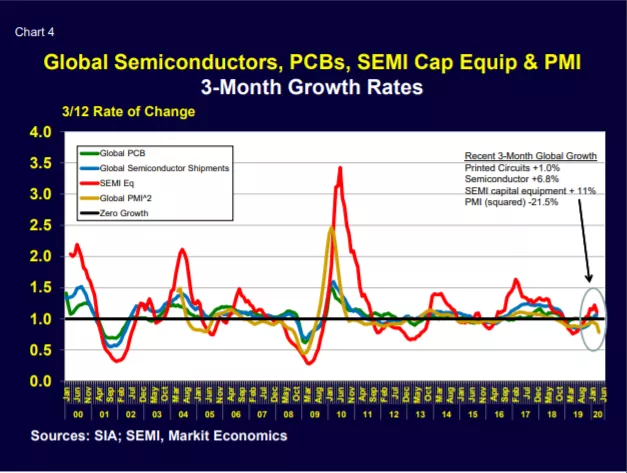

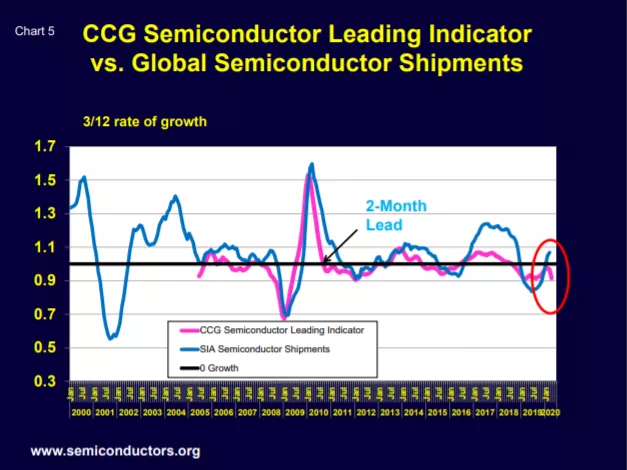

Global electronic supply chain growth is being severely affected. While semiconductor and SEMI equipment growth rates were still positive in the first quarter, their growth rates have peaked (Chart 4). Custer Consulting Group’s semiconductor leading indicator points to further slowing (or an actual semiconductor industry downturn) ahead (Chart 5).

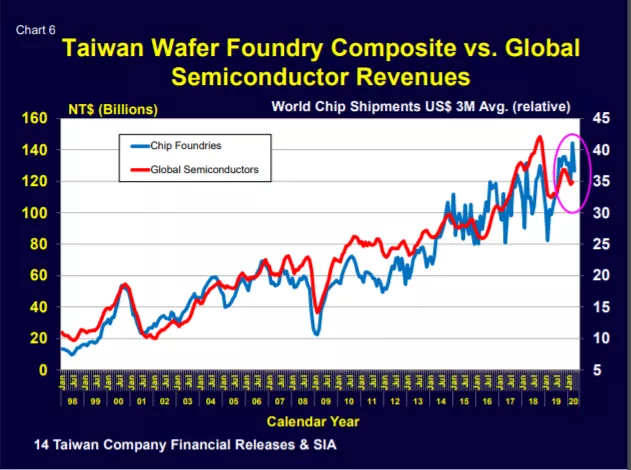

Wafer foundry sales (another semiconductor leading indicator) dipped in April after showing a welcome rebound in the first quarter (Chart 6).

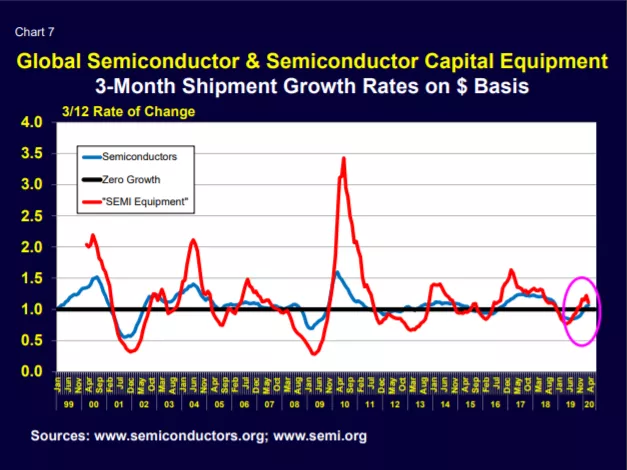

A comparison of growth of semiconductors and SEMI equipment shows that SEMI capital equipment revenues could see a near-term contraction (Chart 7).

Wrapping Up

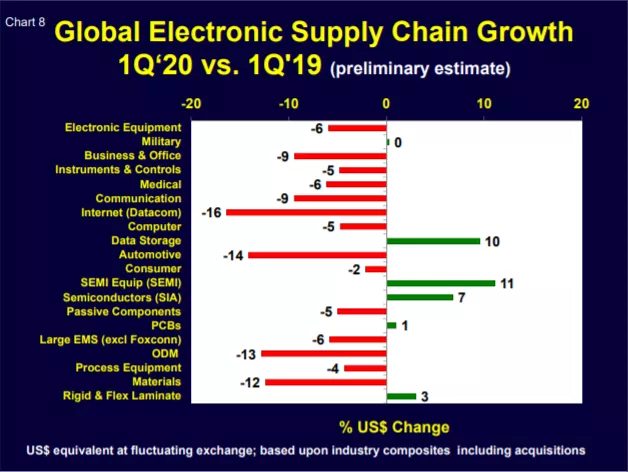

The entire electronic supply chain suffered in the first quarter (Chart 8). The semiconductor chip and equipment group did better but a slowdown in this sector is likely.

The balance of 2020 appears to be in for some tough times with the COVID-19 virus impact difficult to predict and political response unpredictable.

Keep watching the leading indicators!

Walt Custer of Custer Consulting Group is an analyst focused on the global electronics industry.